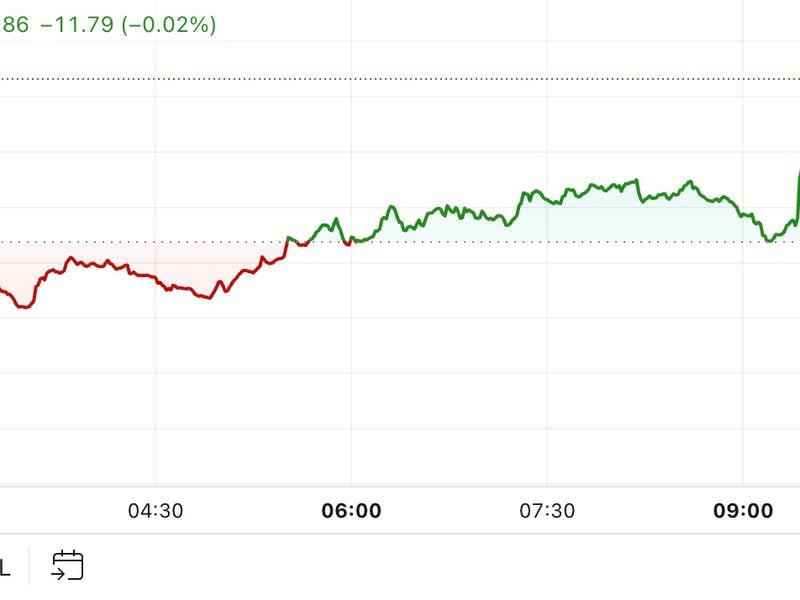

Bitcoin climbed above $64,000 in early U.S. trading hours ahead of a number of Fed speakers, including Chairman Jerome Powell, and after China’s Politburo reportedly pledged continuing support to that country’s economy and markets.

Bitcoin could see increased interest from retail and institutional investors following the approval of options trading on Blackrock’s IBIT.

Bitcoin (BTC) is again setting its sights on the $65,000 level not touched since the first week in August, with a speech later today from Federal Reserve Chair Jerome Powell potentially the next catalyst.

“The market will be following Powell’s speech closely for indications of any shifts in sentiment following last Thursday’s FOMC press conference, which signaled the potential for further easing,” traders at Singapore-based QCP Capital said in a broadcast message. The Fed Chair, however, did not comment on monetary policy or the economic outlook.

The Fed announced its first round of cuts last week – leading to risk assets such as bitcoin surging – and traders expect a 62% chance of an additional 50 basis point reduction in November, according to the CME FedWatch Tool.

Gold notched another in what’s become a series of record highs of late, climbing nearly 1% to above $2,700 per ounce. China is reportedly mulling a $142 billion capital injection into its banking system, along with a number of other stimulus measures. The Shanghai Composite soared another 3.6% and is on track for its best week in a decade. U.S. stock index futures are ahead about 1%.

Bitcoin’s appeal is starting to grow among retail and professional investors alike. Data from SoSoValue shows that the total daily net inflows cracked $100 million for the second day in a row for the BTC ETFs, marking a five-day streak of positive net inflows for the funds.

On the other hand, retail bitcoin investors have accumulated 35,000 BTC in the past 30 days, highlighting increased confidence and participation from smaller holders.

Meanwhile, some say the newly-approved options on Blackrock’s Bitcoin Trust (IBIT) has primed BTC for further gains ahead.

“The approval would increase liquidity and investor participation in the Bitcoin market, marking a further step toward broader institutional adoption,” onchain analysis firm CryptoQuant shared in a note with CoinDesk. “Indeed, Bitcoin options on the CME recorded a fresh high open interest of almost half a billion on March 12, 2024, growing by almost five-fold from their maximum level in 2023.”

Update (Sept. 26, 13:25 UTC): Headline and body changed following Powell’s remarks, which didn’t touch on monetary policy or the economic outlook.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)