Aave V3 is a non-custodial, decentralized liquidity protocol that allows users to borrow and lend cryptocurrencies through smart contracts, without the need for intermediaries. Aave V3 improves upon V2 with features like cross-chain support, e-mode efficiency mode, and advanced risk management tools, aiming to improve capital efficiency and provide users with greater flexibility. The article also provides code examples implemented on the Sepolia testnet and explores optimization strategies and performance examples.

Introduction to Aave e-mode DeFI lending protocol

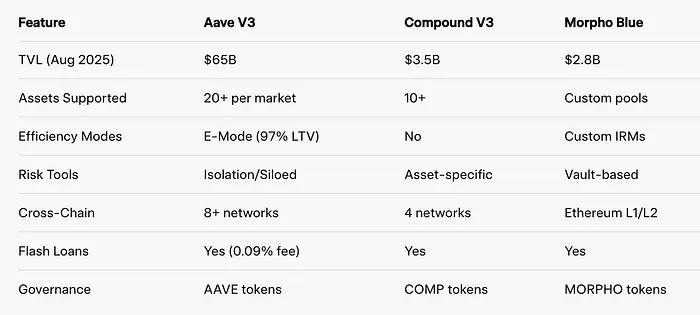

Aave V3, deployed in March 2022, marked a major milestone for the decentralized finance (DeFi) lending protocol. An evolution of earlier versions of Aave, V3 improves capital efficiency, introduces advanced risk management tools, and provides greater flexibility for users across multiple blockchains. Aave V3 has grown to over $65 billion in total value locked (TVL) and supports over 20 assets on networks including Ethereum, Polygon, Arbitrum, Optimism, and Avalanche. Recent integrations such as Ethena Labs’ sUSDe and custom instances with World Liberty Financial highlight its adaptability within the maturing DeFi landscape.

This guide explores Aave V3’s core architecture, e-mode, how it works, and its key improvements over V2. We’ll include practical code examples, diagrams, and a managed liquidity contract for hands-on implementation on the Sepolia testnet. Comparisons to protocols like Compound V3 and real-world use cases (e.g., stablecoin mining with a 6-10% APY) will highlight its advantages. Whether you’re a developer building a DeFi application, an LP optimizing for returns, or a borrower seeking low-risk loans, this article will provide actionable insights.

What is Aave V3?

Aave V3 is a non-custodial, decentralized liquidity protocol that facilitates cryptocurrency lending and borrowing. Users can stake assets to earn interest or borrow against collateral, all managed by smart contracts without the need for intermediaries. Unlike traditional banks, Aave operates on a blockchain network, ensuring transparency, immutability, and global accessibility.

Get codebyankita’s stories in your inbox

Core participants:

- Suppliers (Lenders): Deposit tokens (e.g., USDC, ETH) into the liquidity pool to earn interest from borrowers. They receive aTokens (e.g., aUSDC), which accrue value over time.

- Borrowers: Lock up collateral to borrow assets, paying a floating or fixed interest rate. Overcollateralization (e.g., 150% for volatile assets) can protect against defaults.

- Liquidators: monitor and close undercollateralized positions, earning bonuses (e.g. 5-10%) to maintain the health of the protocol.

- Governance Participants: AAVE token holders vote on protocol upgrades, risk parameters, and asset listings.

Aave V3 builds on V2 (launched in 2020), adding cross-chain support, an efficiency model, and advanced risk tools. It supports over 20 assets per market, with a TVL distribution of Ethereum (approximately $25 billion), Polygon (approximately $15 billion), and L2 (approximately $25 billion in total). Compared to centralized lenders like BlockFi (which went bankrupt in 2022), Aave’s non-custodial model eliminates counterparty risk, although it does introduce smart contract vulnerabilities (mitigated through audits).

How the Aave V3 protocol works

Aave V3 acts as an automated money market where supply and demand dynamically set interest rates. Here’s a detailed breakdown:

- Providing liquidity:

- Users deposit assets through the Pool contract.

- The protocol mints aTokens, which represent claims on deposits and accrued interest.

- Interest is calculated based on the utilization of the funding pool (e.g., higher borrowing demand = higher interest rates).

2. Borrowed assets:

- Users first provide collateral and then borrow money based on the collateral.

- Smart contracts enforce LTV ratios (e.g. 80% for ETH) and health factors (HF = Collateral Value / Debt Value, must be > 1).

- Interest rate: floating (market driven) or fixed (fixed, but rebalanced regularly).

3. Repayment and Withdrawal:

- Borrowers repay through the Pool, unlocking the collateral.

- Providers can withdraw aTokens to obtain the underlying asset as long as there is no borrow utilization preventing it.

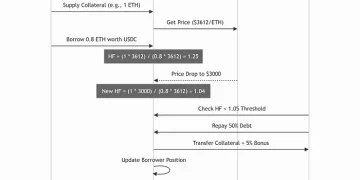

4. Liquidation:

- If HF < 1 (e.g. due to a price drop), the position becomes liquidable.

