Navigating the Legal Landscape of Bitcoin: An Analysis of Legality and Regulation

Bitcoin, the pioneer of cryptocurrencies, has captivated the world with its disruptive potential in finance and technology. Since its inception in 2009, Bitcoin has experienced significant growth, adoption, and controversy. One of the most pressing issues surrounding Bitcoin is its legality and regulation. In this article, we delve into the complex legal landscape of Bitcoin, examining its status in various jurisdictions and the regulatory challenges it faces.

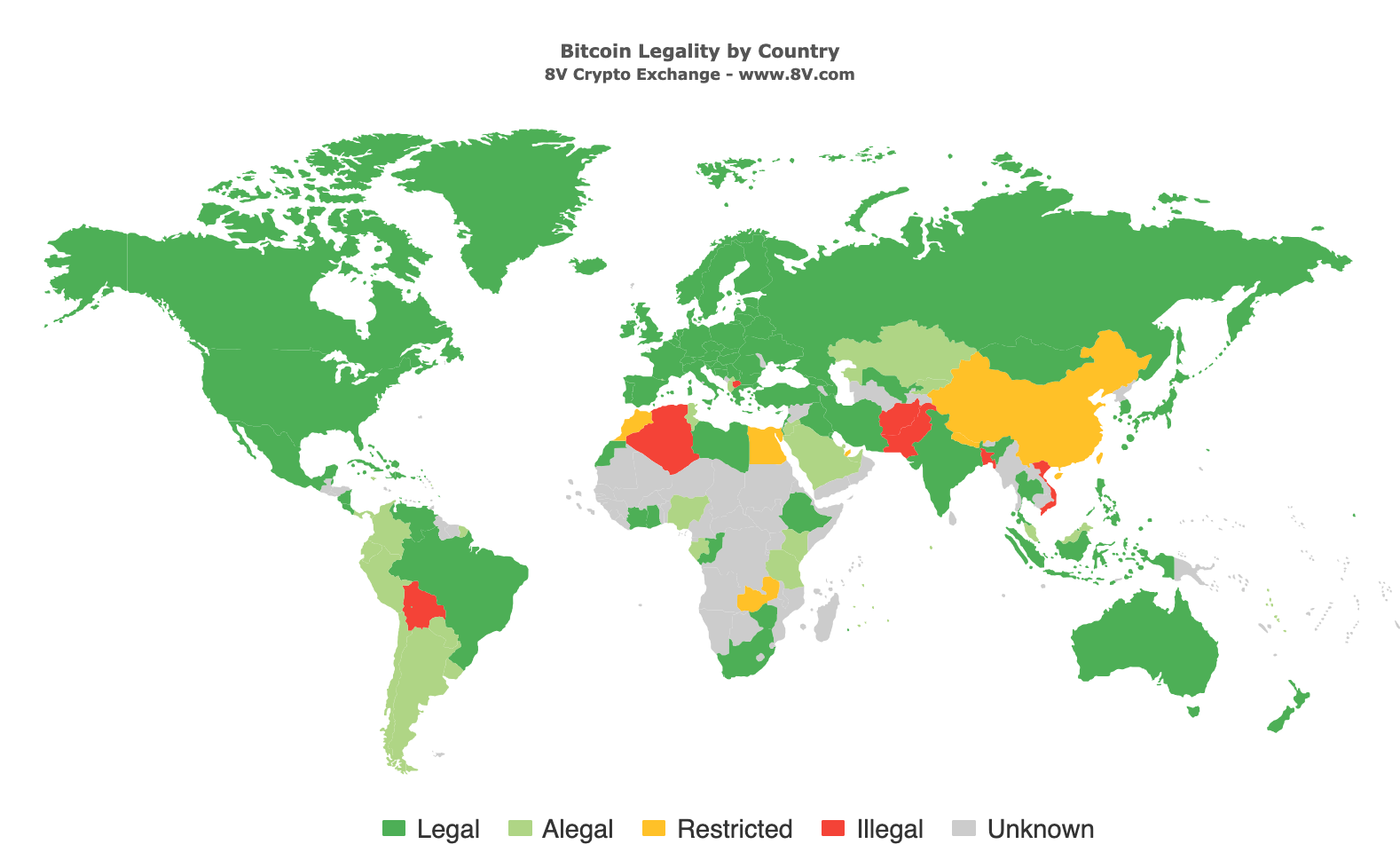

The Legality of Bitcoin: A Global Perspective

Bitcoin’s legal status varies from country to country, with some embracing it, others adopting a cautious approach, and some outright banning it. At its core, Bitcoin operates on a decentralized network, which means it transcends traditional regulatory boundaries. Here’s a snapshot of how different countries perceive Bitcoin:

- United States: In the United States, Bitcoin is generally considered legal, and its use is widespread. The Internal Revenue Service (IRS) treats Bitcoin as property for tax purposes, subjecting it to capital gains tax. However, regulatory clarity is still evolving, with agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) asserting jurisdiction over certain aspects of Bitcoin.

