Commissioner Summer Mersinger, of the Commodity Futures Trading Commission (CFTC), is one of the few U.S. regulators who is routinely willing to defend the crypto industry and call out what she sees as overzealous oversight. She will be speaking at Consensus 2024 in Austin, Texas, on May 30.

CoinDesk caught up with Mersinger to discuss the Cain and Abel rivalry between the CFTC and U.S. Securities and Exchange Commission (SEC), how her agency decides which enforcement actions to pursue and her views on a variety of issues, including the CME possibly getting into the spot bitcoin market, the emerging world of betting markets and Washington D.C. traffic.

Is it an accurate view that the SEC and the CFTC are in somewhat of a turf war over crypto?

I think there are certainly questions around who has the appropriate authority. There are people between the two agencies who are willing to work together, in fact, at Consensus Commissioner Peirce and I will be speaking together. We have some similar views. But it is a struggle because, sometimes where debate has been leveled – whether it’s an enforcement case or another action we have said falls under our fraud and manipulation enforcement authority – we’re seeing the SEC start to ask questions as though it falls under their jurisdiction. And so there is certainly some tension there. It’s largely the lack of clarity that’s really causing the tension.

You’re in a minority position as a regulator who’s somewhat favorable to crypto. Could you just explain why it is that you’re willing to stick your neck out?

Part of the reason I went into government, generally, is that – while there’s a need for government in people’s lives – we don’t want to overstep. We also want to make sure the rules of the road are clear so that people can abide by the law. This is an area where there is a real problem. A lot of people are very interested in investing in, or trading, cryptocurrencies, and we have not provided any clarity – we’ve made it very murky. That’s not what the government should be doing. It’s creating a situation where you have people relying on the word of a regulator, and the rules of the game are being changed in the middle of the play.

I still think it’s important that we speak up and let people know that, whether you like crypto or not, that’s not the point here. The point is that regulators have really made this confusing and difficult.

Do you agree with Commissioner Pham’s idea that the Government Accountability Office should investigate the CFTC’s enforcement actions?

COMMISSIONER MERSINGER: It’s difficult to ask another agency to come in and look at the internal workings of the CFTC. I understand where Commissioner Pham is coming from and I think it’s that same kind of feeling that we shouldn’t be regulating through enforcement. But I also think this is a leadership question. I greatly respect Chairman Behnam, but this is an issue with the political direction from this White House. So, instead of an audit, we need to ask: Is the problem the agency, or the current political leadership driving our agenda and broadly stifling financial innovation?

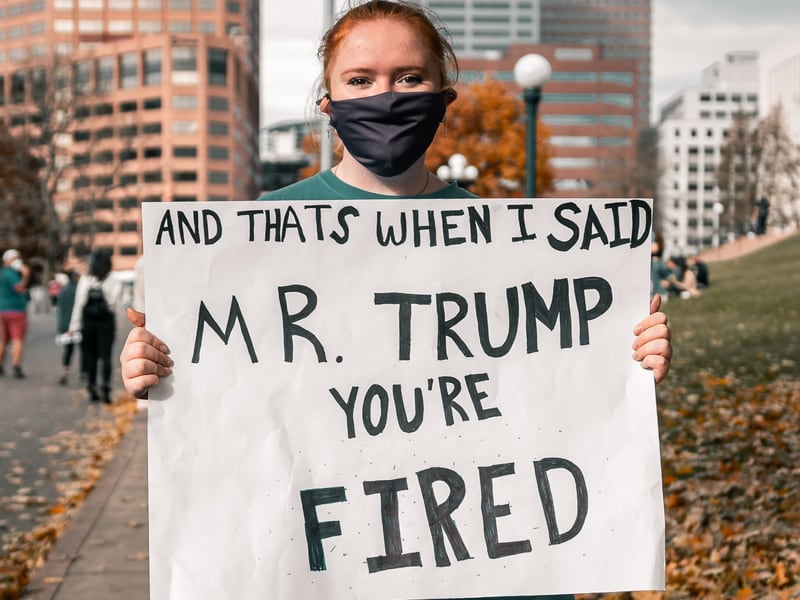

I don’t want to put words in your mouth, but is this to suggest that the regulatory landscape would improve if Trump was re-elected in November?