- The liquidator pays off some of the debt and seizes the collateral at a discount.

5. Flash Loans:

- Uncollateralized loan for arbitrage; must be repaid in a tx +0.09% fee.

Detailed liquidation flow chart:

Cross-chain portal mechanism (step by step):

- Aave V3’s portal functionality enables seamless asset transfers between networks (e.g., Ethereum to Polygon) using bridges like LayerZero or CCIP.

- Initiate transfer: The user calls bridgeCredit on the source chain and destroys the debt token.

- Bridge execution: The protocol uses a bridge (such as CCIP) to transmit messages and cross-chain assets.

- Target minting: On the target chain, new debt tokens are minted and credited to the user.

- Settlement: Governance enforces debt ceiling; fees on L2 are ~$0.10.

- Risk control: Oracles synchronize prices; if the bridge fails, emergency pause occurs.

Code (simplified portal call):

function bridgeCredit(

address asset,

uint256 amount,

uint16 destinationChainId

) external {

require(isBridgeEnabled(destinationChainId), "Invalid chain");

pool.burnCredit(asset, amount, msg.sender);

bridgeAdapter.bridge(asset, amount, destinationChainId, msg.sender);

}

This enables efficient multi-chain strategies, such as supplying on Ethereum and borrowing on Optimism for lower gas fees ($0.0088/tx).

Major improvements in Aave V3

Virtual Accounting

V3’s virtual layer separates internal tracking from on-chain balances to prevent errors caused by external transfers.

- How it works: Using rebasing aTokens for supply and debt tokens for borrowing.

- Code example:

struct ReserveData {

uint256 liquidityIndex;

uint256 variableBorrowIndex;

}

function getNormalizedIncome(address asset) external view returns (uint256) {

return reserves[asset].liquidityIndex;

}

- Advantages: Save 20-25% of gas fees; process airdrops without affecting returns.

E-Mode (Efficiency Mode)

Applicable to related assets (e.g., stablecoins).

- Categories: Up to 255 (e.g., stablecoins: DAI/USDC/USDT).

- Improvements: LTV up to 97% (vs. 75%), with a liquidation threshold of 98%.

- Code example:

struct EModeCategory {

uint16 ltv;

uint16 liquidationThreshold;

}

function setUserEMode(uint8 categoryId) external {

userConfig[msg.sender].eModeCategory = categoryId;

}

- Use case: Borrow $970 USDC against $1,000 DAI; great for leveraged rotation (6-8% APY).

Isolation Mode

Applicable to risky assets.

- How it works: Limit borrowing to stablecoins with a debt ceiling.

- Code example:

struct ReserveConfiguration {

bool isIsolated;

uint256 debtCeiling;

}

function setReserveIsolation(address asset, bool enabled) external onlyRiskAdmin {

reserves[asset].configuration.isIsolated = enabled;

}

- Pros: Secure asset onboarding; e.g., new tokens are capped at $1 million.

Interest rate improvement

Stateful strategy for dynamic interest rates.

- Model: Utilization-based curve with upper bound.

- Code example:

function calculateInterestRates(

uint256 utilizationRate

) external view returns (uint256 liquidityRate, uint256 borrowRate) {

liquidityRate = baseRate + (slope1 * utilizationRate);

borrowRate = liquidityRate + premium;

}

- Advantages: Prevents 100%+ interest rate spikes; governance can update the curve.

Risk Management and Safety

- Cap: Supply/borrowing limit (e.g. $10 million for WBTC).

- Liquidation: If HF < 0.95, all positions will be liquidated; bonus 5-10%.

- Oracle Sentinel: 30 minute grace period during L2 outages.

- Isolated borrowing: limited to one asset per position.

- Code example (health factor):

function getUserAccountData(address user) external view returns (

uint256 totalCollateral,

uint256 totalDebt,

uint256 healthFactor

) {

}

Smart contract design

Modular and Upgradable:

- Pool.sol: core logic.

- AToken.sol: Supplier token.

- DebtToken.sol: Borrower debt.

- Pros: Proxy mode for upgrades; high coverage (792% tested).

Custody liquidity and transparency

- Non-custodial: Users control keys; contracts hold funds.

- Transparency: On-chain data via The Graph subgraph.

- Managed Example: See implementation below.

Governance and Configuration

- AAVE holders: Propose AIP via forum/Snapshot.

- Roles: PoolAdmin (pause pool), RiskAdmin (adjust parameters).

- Cross-chain: Voting is done through LayerZero bridge.

- 2025 Example: sUSDe-integrated AIP.

Implementation: Custodial Liquidity Contract

This contract manages USDC/ETH lending on Sepolia, targeting a 6-10% APY.

