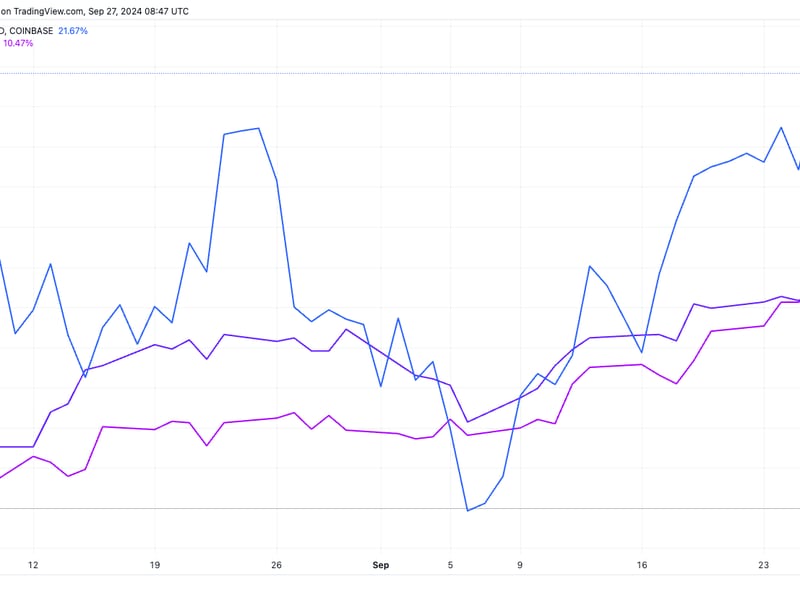

Bitcoin is up 22% since the Yen carry trade unwind on Aug. 5, while gold and the S&P 500 are up around 11%.

Over 65% of the circulating bitcoin supply has remained unmoved for over a year.

Almost all holders are in profit if they held for three years, while they are all in profit if they held for at least five years – Unchained.

BlackRock released a report last week, titled “bitcoin as a unique diversifier.”

The investment giant identified four key points from the report. First, how to analyze bitcoin (BTC) in relation to traditional financial assets due to its fundamental properties, such as not having a quarterly earnings report or a CEO.

Second, bitcoin’s high volatility can be perceived as a “risky” asset, which contributes to the discussion that whether it is a “risk-on” or “risk-off” asset. The token could be considered a flight-to-safety option because it is scarce, non-sovereign, and decentralized. Lastly, BlackRock pointed out that the long-term adoption of bitcoin may come from global instability.

Bitcoin’s realized volatility continues to trend downwards over time, indicating increased stability. In the early years of bitcoin, its realized volatility used to trade over 200%; however, as the asset matured, so did the volatility.

Since 2018, realized volatility has not exceeded 100% and is currently at 50%. As realized volatility decreases and liquidity increases through financial instruments such as the spot and futures market, this may bring in more sophisticated investors such as options traders. This seems to be on the horizon with the U.S Securities and Exchange Commission’s (SEC) approval of physically settled options tied to BlackRock’s spot bitcoin ETF.

BlackRock also asked the question: Is bitcoin risk-on or risk-off? While short-term trading may suggest that bitcoin behaves like a risk-on asset, the data reveals a different narrative over a longer time horizon.

According to data from bitcoin custody service Unchained, “almost all holders (99%+) are in profit if they held for just three years. All bitcoin holders in this class are in profit if they held for at least 5 years”.

We can see this type of mentality on-chain among investors, where over 65% of the circulating bitcoin supply has remained unmoved for more than one year, according to Glassnode. This trend suggests that many investors tend to hold bitcoin because they believe in its store-of-value narrative and view it as a risk-off asset, even though bitcoin has faced multiple 20% corrections in 2024.

BlackRock also showed that bitcoin has a very low correlation to U.S. equities. A graph shows the trailing 6-month S&P 500 correlation with bitcoin; the average correlation is 0.2 since 2015. Sometimes, assets will trade near one-to-one with one another due to external macro factors, most likely in risk-off or liquidity events.

The report notes, “These episodes have been short-term in nature and have failed to produce a clear long-term statistically significant correlation relationship.”

Continuing with the theme of having a long-term time preference, BlackRock noted that bitcoin tends to outperform other risk-on assets after 60 days following a major geopolitical event.

The U.S.- Iran escalation in 2020 saw bitcoin return 20% after 60 days, outperforming gold and S&P 500. This was also the case for Covid-19, the 2020 U.S. election challenges, the Russian Invasion of Ukraine, the U.S. regional banking crisis, and most recently, the Yen Carry trade unwind on Aug. 5.

During the recent Yen carry trade unwind on Aug. 5, which was now 53 days ago, major assets experienced declines on the day. However, bitcoin has risen by 22% since then, with gold and the S&P 500 up roughly 11%.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)