BTC

96,238.77

-1.10%

ETH

3,643.70

-1.83%

XRP

2.64

+35.57%

USDT

1.00

-0.03%

SOL

225.78

-5.28%

BNB

642.19

-3.02%

DOGE

0.42200599

-1.25%

ADA

1.14

+5.56%

USDC

1.00

-0.01%

STETH

3,638.90

-1.88%

AVAX

49.31

+8.53%

TRX

0.21005058

+0.48%

SHIB

0.0₄29213

-9.36%

TON

6.69

-3.59%

XLM

0.53580165

+6.38%

LINK

21.34

+13.08%

WBTC

95,666.79

-1.12%

BCH

516.32

-1.84%

HBAR

0.26751394

+33.46%

SUI

3.27

-5.53%

By Omkar Godbole, Oliver Knight|Edited by Sheldon Reback

Updated Dec 2, 2024, 2:32 p.m. Published Dec 2, 2024, 12:40 p.m.

What to know:

You are currently viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

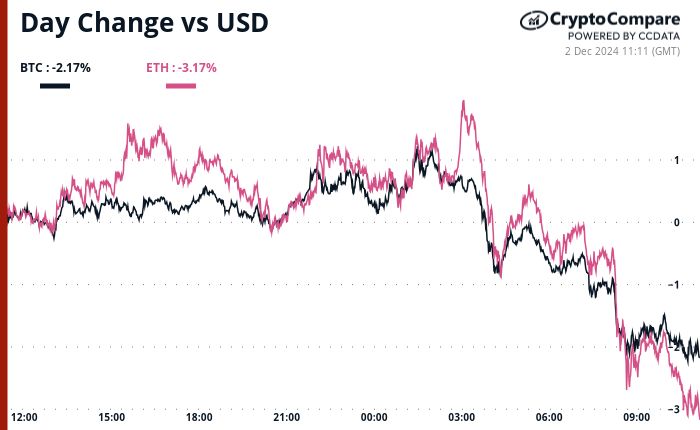

Bitcoin is starting the week on a despondent note, trading 2% lower at $95,000 amid risk-off sentiment in traditional markets. European stocks are falling and the euro is diving against the dollar as concern the French government is on the verge of collapse pushes its bond yields to levels matching those of debt-ridden Greece.

Story continues below

BTC’s decline follows a failed attempt to break through the multimillion-dollar wall of sell orders near $100,000 over the weekend and MicroStrategy’s Michael Saylor’s bitcoin presentation to Microsoft.

Still, bulls shouldn’t lose hope just yet, because the supply scarcity is real, with nearly 75% of bitcoin classified as illiquid and less than 14% in centralized exchanges, according to Andre Dragosch of Bitwise.

There’s chatter about countries adopting BTC as a strategic reserve, with a Middle Eastern nation potentially unveiling something big at the Abu Dhabi Finance Week that runs Dec. 9-12. The noise could get louder as the event draws close.

Ether’s technical analysis is particularly bullish, reminiscent of BTC’s positioning in mid-October, which was signaling a massive rally even before the U.S. elected crypto-friendly Donald Trump as president.

Market flows are on the same page. On Friday, net inflows into nine ether ETFs listed in the U.S. hit nearly $333 million. That’s even more than the BTC funds’ $320 million. Talk about the change in market leadership. In addition, ETH whales have snapped up ETH worth $5.7 billion in 20 days, according to IntoTheBlock.

Meanwhile, XRP has surged over 27% in just 24 hours, making it the third-largest cryptocurrency by market value and pushing Tether’s USDT to fourth place. The rally was accompanied by record volumes in South Korea, indicating strong retail participation. While a surge of 350% in four weeks may look overstretched, that’s not necessarily the case. XRP’s market value-to-realized value (MVRV) ratio, a popular metric modeled alongside the price-to-book ratio in equities and tracked by Santiment, has bounced only to its lifetime average, meaning prices need to rise more before we can start talking about overvaluation.

On the macro front, this week’s focus is the U.S. ISM non-manufacturing PMI on Wednesday, along with Friday’s payrolls and average hourly earnings report. If the employment component and wage growth exceed expectations, the dollar could get a lift while trimming Fed rate-cut bets. Additionally, there’s talk of more easing from China, though the impact of earlier measures has been downplayed. Stay alert!

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 2, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s ISM Manufacturing PMI Report. Est. 47.5 vs Prev. 46.5.

- Dec. 2, 3:15 p.m.: Fed governor Christopher J. Waller gives a speech (“Economic Outlook”) at the American Institute for Economic Research (AIER) Monetary Conference, in Washington, D.C.

- Dec. 4, 4:00 a.m.: The Organisation for Economic Co-operation and Development (OECD) is set to release its latest Economic Outlook. Secretary-General Mathias Cormann and Chief Economist Álvaro Pereira present the findings during an event available online.

