In 2024, among the most anticipated events in the market were three clear positives— the launch of a spot Bitcoin ETF, the Bitcoin halving, and a Fed interest rate cut. The first has already been achieved, propelling Bitcoin to surpass $70,000 and hit an all-time high.

Now, as the halving approaches, with over half of this year’s anticipated positives about to materialize, it may impact the market’s evolution. According to the latest statistics, the countdown to the fourth Bitcoin halving is less than 5 days, expected to occur on April 20, 2024, when block rewards will decrease from 6.25 BTC to 3.125 BTC.

Live Bitcoin Blockchain Stats

As one of the most significant narratives in the crypto industry, the “Bitcoin halving” has always been a highly anticipated event in the market. As we near the end of another halving cycle in 2024, what expectations should we hold? What new variables have emerged in the market?

What is Bitcoin Mining and halving mechanism

Bitcoin mining is the process of creating new bitcoins and validating transactions on the Bitcoin network. Miners use powerful computers to solve complex mathematical problems, which adds new transactions to the blockchain and ensures the network’s security. In return for their work, miners are rewarded with newly generated bitcoins and transaction fees.

The halving mechanism is a feature of Bitcoin’s protocol that occurs approximately every four years or after every 210,000 blocks mined. During a halving event, the reward for mining a new block is reduced by half. This reduction in block rewards is intended to regulate the rate at which new bitcoins are introduced into circulation and is a fundamental aspect of Bitcoin’s monetary policy. The halving mechanism gradually reduces the pace of new bitcoin creation, ultimately leading to a maximum supply of 21 million bitcoins.

Here are the dates of Bitcoin halvings along with the approximate price around those times:

First Halving: 28 November, 2012 (BTC price: $12.30)

Second Halving: 9 July, 2016 (BTC price: $650)

Third Halving: 11 May, 2020 (BTC price $8,500)

Upcoming Halving: 20 April, 2024

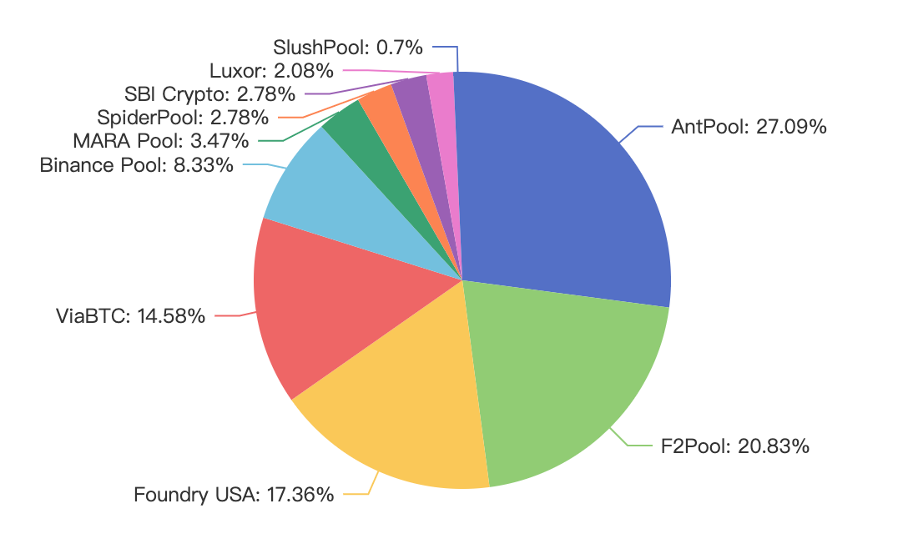

The mining pools and mining power distribution

Overall Mining Landscape:

The total computing power across all mining pools is 627.05 EH/s, with ALL representing 100% of the total.

The distribution of computing power among various pools indicates a diverse ecosystem with multiple participants contributing to the Bitcoin network’s security.

Dominant Players:

AntPool and F2Pool emerge as the two largest mining pools, accounting for 26.35% and 20.27% of the total computing power, respectively.

These pools have a significant influence on the network, with a combined proportion of over 46% of the total computing power.