There are clear differences between President Biden and former President Trump, so that does drive the regulatory agenda. So, if leadership changes, you would certainly assume there would be new policies and a new regulatory agenda.

I’m curious to what extent you’re in active dialogue with Congressmembers about potential crypto legislation?

They use us as a resource. We talk to members of the House Financial Services Committee, the Agriculture Committee, and certainly members of the Senate and work with them on where there is ambiguity in the laws or opportunities to make some delineations and clear paths for regulation. It’s offering our assistance and expertise and it’s helpful to have those conversations because they also want to make sure we’re able to implement the laws that they pass. They may have great intentions, but if it’s impossible for the agency to implement then it’s useless.

That makes a lot of sense. Do you think that there needs to be bespoke crypto legislation or would new interpretations of existing laws suffice?

There are some who believe we can use current statutory authority, whether the SEC or the CFTC, to regulate – which is where we see regulation through enforcement actions. I disagree. The only way to get past just bringing enforcement actions is to have something come out of Congress that says “here’s how to handle cryptocurrencies.”

Beyond legislation, the two agencies also need to sit down and come up with some joint rulemaking. We did that with Dodd Frank, and we certainly could do that here. That’s an important piece of making sure people know which regulator is going to regulate them, which door to walk into. There’s no question that without statutory changes to ensure it’s very clear where the jurisdiction is, agencies will try to go in separate directions.

I know every enforcement action is primarily driven by facts on the ground. But I think it might be interesting to get a view into how these cases are built. What is the process of building a case against someone like Avi Eisenberg?

Without talking about any specific enforcement cases, with a lot of these cases it’s been whistleblower reports saying “I think somebody is violating the law.” It could be a victim who says they lost money, and I don’t think what they’re doing is legal. We have a pretty large team of enforcement investigators and attorneys who start building a case. By the time it gets to us at the commission, usually the facts have been pretty well established and how they line up with the law. We’re kind of like a jury that decides whether the facts meet our statutory requirements.

A lot of it is done by the enforcement team that might interview the whistleblower and other employees, get documents. A lot of time goes into each case before it gets to the commission for a vote. There’s also a lot of cooperation between the various agencies, whether it’s the DOJ, state regulators or the SEC. So where there’s opportunities to bring cases under multiple statutes, or different regulators, they’ll work together. It’s more efficient for the government if they can work together. They can also tip each other off. If we had to get every lead, I think it’d be really difficult.

Now one distinction I want to make is you hear a lot of numbers around crypto enforcement cases. I think it’s a little unfair because a lot of these cases are just run of the mill fraud; somebody stealing someone else’s money, someone claiming to buy crypto, but not actually buying the crypto. So we’ve seen this play out with whatever the hot topic is at the time. I’d say every few years the theme changes – it was foreign currencies, it was metals, we saw a lot of gold fraud. Right now crypto is the hot thing. A lot of cases have been portrayed as cryptocurrency fraud, but it’s just fraud with a crypto wrapper around it. So tomorrow, it might be AI fraud.

I almost hate to say it, but given how much fraud centers around crypto, do you think that there should be more enforcement actions?

I think when it’s straight up fraud, yes. There’s a distinction here when you have a case where somebody just takes your money and claims to invest in something and never does – there’s no question who has the authority there. The more we can try to shut some of this down, the better.

But where there’s a policy question around a certain activity and how our statute would fit with that activity, that’s where I get a little nervous. For instance, if we’re looking at a DeFi protocol, and we’re saying they’re violating our statute it can be difficult if we’ve never really said how our statute applies to DeFi.

We’re starting to set out definitions and interpretations based on court cases, because sometimes you’ll find use cases where there are bad actors. Sometimes it’s people who want to abide by the law, but there’s no clear way how they would do that. That’s why I think we’d be better off with rulemaking.