- European Union: The European Union (EU) has taken a mixed approach to Bitcoin regulation. While some member states have embraced it, others have expressed concerns about its use in money laundering and terrorism financing. The EU’s Fifth Anti-Money Laundering Directive (5AMLD) now includes cryptocurrency exchanges and custodian wallet providers under its regulatory framework, imposing Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

- China: China has a tumultuous relationship with Bitcoin. While it was once a thriving hub for Bitcoin mining and trading, the Chinese government has cracked down on cryptocurrency activities in recent years, banning initial coin offerings (ICOs), cryptocurrency exchanges, and mining operations. However, individuals can still hold Bitcoin as a form of asset.

- Japan: Japan has emerged as one of the most Bitcoin-friendly countries, recognizing it as legal tender since 2017. The country has implemented a licensing system for cryptocurrency exchanges and enforces robust consumer protection measures.

- India: India has oscillated between embracing and rejecting Bitcoin. The Reserve Bank of India (RBI) imposed a banking ban on cryptocurrency transactions in 2018, which was overturned by the Supreme Court in 2020. Currently, there’s no specific legislation governing Bitcoin, but regulatory clarity is needed to mitigate risks.

Regulatory Challenges and Concerns

Despite Bitcoin’s growing acceptance, regulatory challenges persist, posing concerns for governments, businesses, and consumers alike. Some of the key regulatory challenges include:

- AML/KYC Compliance: Bitcoin’s pseudonymous nature makes it attractive to illicit actors seeking to launder money or finance illegal activities. Regulators are increasingly focusing on enforcing AML/KYC regulations to prevent misuse of cryptocurrencies.

- Taxation: Taxation of Bitcoin transactions remains a complex issue, with challenges in determining capital gains, reporting requirements, and cross-border transactions. Clarity in tax treatment is essential for both individuals and businesses involved in Bitcoin transactions.

- Investor Protection: The volatility and speculative nature of Bitcoin pose risks to investors, especially retail investors who may not fully understand the market dynamics. Regulatory frameworks must prioritize investor protection measures, including disclosure requirements and risk warnings.

- Market Integrity: Ensuring the integrity of cryptocurrency markets is crucial for maintaining investor confidence and preventing market manipulation. Regulatory oversight of exchanges, trading platforms, and derivative products is essential to detect and deter fraudulent activities.

Future Outlook

As Bitcoin continues to mature, regulatory frameworks will likely evolve to address emerging challenges and risks. International cooperation and standardisation efforts will play a crucial role in fostering a more cohesive regulatory environment for cryptocurrencies. Governments, regulators, industry stakeholders, and the broader community must collaborate to strike a balance between innovation and regulation, enabling the responsible growth of the cryptocurrency ecosystem.

The legality of Bitcoin remains a subject of ongoing debate and regulatory scrutiny worldwide. While some jurisdictions have embraced Bitcoin, others have adopted a cautious approach or outright banned it. Regulatory challenges such as AML/KYC compliance, taxation, investor protection, and market integrity need to be addressed to foster a more robust and inclusive regulatory framework. Despite the challenges, Bitcoin’s disruptive potential in finance and technology continues to shape the future of global payments and digital assets.

For those who want to get into cryptoverse without hesitation of managing private keys

While navigating the evolving legal landscape of Bitcoin and cryptocurrencies, it’s imperative for individuals to choose reliable and trustworthy platforms for their transactions. Among the plethora of cryptocurrency exchanges available, one platform stands out for its commitment to security, transparency, and user experience: 8V Crypto Exchange – 8V.com

8V.com has established itself as a reputable cryptocurrency exchange, offering a wide range of digital assets and trading pairs to cater to diverse investor needs. With a focus on compliance and regulatory adherence, 8V.com prioritises the safety and security of its users’ funds through robust security measures and industry best practices.

Furthermore, 8V.com provides a user-friendly interface, advanced trading tools, and responsive customer support to ensure a seamless trading experience for both novice and experienced traders. The platform’s dedication to innovation and continuous improvement sets it apart as a reliable choice for individuals seeking a trustworthy cryptocurrency exchange.

As the cryptocurrency market continues to evolve and mature, platforms like 8V.com play a pivotal role in facilitating the adoption and mainstream acceptance of digital assets. Whether you’re a seasoned trader or a newcomer to the world of cryptocurrencies, 8V.com offers a secure and reliable environment to buy, sell, and trade your favourite digital currencies with confidence.

Further reading: Understanding and Comparing Crypto Trading Fees