Significant Contributors:

Foundry USA, ViaBTC, and Binance Pool also hold substantial shares of the computing power, contributing 16.89%, 14.18%, and 8.10%, respectively.

These pools play a crucial role in block production and network security, collectively representing a considerable portion of the mining power.

Smaller Players:

MARA Pool, SpiderPool, SBI Crypto, Luxor, and SlushPool are smaller players in terms of computing power share, each contributing less than 5% individually.

While their individual shares are relatively small, collectively, these pools still play a role in decentralizing mining power and contributing to the overall security of the network.

Block Production and Fees:

The number of blocks produced varies across pools, with some producing significantly more blocks than others.

AntPool and F2Pool, being the largest pools, have produced the highest number of blocks.

The average mining fee varies among pools, with Binance Pool having the highest average mining fee at 0.954292 BTC and SlushPool having the lowest at 0.321885 BTC.

The mining fee ratio, which represents the proportion of mining fees relative to the block reward, also varies among pools, with Binance Pool having the highest ratio at 15.27% and SlushPool having the lowest at 5.15%.

Mining block data of each BTC mining pool within 24 hours (dated 15 April 2024)

| # | Mining Pool | Computing Power | Proportion | Blocks Produced | Empty Blocks |

| 1 | AntPool | 165.24 EH/s | 26.35% | 39 | 0 |

| 2 | F2Pool | 127.10 EH/s | 20.27% | 30 | 0 |

| 3 | Foundry USA | 105.92 EH/s | 16.89% | 25 | 0 |

| 4 | ViaBTC | 88.97 EH/s | 14.18% | 21 | 0 |

| 5 | Binance Pool | 50.84 EH/s | 8.10% | 12 | 0 |

| 6 | MARA Pool | 21.18 EH/s | 3.37% | 5 | 0 |

| 7 | SpiderPool | 16.95 EH/s | 2.70% | 4 | 0 |

| 8 | SBI Crypto | 16.95 EH/s | 2.70% | 4 | 0 |

| 9 | Luxor | 12.71 EH/s | 2.02% | 3 | 0 |

| 10 | SlushPool | 4.24 EH/s | 0.67% | 1 | 0 |

| Total | 627.05 EH/s | 100.00% | 148 | 0 |

Bitcoin Price In Relationship to Halving

The relationship between Bitcoin’s price and its halving events has been a topic of significant interest and analysis within the cryptocurrency community. While historical data suggests correlations between Bitcoin halving events and subsequent price movements, it’s essential to understand that correlation does not imply causation, and various factors can influence Bitcoin’s price dynamics.

Here’s a general overview of the relationship between Bitcoin’s price and halving events:

Pre-Halving Speculation: In the months leading up to a halving event, there is often increased speculation and anticipation in the market. Traders and investors may anticipate a reduction in the rate of new Bitcoin issuance, leading to expectations of decreased supply and potential upward price pressure.

Supply Dynamics: Bitcoin halving events directly impact the rate at which new bitcoins are created, reducing the block reward by half. This reduction in supply growth can theoretically lead to a decrease in selling pressure from miners, as they receive fewer newly minted bitcoins as rewards for their mining efforts. A decrease in selling pressure, coupled with sustained or increased demand, could contribute to upward price movements.

Market Sentiment and Investor Behavior: Market sentiment and investor behavior play crucial roles in determining Bitcoin’s price movements. Positive sentiment surrounding a halving event, coupled with bullish narratives and media coverage, can attract new investors and drive demand for Bitcoin, potentially leading to price appreciation.

Historical Patterns: Historical data suggests that Bitcoin’s price has exhibited significant volatility around halving events. In the past, both leading up to and following halving events, Bitcoin has experienced notable price rallies. However, it’s essential to note that past performance is not indicative of future results, and market dynamics can evolve over time.

External Factors: Bitcoin’s price is also influenced by various external factors, including macroeconomic trends, regulatory developments, technological advancements, and market sentiment. These factors can interact with the supply dynamics resulting from halving events and contribute to Bitcoin’s overall price trajectory.