What do you make of the argument that the SEC implicitly said that Ethereum is a commodity when futures went live in 2021?

So this is an interesting question in development. We do have futures products trading on ether. And I do think if somebody decides that ether is a security, it calls into question what happens. We’ve [the CFTC] been regulating those contracts. They operated well, we have no concerns. This was an area where we thought there was clarity, and now we’re not quite sure if there’s clarity and that’s dangerous.

The law is a little strange; commodities can be a lot of other things – you can have a commodity that is a security. The nomenclature gets a little tricky the way the law is written. But we’ve said we believe this is a commodity and we’re going to regulate it as such under CFTC jurisdiction because it is a derivative product. To me that has been clearly laid out and we shouldn’t be introducing new kinds of questions around what has been a clear policy.

Given how interrelated these assets are, do you think the U.S. would be better off with a single unified agency, like the U.K.’s FCA?

I’m always hesitant to recommend any new government agencies or adding more government. History has shown that more government has never been the answer. But I do think sometimes you’ve got to better tailor statutes. Crypto doesn’t neatly fit into any of our financial categories, so we’re gonna have to fine tune some of the law. That’s what Congress does, so we can easily do this without any new agency.

Why is the CFTC so against betting markets?

It’s a very tough, difficult topic because there’s a lot of nuance. So these markets, which we call event contracts, are part of our statute that was added under the Dodd Frank Act. In the grand scheme of things, it’s relatively new, but we’ve seen interest in these contracts for quite some time and it’s certainly ramping up. The way Congress laid it out for us it said these contracts generally are OK, as long as they don’t touch on a number of topics, like gaming, war, terrorism, assassination – anything that’s against federal law. There are a number of people who really don’t like election contracts and would like to include them in this list.

Then there’s this public interest piece that tries to determine whether having this contract would be against the public interest. It’s not necessarily that we are against these markets, but there have to be some guardrails. Congress directed us to have some guardrails, and we’re trying to build them. You see that with our recent vote. My feeling is if that’s the route you want to take, you still have to do a public interest determination for every contract, which is why I dissented because we were limiting elections as a category.

At the end of the day, we want to create a framework where if you’re registered with us, you won’t have a legal question every time you try to do something new. We are just struggling a little bit with the approach. Congress tried to help us create clarity, but certainly left a lot of a lot left to the regulator to figure out.

The Financial Times reported today that CME is thinking about listing spot bitcoin trading, not not just bitcoin futures. Is that something that you are supportive of?

You know, the first time I heard about it was this morning as well, so I haven’t had those conversations. I want to talk a little bit more with CME and with our staff to find out what this means. There’s a lot of questions around custody and other issues. So right now, I don’t have a positive or negative opinion and honestly, as a regulator, I shouldn’t. They should be able to make those market decisions as long as they’re following the rules. We try to be a regulator that is principles based and let our registered entities run the markets, because that’s what they do. Our job is just to make sure everyone’s following the rules.

Quick round of overrated/underrated? You could decline to answer or clarify your position. DeFi?

I don’t have a position one way or the other. I just think as a regulator, we should have clear rules of the road for DeFi.

Washington D.C.?

You know, I’m gonna say Washington D.C. is a little overrated. Mostly because I was just in the Midwest where there was no traffic. It was very pleasant.

Gary Gensler?

Neutral. You know, I’ve never met him. So I try to withhold my opinions of people until I’ve had a chance to sit down and get to know them.

The phrase “sufficiently decentralized?”

You’re either decentralized or you’re not. So I think sufficiently decentralized feels a little overrated because I don’t know what that means. It probably means you’re not decentralized.

What are you most looking forward to at Consensus?

The conversations with so many different stakeholders. This is an opportunity to talk with people we ordinarily wouldn’t see in Washington, D.C. and to have them all in one place is really special.

Thank you again for the time. Nice to meet you both.

Absolutely. Thank you.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)