Predicting a 2x or higher increase in the price of certain altcoins by 2026 isn’t without its challenges and involves a degree of optimism, but it’s rooted in several factors that are believed could drive significant growth in the coming years. Let’s break down the reasoning behind these ambitious price predictions.

1. Rapid Technological Advancements

- Blockchain Evolution: Many of these altcoins are improving their underlying technologies, especially in terms of scalability, security, and transaction speed. For example, Elrond and Algorand are building fast and scalable blockchains that could outperform Ethereum, which is experiencing issues with gas fees and transaction congestion. As blockchain technology improves and adoption increases, these coins become more valuable because they offer better solutions for real-world use cases.

- Interoperability and Cross-chain Solutions: Coins like Quant and Cosmos are building interoperable ecosystems that allow for better communication between different blockchains. This is a critical need as the decentralized ecosystem grows. A seamless multi-chain world could make these interoperability-focused coins more valuable over time.

2. Mass Adoption of Blockchain Technology

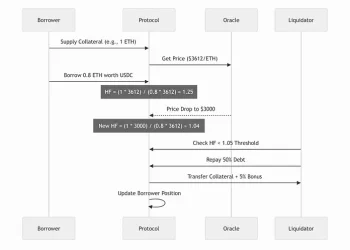

- DeFi and NFT Growth: The DeFi space is growing exponentially, and Fantom, Avalanche, Polygon, and Immutable X are all critical players in this sector. NFTs, though volatile, have proven their staying power, with major brands and industries adopting blockchain-based collectibles and digital ownership. If these sectors continue to expand, these coins will benefit as they provide essential infrastructure for these ecosystems.

- Enterprise Blockchain Adoption: Companies are increasingly looking to leverage blockchain for efficiency, transparency, and security. VeChain’s focus on supply chain tracking is already showing promise, and Kadena and Celo aim to improve real-world use cases, such as cross-border payments and mobile-first financial solutions. If these technologies are adopted by major enterprises, these coins will become more valuable.

3. Supply Constraints and Increasing Demand

- Limited Supply: Many of the coins mentioned, like Bitcoin, Solana, and Polkadot, have a limited supply or designed scarcity in their protocols. Scarcity coupled with increasing demand tends to drive price increases. While not all of the altcoins mentioned have a hard cap like Bitcoin, those with low circulating supply (e.g., Quant) or those undergoing deflationary mechanisms (like Avalanche) are likely to see their prices appreciate as demand increases.

- Staking and Yield: Several of these coins (e.g., Ethereum, Algorand, Elrond) use proof-of-stake (PoS) or similar mechanisms that incentivize holding. As more investors stake their coins to earn passive income, this can reduce the available circulating supply, causing upward pressure on the price.

4. Mainstream Adoption and Institutional Interest

- Institutional Investment: The market had already seen increasing interest from institutional investors in the cryptocurrency space. Projects like Elrond, Quant, and Avalanche have strong potential to attract more institutional support due to their scalability, performance, and enterprise-ready solutions. If larger financial institutions and tech companies continue to integrate blockchain technology, these altcoins could see massive growth in demand.

- Regulatory Clarity: Although the crypto space has faced regulatory hurdles, increased regulatory clarity and favorable policies could be a major factor in boosting adoption. As more governments provide clear guidelines for cryptocurrencies and blockchain technology, institutional investors may feel more comfortable investing in altcoins. This could lead to long-term value appreciation.

5. Unique Value Propositions

- Real-World Use Cases: Many of these altcoins have strong real-world use cases that differentiate them from other cryptocurrencies. VeChain focuses on supply chain management, Celo targets mobile-first users in emerging markets, and The Graph provides crucial indexing services for dApps. As industries look to adopt blockchain technology for transparency, traceability, and efficiency, these coins can be seen as critical infrastructure projects.

- NFT and Gaming Ecosystem: Immutable X’s gas-free scalability is highly attractive in the booming NFT market. As NFTs continue to grow, Immutable X could become the go-to platform for NFTs, resulting in major price increases. Similarly, Fantom’s low fees and speed make it attractive for gaming and other decentralized applications.

6. Network Effects and Ecosystem Growth

- Expanding Ecosystems: Many of these altcoins, such as Polygon, Fantom, and Avalanche, have already developed active ecosystems, and these ecosystems tend to grow exponentially. As more projects build on top of these platforms, the value of the underlying cryptocurrency increases. Ethereum’s success is partly due to its massive ecosystem of dApps, and other coins can follow suit.

- Partnerships and Collaborations: Strategic partnerships and collaborations are key drivers of price growth. Coins like VeChain have already formed partnerships with global companies (e.g., Walmart China, BMW), and Celo is working with organizations like the World Economic Forum to enable mobile payments. More of these partnerships in the coming years can lead to rapid price appreciation.

7. Economic and Global Trends

- Macro Trends: In the broader context, factors like inflation, economic instability, and the potential for global currencies to devalue could push investors towards cryptocurrencies as alternative assets. If cryptocurrencies like Elrond and Quant become widely adopted as store-of-value or infrastructure solutions for decentralized finance, their prices could appreciate significantly.

- Geopolitical Events: Crypto markets are often seen as a hedge against geopolitical instability. If nations continue to struggle with traditional financial systems or currencies, blockchain-based solutions (especially stablecoins and decentralized finance applications) could see massive adoption, driving prices for projects that enable this infrastructure.

Conclusion: Why the Ambitious 2x Prediction?

- The crypto space is maturing quickly, and many of these altcoins are working on the cutting edge of scalability, interoperability, and real-world adoption.

- The projects I’ve listed have strong technological fundamentals and address real-world problems that could drive large-scale adoption.

- As DeFi, NFTs, Web3, and blockchain infrastructure expand, many of these projects will benefit from increased demand and adoption, likely pushing their prices higher.

While a 2x increase is an ambitious target, it’s achievable for several of these coins, especially if the broader market experiences continued growth, and blockchain adoption accelerates across industries.

Disclaimer: These predictions are based on current trends and reasonable expectations but are speculative in nature. Cryptocurrency markets are volatile and unpredictable, and significant risk is involved. Always do your own research before making any investment decisions.

Summary of Price Predictions:

| Coin | Today’s Price (May 20, 2025) | 2026 Price Prediction |

|---|---|---|

| Avalanche (AVAX) | $22.02 | $28–$42 |

| Algorand (ALGO) | $0.2181 | $0.65–$1.2 |

| Fantom (FTM) | $0.5977 | $0.8–$1.5 |

| Kadena (KDA) | $0.5676 | $1.2–$2 |

| Elrond (EGLD) | $17.92 | $26–$35 |

| The Graph (GRT) | $0.1068 | $0.6–$0.8 |

| Celo (CELO) | $0.3738 | $0.7–$1.2 |

| Quant (QNT) | $96.09 | $120–$1,50 |

| VeChain (VET) | $0.02745 | $0.5–$0.8 |

| Immutable X (IMX) | $0.6346 | $0.9–$1.3 |

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)