In summary, while Bitcoin halving events have historically been associated with periods of heightened price volatility and speculative activity, the relationship between halvings and price movements is complex and influenced by a multitude of factors. While halving events may contribute to bullish sentiment and supply-driven dynamics, other market forces and external factors also play significant roles in shaping Bitcoin’s price dynamics.

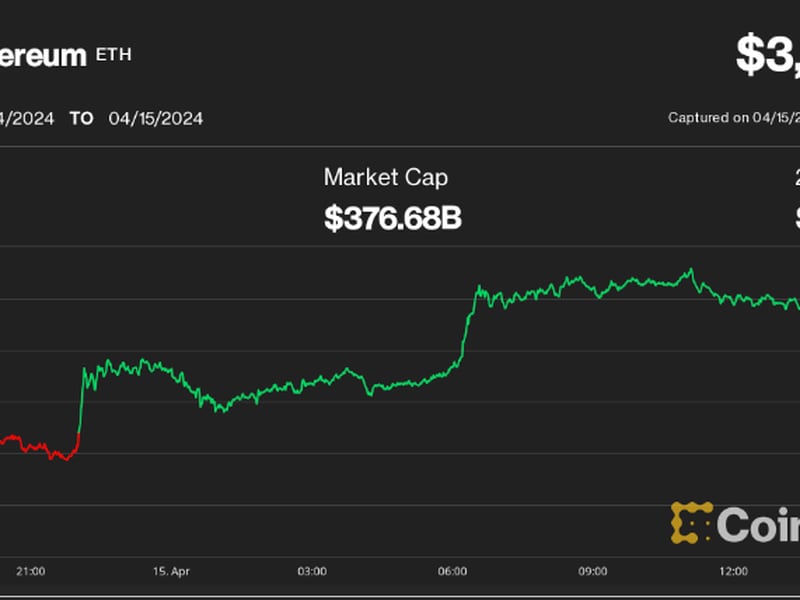

Current BTC Price Versus Mining Cost

Bitcoin’s price skyrockets to a staggering $64,551 (dated 15 April 2024), sending shockwaves through the cryptocurrency world. But as the highly anticipated halving event looms on the horizon, miners face a daunting reality: the average cost of producing a single Bitcoin could soar above $42,000, threatening their profitability.

Despite this ominous forecast, there’s a glimmer of hope for miners amidst the chaos. Thanks to Bitcoin’s recent meteoric rise, most miners find themselves in a sweet spot, with production costs comfortably below the current market price. But this delicate balance could soon tip if the price dips, leaving miners scrambling to stay afloat in the volatile sea of cryptocurrency.

Yet, amid the uncertainty, one thing remains clear: the fate of Bitcoin’s price hangs in the balance. With production costs on the rise, miners may hold onto their precious Bitcoin reserves tighter than ever before, potentially driving prices even higher. Brace yourselves for a wild ride as the countdown to the halving event ticks closer, and the fate of Bitcoin hangs in the balance.

Recent Bitcoin Blockchain Innovation

Software engineer Casey Rodarmor created the Ordinals protocol in January 2023 (Trade ORDI/USDT). Later, other developers also established the BRC-20 token standard based on this, launched a homogeneous token for the Bitcoin ecosystem, and made Bitcoin Blockchain can also “issue coins”. After the protocol went live, the number of inscriptions continued to hit new highs in the following weeks, but it also led to explosive growth in usage, transaction fees, and storage space on the Bitcoin network, triggering a wave of debate in the community. Then, many experimental projects began to appear, such as SATS Ordinals (SATS), the BRC-20 token with the largest market value in the Bitcoin ecosystem, and Bitcoin Frogs, etc. Most of these projects have achieved good results all the way up to now.

Many new projects have appeared on the blockchain in the past two weeks. As mainstream exchanges such as 8V.com (8V Crypto Exchange) began to list BRC-20 tokens, the Bitcoin blockchain ecosystem attracted more investors and traders, and the transaction volume It also grew rapidly and ushered in a market explosion period. Of course, compared with the projects at the beginning of the year, it is difficult to see cheap floor prices. However, because of the involvement of capital, these projects have better applications and forms than those at the beginning of the year.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)