Leverage Trading

The Three Major Benefits of Leveraged Trading: 8V Exchange’s “Super Leverage” Feature Lets You Leverage Up to 200x!

What is the definition of leveraged trading?

Leverage is a financial concept that refers to the mechanism of trading at a scale that is multiple times the deposited margin. It is also commonly known as the “principle of leverage.”

For example, a deposit of 10,000 in margin would typically allow for trading up to a 10,000 limit. However, with 200x leverage, the same 10,000 can facilitate trading up to a 2,000,000 limit.

When using leveraged trading, brokers usually require you to hold only a small portion of your position’s value, with the remainder supported by the broker’s funds. The potential profits and losses of a trade depend on the total size of your position, so the final outcome could be significantly higher than your initial investment. It is essential to remember that losses can also exceed the initial margin, bringing high risk.

Introduction and Advantages of Super Leverage Trading

8V Exchange’s super leverage function can amplify the general contract trading leverage principle up to 200 times.

In addition, you do not need to consider or calculate the cost of the funding rate, the transaction fees are also better than other exchanges in the market, and it differs from typical margin trading; you do not need to pay additional interest on borrowed cryptocurrency.

Download the 8V Exchange app now and plan your investment portfolio👉🏻 8V Download

Low Threshold

No need to learn professional jargon, quick to get started, and rapidly open positions; you can trade a variety of targets at the same time, all settled in USDT.

Fairness and Equity

The price of the trading targets comes from a weighted synthesis of major exchanges, preventing losses due to price deviation or manipulation.

Low Cost

You can open a position with just 50 USDT, with no interest on borrowed funds, no funding rate, no overnight holding fees, or any other charges.

High Profitability

Supports both bullish and bearish trades, allowing for profit in both directions; with up to 200x leverage, profits can be amplified by 200 times.

Super Leverage Trading Rules

| Trading Aspect | Rules |

|---|---|

| Trading Targets | BTC, ETH |

| Settlement Currency | USDT (No need to hold the trading target) |

| Trading Hours | 24/7 |

| Trading Direction | Both up and down (long and short) |

| Single Position Capital | 50 – 1,000 USDT |

| Maximum Leverage | 200x |

Super Leverage Fees

| Leverage Multiplier | Fee |

|---|---|

| > 0 < 100 | 0.01% |

| >= 100 < 200 | 0.09% |

Opening Fee: Opening Capital * Leverage Multiplier * Opening Fee Rate, included in the position’s profit or loss.

Closing Fee: Opening Capital * Leverage Multiplier * Closing Fee Rate, included in the closing position’s profit or loss.

Example Calculation for Buying Long/Going Long

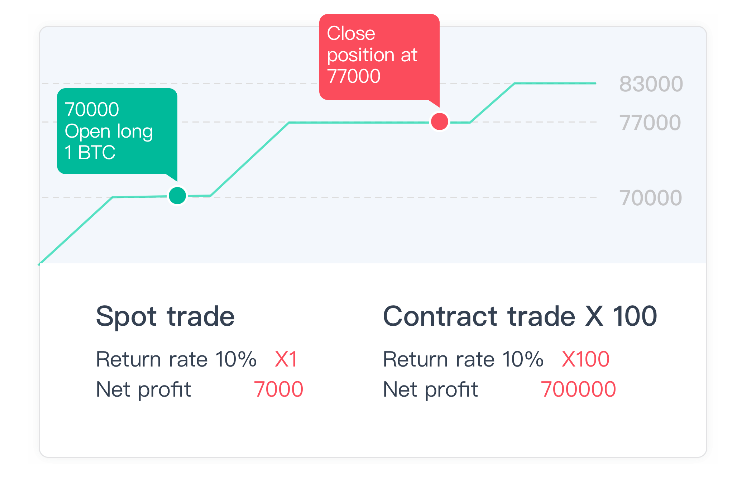

When you enable the leverage function for contract trading, the final net profit can be multiplied by 2-200 times. If you only engage in spot trading, then the final net profit will only be the actual rate of return earned on the principal.

Example Calculation for Selling Short/Going Short

When you enable the leverage function for contract trading, going short allows you to profit even when the price falls, with the net profit multiplied by 2-200 times. If you only engage in spot trading, you cannot utilize the short-selling function or enable leverage.

Super Leverage Trading Operation Tutorial

1. How to Open a Leverage Trading Position?

- Open the leveraged trading section and select the trading pair.

- Choose the leverage multiplier.

- Set the intended margin amount: The currency price can be set at market price or a custom value.

- Choose to buy long (bullish) or sell short (bearish).

2. How to View Leverage Trading Positions?

- Click on the “Positions” button at the bottom of the page to switch to the positions page.

- The positions page will display all of your open positions.

Each position will show current profit or loss, profit or loss percentage, and the price at which forced liquidation occurs. - Click on a position to view its details.

3. How to Close a Position?

- “Closing a position” means settling the profit or loss of that position at the current market price immediately. After closing, the principal and the profit or loss from closing will be returned to your balance.

To close a position, simply click the “Close Position” button corresponding to the open position. - You can also set a take-profit and stop-loss price to have the system automatically close the position for you.

- After closing, click the “Billing” icon in the upper right corner to view the record.

- You can view information about closed positions and their profit or loss under the “Closed Positions” tab.

3. Automatic De-leveraging

This section provides a detailed technical explanation of our Automatic Deleveraging (ADL) protocol, an integral component of our risk management framework. The ADL protocol is activated under exceptional market conditions to ensure the stability of our trading platform and to safeguard our users’ interests.

Mechanics of Automatic Deleveraging

The ADL system is triggered when our Risk Protection Fund is insufficient to cover the outstanding liabilities of positions that have been liquidated due to adverse market movements. In such scenarios, the ADL protocol may forcibly close positions in a prioritized manner to prevent systemic risk.

Strategies to Mitigate ADL Activation

We employ various preemptive strategies, including ‘Fill and Kill’ order executions, to minimize the likelihood and impact of ADL events. These strategies are designed to absorb market shocks and reduce the necessity for ADL interventions.

Notification and Impact on Users

In the event of ADL activation:

- Immediate notifications are dispatched to users whose positions are implicated.

- Impacted positions are liquidated at the bankruptcy price, which may not align with real-time market prices.

- Users are entitled to re-enter the market following the closure of their positions.

Prioritization Algorithm in ADL

The selection of positions for ADL is governed by a sophisticated algorithm that considers the Profit/Loss Ratio (P/L Ratio) and Margin Ratio of each position. The algorithm is designed to prioritize positions with higher leverage and profitability for deleveraging, based on the following formulas:

- P/L Ratio: P/L Ratio=max(0,Unrealized P/L)max(1,Account Balance)P/L Ratio=max(1,Account Balance)max(0,Unrealized P/L)

- Margin Ratio: For positive account balances, Margin Ratio=Maintenance Margin RequirementAccount Balance + Unrealized P/LMargin Ratio=Account Balance + Unrealized P/LMaintenance Margin Requirement; for non-positive balances, the Margin Ratio defaults to 0.

- Leverage Gain: Leverage Gain=Margin Ratio×P/L RatioLeverage Gain=Margin Ratio×P/L Ratio

- Ranking for ADL: Positions are ranked based on their Leverage Gain, with the ranking algorithm calculating the relative position within the total user base.

Risk Management Recommendations

We advise all users to employ prudent risk management strategies and to be cognizant of the implications of high-leverage trading, especially during volatile market periods. Our platform offers a suite of tools designed to assist in effective risk assessment and management.