-

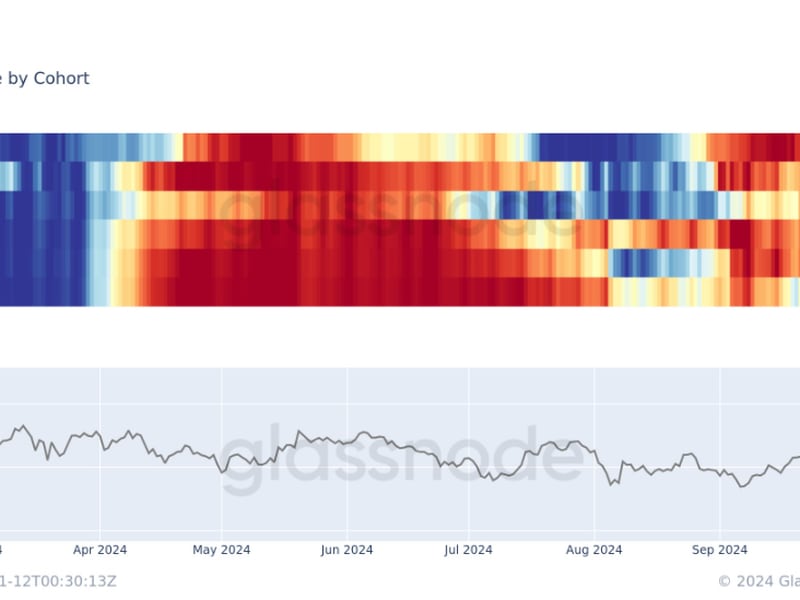

Investors who hold less than one BTC continue to accumulate, as they have been doing for the past two months.

-

Humpback whales who hold over 10K BTC, continue to distribute coins, extending the two-month trend.

-

Long-term holders, on average, seem unfazed about this rally and continue holding onto bitcoin, demanding higher prices.

Bitcoin’s (BTC) blockchain data reveals that small addresses continue to accumulate BTC, even as whales stick to their “sell on rise” strategy.

BTC, the leading cryptocurrency by market value, nearly tested the $90,000 threshold early Tuesday and has since pulled back to trade near $87,400 at press time, still up 27% on a seven-day basis, according to CoinDesk data.

The 40,000-foot view tells us that the recent buying pressure has largely originated from the Nasdaq-listed Coinbase (COIN) exchange, often considered a proxy for the stateside institutional activity. However, granular data reveals that small addresses – often referred to as “shrimps” – are actively boosting their coin stash as they chase the ongoing price rally.

Glassnode data shows a breakdown of all cohorts from less than one BTC, referred to as “shrimps,” up to over 10,000 BTC, called “humpback whales.” A value closer to one shows that cohorts are accumulating tokens, while a near zero value represents distribution.

All cohorts other than humpback whales have accumulated bitcoin for the past two months. This has coincided with bitcoin’s upward price trajectory, as it climbed from approximately $55,000 in September to just shy of $90,000 in November.

The data challenges the narrative that whales are the smart money of the ecosystem. The feature image shows that whales have been selling into price strength, while retail has been buying the rally. CoinDesk research shows how retail has evolved into smart money over time.

When we aggregate the data from all cohorts, including miners, exchanges, and retail investors, over the past 30 days, it shows that all groups combined have accumulated a total of 26,000 BTC. But again, this demand has been consistent for the past three months since September, outstripping supply and issuance.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HG4LHYSC7VEERP22KFKNHD65SA.png)

Glassnode defines long-term holders (LTHs) as investors who have held bitcoin for more than 155 days. We typically see them distribute bitcoin into price strength, which we have seen on previous occasions when bitcoin has hit all-time highs in 2017 and 2021, and accumulate at bottoms.

This time, however, they seem to be holding on to their balances, a sign of bullish expectations. Perhaps, prices are going to have to go much higher for LTHs to part with their bitcoin.

Currently, LTHs hold 78% of the bitcoin circulating supply approximately over 15 million coins. In the past month, they have reduced their supply by just around 3%, but compared to 2017 or 2021, when their supply dropped as much as 20%.

The inverse can be seen with short-term holders (STHs) or those who hold coins for less than 155 days and tend to buy bitcoin on euphoric days like Monday, when bitcoin shot up 10%. Their supply is near all-time lows, albeit with a brief tick higher. During previous bull markets, STHs have held as much as 35% or 50% of the supply.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VXOKL7OOYJFELBDS2QVKVG764Q.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)