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases its Services Purchasing Managers Index (PMI) for November. Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:45 p.m.: Fed Chair Jerome H. Powell takes part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases the October Employment Report.

- Nonfarm Payrolls (NFP) Prev. 12K.

- Unemployment Rate Prev. 4.1%.

- Token unlocks

- Ethena (ENA) to unlock 0.44% of circulating supply worth $10.75 million on Dec. 3.

- Cardano (ADA) to unlock 0.05% of circulating supply worth $20.18 million on Dec .4.

- Jito (JTO) to unlock 102.7% of circulating supply worth $464.1 million on Dec. 7.

- Governance votes

- SafeDAO opened preliminary discussions on allocating $50,000 toward creating a modular treasury management system. The discussion opened on Dec. 1.

- Arbitrum is voting on allocating $20,000 to research user behavior and subsequent development direction. The vote closes Dec. 5.

- Dec. 2: ETHVenice 2024 (Venice)

- Dec. 2 – 3: DigiAssets Connect 2024 (Geneva)

- Dec. 2 – 3: Digital Transformation Kuwait Conference 2024 (Kuwait)

- Dec. 2 – 6: Theory of Cryptography Conference 2024 (Milan)

- Dec. 3 – 4: FT’s Global Banking Summit (London)

By Oliver Knight

HyperLiquid’s native token, HYPE, hit the market last week to become one of the most profitable airdrops of the year. It tripled in price over the weekend after debuting at a $1 billion market cap. The token is now trading at $8.57 after touching a record high of $9.79.

Unlike many other generic native tokens that offer utility through governance votes, HYPE can be staked to secure HyperBFT, the proof-of-stake consensus algorithm that powers the HyperLiquid exchange. It is also being used as the primary token for paying transaction fees on the network.

True to its ticker, the token garnered notable attention among crypto enthusiasts on X (the so-called Crypto Twitter community) with almost all of the well-known influencers mentioning, recommending and occasionally scrutinizing it.

The bull case for HYPE is in the tokenomics because supply is skewed toward the community as opposed to venture capitalists and early investors. As a result, it is trading more like a meme coin with a viral following without the risk of supply suppression by anyone who bought in a funding round at a cheaper price.

Quant trader Flood, who goes under the X account @ThinkingUSD, wrote that they were “adding huge” under $4 on the day of release. Since then trading terminal Insilico announced it was strategically accumulating a HYPE reserve, allocating 25% of weekly revenue.

- The three-month basis in BTC and ETH futures on offshore exchanges has softened from weekend highs, suggesting a moderation in bullish sentiment.

- Perpetual funding rates across the broader market are normalizing, which could pave the way for a more sustained price rally.

- In the options market, calls for BTC and ETH are still trading at a premium to puts. However, ETH calls are more expensive than BTC calls, indicating bullish expectations for ether relative to bitcoin.

- IBIT and MSTR’s high implied volatility has sparked interest in covered call strategies.

- BTC is down 2.6% from 4 p.m. ET Friday to $94,939.66 (24hrs: -2%)

- ETH is down 0.5% at $3,579.86 (24hrs: -3%)

- CoinDesk 20 is up 3.6% to 3,641.28 (24hrs: 6+2.13%)

- Ether staking yield is unchanged at 3.07%

- BTC funding rate is at 0.017% (18.8% annualized) on Binance

- DXY is up 0.4% at 106.2

- Gold is down 0.6% at $2,635.20/oz

- Silver is up 1.2% to $30.26/oz

- Nikkei 225 closed +0.8% at 38,513.02

- Hang Seng closed 0.65% at 19,550.29

- FTSE is up 0.14% at 8,273.78

- Euro Stoxx 50 is 0.20% at 4,813.85

- DJIA closed on Friday +0.42% to 44,910.65

- S&P 500 closed +0.56% at 6,032.38

- Nasdaq closed +0.83% at 19,218.17

- S&P/TSX Composite Index closed +0.41% 25,648

- S&P 40 Latin America closed -1.58% at 2,328.18

- U.S. 10-year Treasury was unchanged at 4.2%

- E-mini S&P 500 futures are down 0.2% to 6039.50

- E-mini Nasdaq-100 futures are down 0.21% to 20949

- E-mini Dow Jones Industrial Average Index futures are down 0.12% at 44999

- BTC Dominance: 56.78% (-0.04%)

- Ethereum to bitcoin ratio: 0.0379 (-0.37%)

- Hashrate (seven-day moving average): 744 EH/s

- Hashprice (spot): $62.14

- Total Fees: 20.1 BTC/ $1.9 million

- CME Futures Open Interest: 181,105 BTC

- BTC priced in gold: 36.2 oz

- BTC vs gold market cap: 10.32%

- Bitcoin sitting in over-the-counter desk balances: 421,809

BTC’s dominance rate has slipped below an ascending trendline that tracks its year-to-date rise. The breakdown points to a continued investor preference for altcoins over bitcoin.

