Last week’s stablecoin depegging once again shook the decentralized finance (DeFi) world, with USDX, a synthetic stablecoin issued by Stable Labs, experiencing a dramatic depegging event. On November 6, 2025, the price of this token, which was supposed to maintain a 1:1 value to the US dollar, plummeted, falling to a low of $0.30. This event sent ripples through the entire DeFi ecosystem, raising new questions about the stability of synthetic assets, the hidden risks in complex lending protocols, and the potential contagion effects in interconnected markets. This article will explore the timeline of the USDX crash, delve into its underlying synthetic stablecoin mechanism, analyze the possible reasons for the depegging, and examine its broad impact on the DeFi landscape.

Stablecoin depegging analysis: What exactly happened to USDX?

The stablecoin depegging crisis unfolded rapidly on November 6th. USDX, an asset whose circulating supply once exceeded $680 million at its peak, began to falter. Within hours, its value plummeted by over 60%, a catastrophic failure for an asset built on a promise of stability. The price crash triggered widespread alarms among users and integration platforms. Prominent DeFi protocols using USDX in their liquidity pools and lending markets were forced to react swiftly. PancakeSwap, a major decentralized exchange (DEX) on the BNB Smart Chain, issued a statement urging users to review and monitor their positions involving USDX vaults, acknowledging the situation.

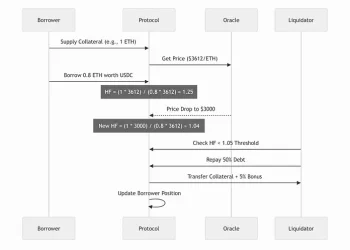

Meanwhile, Lista DAO, an on-chain lending protocol that uses USDX as collateral, found itself at the center of the crisis. The protocol observed unusually high lending rates, reaching a staggering 800% in some vaults, without any corresponding repayment activity from major borrowers. These borrowers, reportedly linked to Stable Labs, were using USDX and its collateralized version, sUSDX, as collateral to borrow other stablecoins such as USDC and USDT. This activity was effectively depleting the platform’s liquidity while accumulating unsustainable interest, indicating a lack of intention to repay the loans.

In response, the Lista DAO initiated an emergency governance vote (LIP 022) to launch a forced liquidation of the affected USDX market. The proposal, quickly approved by veLISTA token holders, aimed to adjust the oracle price of USDX to reflect its actual market value, thereby triggering a public liquidation of undercollateralized positions. Its goal was to minimize further losses and prevent a complete collapse of the lending pool. Re7 Labs, the vault manager on Lista, proposed the liquidation plan, and the DAO executed a flash loan, liquidating over 3.5 million USDX and recovering nearly 3 million USD1 tokens in the process.

Despite these measures, the damage has already been done. Trust in the USDX has been shattered, and its value continues to fall well below its expected $1 peg, exposing the vulnerabilities in its design and the systemic risks it poses to protocols that integrate it.

Understanding Synthetic Stablecoin Mechanisms

To understand why USDX failed so spectacularly, it’s essential to first understand what synthetic stablecoins are and how they differ from other stablecoin models. Unlike fiat-backed stablecoins (such as USDC or USDT) that are backed by actual US dollar or equivalent asset reserves held by banks, synthetic stablecoins generate their value through complex on-chain financial engineering. Specifically, USDX is designed to maintain its peg through a “delta-neutral” hedging strategy. This concept is relatively complex. In theory, Stable Labs receives user deposits and uses them to create positions that hedge against market price fluctuations. For example, they might hold a long position in a crypto asset (such as Bitcoin or Ethereum) while simultaneously holding an equal short position. The goal is to ensure that any loss on one side of the trade is offset by gains on the other, thus creating a stable, “delta-neutral” portfolio. The returns generated by these trading strategies are then used to support the value of the issued stablecoin, USDX. This model is inherently more complex than a simple reserve-backed model and carries different risks. Its stability relies on several key assumptions:

- Effective hedging: Delta-neutral strategies must be perfectly managed. Any failure to maintain hedging can expose collateral to market volatility.

- Sufficient liquidity: The market must have sufficient liquidity so that strategies can be executed effectively and redemptions can be processed without causing price slippage.

- Active management: Collateralized portfolios require continuous monitoring and rebalancing to adapt to changing market conditions.

- Oracle integrity: The system relies on reliable sources of price information (oracles) to value its collateral and correctly trigger liquidation.

When these assumptions are broken, the entire structure can quickly become unstable. The strength of a synthetic stablecoin depends on its underlying mechanisms and the diligence of its managers. The depegging of USDX serves as a stark reminder that promises of stable value derived from complex algorithms and trading strategies can be extremely fragile.

Exploring the Reasons for Stablecoin Depegging

While USDX issuer Stable Labs remained silent immediately after the incident, on-chain analysts and community members pieced together a compelling narrative of possible causes. The crash appears to have been triggered by a combination of external shocks, questionable internal operations, and inherent flaws in the stablecoin’s design.

The spread of the Balancer hacking incident

One prevailing theory points to the aftermath of a major security breach. On November 3rd, just days before the stablecoin depegging incident, the DeFi protocol Balancer suffered a massive attack, resulting in losses of approximately $128 million. Some analysts believe that Stable Labs had hedging positions on Balancer or related platforms. This attack may have triggered a series of forced liquidations of Stable Labs’ short positions in BTC and ETH. If the protocol’s hedging is subsequently liquidated at a loss, the value of the collateral backing USDX will be severely damaged. This could trigger a wave of user redemptions due to concerns about the stablecoin’s solvency. A sudden run would put immense pressure on the remaining collateral, creating a scenario reminiscent of a bank run, and ultimately breaking the peg.