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/security/ReentrancyGuard.sol";

import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

import "@aave/core-v3/contracts/interfaces/IPool.sol";

import "@aave/core-v3/contracts/interfaces/IAToken.sol";

contract AaveV3LiquidityManager is ReentrancyGuard {

address public constant USDC = 0xYOUR_USDC_ADDRESS;

address public constant WETH = 0xYOUR_WETH_ADDRESS;

IPool public immutable pool;

struct Position {

address owner;

uint256 amountSupplied;

uint256 amountBorrowed;

uint256 healthFactor;

}

mapping(address => Position) public positions;

constructor(address _pool) {

pool = IPool(_pool);

}

function supplyLiquidity(address asset, uint256 amount) external nonReentrant {

require(amount > 0, "Invalid amount");

IERC20(asset).transferFrom(msg.sender, address(this), amount);

IERC20(asset).approve(address(pool), amount);

pool.supply(asset, amount, msg.sender, 0);

positions[msg.sender].amountSupplied += amount;

positions[msg.sender].healthFactor = pool.getUserAccountData(msg.sender).healthFactor;

}

function borrowAsset(address asset, uint256 amount) external nonReentrant {

require(positions[msg.sender].amountSupplied > 0, "No collateral");

pool.borrow(asset, amount, 2, 0, msg.sender);

positions[msg.sender].amountBorrowed += amount;

positions[msg.sender].healthFactor = pool.getUserAccountData(msg.sender).healthFactor;

}

function repayLoan(address asset, uint256 amount) external nonReentrant {

IERC20(asset).transferFrom(msg.sender, address(this), amount);

IERC20(asset).approve(address(pool), amount);

pool.repay(asset, amount, 2, msg.sender);

positions[msg.sender].amountBorrowed -= amount;

positions[msg.sender].healthFactor = pool.getUserAccountData(msg.sender).healthFactor;

}

function withdrawLiquidity(address asset, uint256 amount) external nonReentrant {

require(positions[msg.sender].amountSupplied >= amount, "Insufficient balance");

pool.withdraw(asset, amount, msg.sender);

positions[msg.sender].amountSupplied -= amount;

positions[msg.sender].healthFactor = pool.getUserAccountData(msg.sender).healthFactor;

}

}

Deploy on Sepolia:

- Import Aave V3 core from GitHub.

- Deploy using the Pool address (Aave Sepolia testnet).

- Test: Provide 1000 USDC, borrow 800 USDC (E-Mode), and monitor HF.

Optimization Strategies and Benefit Examples

- Stablecoin mining: Supply USDC (4% yield), borrow DAI in E-Mode, and stake to earn 6-8% APY.

- Leverage loop: borrow the provided ETH and resupply it to earn 8-10% (risk IL).

- Cross-chain: Supply on Polygon (0.0075 gas), borrow on Arbitrum.

- Monitoring script (Python):

from web3 import Web3

w3 = Web3(Web3.HTTPProvider('https://eth-sepolia.g.alchemy.com/v2/KEY'))

pool = w3.eth.contract(address='POOL_ADDRESS', abi=POOL_ABI)

def get_health_factor(user):

data = pool.functions.getUserAccountData(user).call()

return data[5] / 1e18

print(get_health_factor('USER_ADDRESS'))

- Yield in 2025: 4-6% for stablecoins, 6-10% for ETH (after Fusaka gas reduction).

Security Considerations and Auditing

- Reentry/Flash Loans: Protected; Flash loan fee 0.09%.

- Oracle Control: Multiple oracles (Chainlink, custom); Sentinel for downtime.

- Audits: by OpenZeppelin (2022), PeckShield (2024); $10 million bug bounty.

- Risk: HF down due to volatility; use a buffer >1.5 to mitigate.

- Tools: Slither for static analysis and Foundry for testing.

Latest Developments and Future Outlook (2025)

- Ethena Labs: sUSDe integration increases stablecoin yields (5-7%).

- World Liberty Financial: Custom Aave Executor shares 20% of fees with the DAO.

- Fusaka Upgrade: Ethereum’s November 2025 update will reduce fees by 70%, benefiting Aave.

- V4 Preview: Hub-and-Spoke unified liquidity; risk for custom interest rates.

- Prediction: TVL to reach $100 billion by 2026; focus on RWA and AI-driven risk models.

Comparison with other agreements

Aave excels at multi-chain and risk tools; Compound excels at simplicity; Morpho excels at customization.

in conclusion

Aave V3 sets the standard for DeFi lending with its efficient, secure, and flexible design. Improvements like E-Mode, Segregated Mode, and Virtual Accounting enable higher yields (6-10% APY) while minimizing risk. Custody contracts simplify management and make deposits and withdrawals accessible to all users. As DeFi grows to $312 billion in TVL, Aave’s innovations—with support from integrations and Ethereum upgrades in 2025—will position it for continued leadership. Developers: Test on Sepolia, thoroughly audited. LPs: Diversify and monitor HFs. The future of lending is decentralized, efficient, and user-centric—embrace it with Aave V3.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)