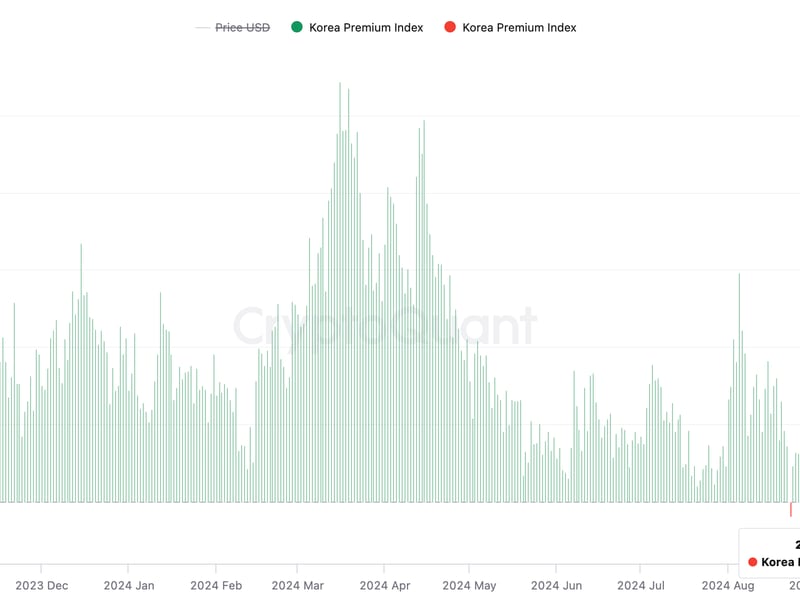

Bitcoin is trading on Korean exchanges at the steepest discount since October 2023, according to CryptoQuant.

Smart traders have shifted to high-beta altcoins, data tracked by 10x Research show.

Crypto traders on South Korea-based exchanges seem to have shifted from bitcoin (BTC) to alternative cryptocurrencies (altcoins) amid bullish analysts’ forecasts in the wake of the recent U.S. interest-rate cut.

That’s the message from analytics firm CryptoQuant’s Bitcoin Korea premium index, which measures the price gap between Korean and offshore exchanges.

The index turned negative Wednesday, sliding to -0.55, reflecting the deepest discount since October 2023. In other words, bitcoin has fallen out of favor in Korea. Trading volumes over Korean exchanges suggest the same, indicating a shift toward high-beta alternative cryptocurrencies.

The chart by 10x Research shows daily Korean trading volumes over the past 40 days, with the most traded pair each day. Lately, traders have shifted from the bitcoin-korean won (BTC/KRW) pair to altcoins like UXLINK, CKB, ARK and PENDLE.

Traders elsewhere are focusing on altcoins as well, anticipating more Federeal Reserve rate cuts in the coming months.

“Quick-moving traders are seizing the opportunity to load up on their favorite altcoins, anticipating a strong Q4 rally,” Markus Thielen, founder of 10x Research, said in a note to clients on Wednesday, noting the shift away from bitcoin.

“As Bitcoin surged past $60,000 and set its sights on breaking $65,000, savvy traders have accumulated undervalued altcoins, including TAO, ENA, SEI, APT, SUI, NEAR, and GRT,” Thielen wrote.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)