Poor portfolio management and questionable collateral

Further investigation raised serious questions about Stable Labs’ collateralized portfolio management. A researcher at digital asset management firm Hyperithm pointed out that USDX’s portfolio composition had not been updated for over two months. This lack of active management is a major red flag for a delta-neutral strategy that requires constant adjustments to maintain effectiveness. More worryingly, the portfolio contained unusual and illiquid assets such as “BANANA31.” Holding such assets violates the principles of a stable, delta-neutral fund and indicates poor risk management. An idle portfolio exposed to market volatility is a time bomb, and the lack of rebalancing could leave USDX vulnerable to the volatility it should be neutralizing.

Depegging of stablecoins drains liquidity and raises questions about lending activity.

Perhaps the most compelling evidence comes from on-chain data tracking the activity of a wallet allegedly associated with Stable Labs founder Flex Yang. In the days leading up to the collapse, this wallet was observed depositing USDX and sUSDX as collateral on lending platforms such as Lista, Euler, and Silo. It then used this collateral to borrow other, more reliable stablecoins, such as USDC and USDT. This activity is highly suspicious for two reasons. First, it systematically siphoned liquidity from these platforms away from high-quality stablecoins and replaced it with the less reputable USDX. Second, borrowers were willing to pay annual interest rates as high as 800% with no apparent intention to repay. This behavior strongly suggests a deliberate strategy to extract as much real value as possible from the ecosystem before the inevitable collapse of USDX. To many observers, this appears more like a carefully orchestrated exit than a market failure leaving the lending protocols and their users with a mess.

The chain reaction of stablecoin depegging: its connection to other failures

The DeFi space is a network of interconnected protocols, and instability in one project can quickly spread to others. The USDX stablecoin depegging crisis occurred under the shadow of another recent crash. Another DeFi protocol, Stream Finance, suspended operations on November 4th due to a $93 million hack. Its own stablecoin, xUSD, depegged and collapsed. Notably, the collateral used in the troubled USDX vault on Lista DAO is similar to the assets involved in the Stream Finance failure, highlighting a pattern of spread through the ecosystem via high-risk cross-collateralized financial products. Elixir, the protocol issuing its own stablecoin deUSD, announced it would cease supporting the token following the Stream Finance hack, citing its significant exposure to the event. This domino effect demonstrates how the failure of one asset can trigger a crisis of confidence, dragging down neighboring projects.

Wider impact on the DeFi ecosystem

The USDX stablecoin depegging incident is more than just an isolated stablecoin depegging event; it’s a far-reaching cautionary tale with significant implications for the broader DeFi space. First, it dealt another blow to the reputation of synthetic and algorithmic stablecoins. Following the multi-billion dollar collapse of Terra-Luna in 2022, the market has maintained an understandable wariness of stablecoins not fully backed by transparent off-chain reserves. The failure of USDX, a project that had touted itself as MiCA compliant and well-funded, reinforced the perception that these models are inherently risky and complex. It highlighted the difficulty of maintaining a peg through algorithms and active trading, especially during periods of market stress. Second, the incident underscored the dangers of cross-protocol integration and systemic risk. When protocols like PancakeSwap and Lista DAO integrated USDX into their systems, they inherited those risks. The crisis forced these platforms into emergency mode, eroding user trust and potentially causing financial losses for liquidity providers and lenders. This is a crucial lesson for DeFi protocols: they must conduct rigorous due diligence on the assets they integrate and diversify their collateral to avoid a single point of failure. Third, it puts the actions of project founders and teams under intense scrutiny. Allegations of a wallet deliberately draining liquidity linked to the founder of Stable Labs raise serious ethical and potentially legal questions. If true, such behavior would poison the well of trust upon which the entire DeFi ecosystem relies. It shifts the discussion from market risk to counterparty risk, even in an environment that should be “trustless.” Finally, this incident has sparked renewed calls for better risk management tools and more robust governance mechanisms. Lista DAO’s swift action in initiating a forced liquidation vote demonstrates the importance of establishing emergency procedures. However, the rapid deterioration also indicates that current safeguards are not foolproof. Protocols may need to implement stricter collateral requirements, dynamic borrowing limits, and more sophisticated real-time risk monitoring to protect themselves and their users from similar future events. The story of the USDX crash is not unfamiliar in the volatile crypto world. This is a story of ambitious financial engineering, opaque operations, and the devastating consequences when trust is broken. While some speculative traders may profit by buying depegged assets, the end result is a loss of confidence and capital for the wider community. As the DeFi space matures, it must learn from these failures. Building a truly resilient and sustainable financial system requires more than just innovative code; it requires transparency, accountability, and a deep-seated respect for risk.

8V official website: https://8V.com and https://8V.com/info

Android Google PlayStore download (not applicable to UK IPs): https://play.google.com/store/apps/details?id=com.royallyborn.v8&hl=en

Android Standalone installation package: https://static.aws-s1.com/app/8v_1_2_5.apk

Apple iOS standalone installation package: https://app.8v.com/Dw/Download

Samsung GalaxyStore download: https://galaxystore.samsung.com/detail/com.royallyborn.v8

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)