Amid a bustling financial district, a young investor stood transfixed before a flickering array of screens, each pulsating with graphs and numbers that seemed to dance to an unpredictable rhythm. Cryptocurrencies, once the renegades of the investment world, had claimed their place amidst traditional assets, with their volatility both a source of wariness and incredible allure. As the clock ticked towards the final quarter, Q4, the investor knew the critical question wasn’t whether to navigate the choppy crypto waters, but how to chart a course that could weather the impending storm or seize the wind — Q4 Crypto Investment Strategy. Thus begins our discussion on strategizing crypto investments for the closing chapter of the fiscal year.

Understanding Market Trends in Q4

Cryptocurrencies have historically shown a tendency for increased volatility in the fourth quarter. During this period, investors look back at yearly performance and adjust portfolios accordingly— a strategy that can cause significant market movements. Evaluating long-term trends and seasonal patterns is essential to anticipate changes. Knowing historical behaviors like the “October effect,” where stocks and, by extension, cryptos might dip, or the end-year rally phenomena can inform investment decisions. Daily crypto market breaking news available here at 8V Crypto Academy.

Strategic Portfolio Allocation

A smart Q4 crypto investment strategy includes a balanced portfolio allocation. Diversifying across different cryptocurrencies can potentially mitigate risks and capitalize on the growth of various tokens. However, with over 10,000 cryptocurrencies in existence, it is crucial to invest in those with strong fundamentals, a solid use case, and robust community support. Investors should consider configuring their portfolios with a mix of established cryptocurrencies and emerging tokens with high potential for growth. Take a look at 8V Crypto Trading APP for portfolio management.

Risk Management

The mercurial nature of cryptocurrencies necessitates meticulous risk management, including the use of stop-loss orders to protect against market crashes. Investors must also be resilient against the FOMO (fear of missing out) that often accompanies surge cycles in crypto markets. Instead, a disciplined investment approach that sticks to pre-defined entry and exit strategies should be employed. 8V Crypto Exchange provides various risk management tools for user to hedge crypto investment risks to maximize profitability.

Regulatory Vigilance

Cryptocurrency regulations can have a profound impact on market behavior, especially in Q4, when many governmental fiscal policies are reviewed and enacted. Investors must stay vigilant of any upcoming regulations or legal frameworks that could affect cryptocurrency operations within different jurisdictions. 8V Crypto Exchange has valid MSB licence, a crypto platform you can trust with.

Tax Considerations

Q4 is not only a significant quarter for investment decisions but also vital for tax planning. Managing the tax implications of cryptocurrency investments, such as capital gains or losses, can affect overall return on investment. Keeping abreast of the tax laws and seeking expert advice is key to maximizing post-tax returns.

Technological Developments

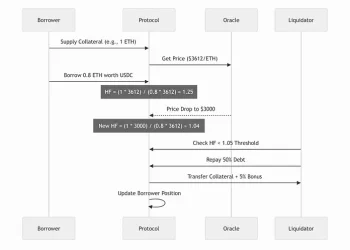

The rapid pace of technological advancement in blockchain and cryptocurrency should be monitored closely. Innovations, scaling solutions, or new applications like DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) can influence investor sentiment and market dynamics, offering ripe opportunities or warning flags for the prudent investor. Learn more about blockchain and crypto fundamental knowledge through 8V Academy.

Sentiment Analysis

Investment success in cryptocurrencies requires a pulse on the sentiments of the market— a sphere greatly influenced by media, influencers, and broader investor behavior. Tools that analyze social media sentiment and trends can be instrumental in gauging market mood and timing investment moves. 8V offers crypto news and real-time market data, crypto price heat map etc. See more on 8V Crypto Academy.

Conclusion

When Q4 approaches, savvy investors do not merely brace for a financial chill but prepare themselves for the opportunities that the winter winds may bring. A crypto investment strategy for the year’s end must balance an agile responsiveness to short-term market movements with a grounded understanding of long-term trends. As the young investor, illuminated by the glow of fluctuating screens, contemplates the quarter ahead, the blend of wariness and strategic confidence that marks an experienced crypto trader becomes the beacon guiding the journey through the maze of Q4’s high-stakes game. Signup today and start your crypto trading journey with 8V.com.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)