- MicroStrategy (MSTR): closed on Friday at $387.47 (-0.35%), down 2.17 % at $379.05 in pre-market.

- Coinbase Global (COIN): closed at $296.20 (-4.75%), up 0.22% at $296.84 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$25.61 (+1.83%)

- MARA Holdings (MARA): closed at $27.42 (+1.86%), down 1.42% at $27.03 in pre-market.

- Riot Platforms (RIOT): closed at $12.65 (+2.26%), down 1.03% at $12.52 in pre-market.

- Core Scientific (CORZ): closed at $17.88 (+0.96%), down 1.17% at $17.67 in pre-market.

- CleanSpark (CLSK): closed at $14.35 (+3.54%), up 0.14% at $14.37 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.14 (+4.18%).

- Semler Scientific (SMLR): closed at $57.02 (-6.6%), up 0.63% at $57.38 in pre-market.

Spot BTC ETFs:

- Daily net inflow: $320 million

- Cumulative net inflows: $30.67 billion

- Total BTC holdings ~ 1.076 million.

Spot ETH ETFs

- Daily net inflow: $332.9 million

- Cumulative net inflows: $576.8 million

- Total ETH holdings ~ 3.047 million.

Source: Farside Investors

- The chart shows the 30-day change in the fully diluted market capitalizations of tokens grouped by category.

- The store-of-value sector, comprising cryptocurrencies with BTC-like appeal, has seen an industry-beating 262% surge in four weeks.

- DeFi, meanwhile, has put in a below-average performance.

- XRP Replaces Tether as 3rd-Largest Cryptocurrency While BTC Faces $384M Sell Wall (CoinDesk): XRP has surged 375% in 30 days to $2.40, becoming the third-largest cryptocurrency by market cap. TikTok trends, speculation on a Ripple stablecoin and ETF hopes are fueling interest. Bitcoin, meantime, faces resistance near $100,000, with a $384 million wall of sell orders.

- Ether’s Price Chart Now Mirrors a Pattern That Foretold Bitcoin’s Record Rally (CoinDesk): Ethereum’s price chart shows a bullish breakout, ending an eight-month corrective trend and resuming its October 2023 uptrend from $1,500. Similar to Bitcoin’s October rally, it may trigger cascading gains. Supporting this are rising network activity and $332.9 million in net inflows to U.S. spot ether ETFs last Friday.

- Ethereum ETFs See Record $333M Inflows, Outpacing Bitcoin Funds as Catch-Up Trade Gains Momentum (CoinDesk): Ethereum ETFs in the U.S. saw record inflows Friday, totaling $332.9 million, led by BlackRock and Fidelity funds. Last week, ether outpaced bitcoin in ETF flows and price gains, hitting $3,700. Analysts attribute the resurgence to improving DeFi sentiment, anticipation of regulatory clarity and potential bottoming in the ETH-BTC ratio after three years.

- Establishment’s Takeover of Bitcoin Creates a New List of Risks (Bloomberg): Spot bitcoin ETFs hold over 1 million tokens, or 5% of the supply, rivaling Satoshi Nakamoto’s stash. Rising institutional demand, potential U.S. government stockpiles and supply constraints fuel price forecasts of high as $1 million per BTC. However, concentrated ownership and policy risks could create market vulnerabilities despite ongoing price surges.

- Yen Strengthens Past 150 per Dollar on BoJ Rate Rise Expectations (Financial Times): The yen has strengthened past 150 per dollar after stronger Tokyo inflation data fueled speculation of a December Bank of Japan interest-rate increase. Core CPI rose 2.2% year-on-year, driven by higher rice costs. Despite recent yen declines and $100 billion in interventions, a rapid yen appreciation could deter the bank from raising rates.

- Russia’s Central Bank Acknowledges ‘Short-Term’ Impact on Ruble Exchange Rate (The Moscow Times): On Friday, Russia’s Central Bank attributed the ruble’s drop to U.S. sanctions on Gazprombank while expressing confidence in its own actions, including halting foreign currency purchases and maintaining a 21% interest rate. Friday’s official rate was 109.57 per dollar and 116.14 per euro, with officials optimistic about currency stabilization.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Oliver Knight joined CoinDesk as a news reporter in April 2022. Before joining CoinDesk, Knight was the Chief Reporter at Coin Rivet for three years. Having graduated with a journalism degree from Birmingham City University, Knight went on to work at various sports publications before diving into the world of Bitcoin in 2014. He does not have any crypto holdings.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)