BTC

95,098.82

+1.81%

ETH

3,312.24

+0.51%

USDT

1.00

+0.05%

XRP

2.32

+0.50%

BNB

696.85

-0.18%

SOL

192.17

+0.92%

DOGE

0.33677825

+1.80%

USDC

1.00

+0.01%

ADA

0.95772603

+4.89%

TRX

0.24284075

-0.79%

AVAX

37.57

+2.29%

SUI

5.08

+10.38%

TON

5.26

+0.53%

LINK

20.41

+2.14%

SHIB

0.0₄21750

+2.62%

WBTC

94,891.24

+1.74%

XLM

0.40723599

+1.43%

HBAR

0.28051521

+3.06%

BCH

434.12

+1.46%

LEO

9.04

+0.51%

By Omkar Godbole, Shaurya Malwa|Edited by Aoyon Ashraf

Jan 10, 2025, 11:57 a.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market has regained some stability, with BTC rising back to nearly $95K as order books signaled the presence of bargain hunters. Late Wednesday, prices tested the long-standing support zone of $90K-$93K, which has successfully halted downward movements at least six times since the second half of November.

This latest bounce will be tested by Friday’s U.S. nonfarm payrolls report, which is anticipated to show an addition of 164,000 jobs in December, following November’s gain of 227,000, per FXStreet. The unemployment rate is expected to match November’s pace of 4.2%, while average hourly earnings are projected to cool slightly to 0.3% month-on-month, down from 0.4%.

A stronger-than-expected jobs report could add to the existing hawkish Fed fears, further increasing inflation-adjusted bond yields. These yields have been rising due to inflation worries, complicating matters for risk assets. The inflation scare and rates volatility likely catalyzed BTC’s rapid descent from $102K to $93K in the past four days.

To illustrate just how bearish sentiment was early today, the funding rate in perpetual markets turned negative, representing a dominance of shorts, that too at a time when BTC is just 15% away from its record high.

The prevalence of the Fed-led pessimism means any sign of weakness in the payrolls figure will likely trigger sharp market reactions, reviving the case for Fed rate cuts and shifting sentiment markedly in favor of risk assets. If the data misses estimates by a wide margin, BTC could easily make another attempt at $100K, provided the U.S. government, which holds approximately $18.50 billion worth of BTC, refrains from flooding the market with offers to sell. Stay alert.

- Crypto

- No major crypto events scheduled today.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

- Jan. 13: Solayer (LAYER) “Season 1” airdrop snapshot for staking participants, liquidity providers, and partner ecosystem users. Eligibility details and terms will be available on the Solayer dashboard.

- Jan. 15: Derive (DRV) to create and distribute new tokens in token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 73.8 vs. Prev. 74.0.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Prev. 0.4%.

- Core PPI MoM Prev. 0.2%.

- Core PPI YoY Prev. 3.4%.

- PPI YoY Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Prev. 0.3%.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate MoM Prev. 0.3%.

- Inflation Rate YoY Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Prev. -0.1%

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Prev. 201K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Governance votes & calls

- No major events scheduled today.

- Jan. 14: Mantra community call with its co-founder

- Unlocks

- No major unlocks scheduled today.

- Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worth $98.85 million.

- Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worth $14.08 million.

- Jan. 14: Arbitrum to unlock 0.93% of its circulating supply, worth $70.65 million.

- Token Launches

- No major token launches scheduled today.

- Jan. 15: Derive (DRV) will launch, with 5% of supply going to sENA stakers.

- Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

- Day 5 of 14: Starknet, an Ethereum layer 2, is holding its Winter Hackathon (online).

- Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

- Jan. 18: BitcoinDay (Naples, Florida)

- Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 21: Frankfurt Tokenization Conference 2025

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Feb. 3: Digital Assets Forum (London)

- Feb. 18-20: Consensus Hong Kong

By Shaurya Malwa

- Usual protocol’s USD0++, which is a special version of USD0 where users can earn interest by “staking” it, has dropped from being worth $1 to about 93 cents after the team made changes to how users can get their money back early.

- Traders showed a preference for AI Agent tokens aiXBT, Cookie DAO’s COOKIE, and ChainGPT as they rose as much as 50% on Binance spot listings. Viral token ai16z was up 11% and the agents category up was 8% on average, leading growth among all other crypto sectors.

- A deposit vault on the upcoming network Berachain hit $1.1 billion in holdings, led by StakeStone at $370 million.

- The Arbitrum DAO is voting on an improvement proposal (AIP) to implement the Bounded Liquidity Delay (BoLD) on Arbitrum One and Nova. If approved, it will replace the current validator system with a permissionless one, allowing broader participation in securing the network.

- Ronin and Virtuals have collaborated to introduce an AI agent named

$JAIHOZ, fashioned after Ronin’s cofounder @Jihoz_Axie. The token was launched with a supply split between Base and Ronin blockchains, with some tokens airdropped to community members.

- HYPE, LTC, SHIB, SUI and TON have experienced an uptick in perpetual futures open interest in the past 24 hours, with XLM leading the drop in open positions in other major tokens.

- The front-end BTC and ETH risk reversals show put bias while longer duration calls continue to draw premium relative to puts.

- Block trades in BTC options painted a mixed picture. In ETH’s case, the largest block trade involved a short position in the $3,700 call expiring on Feb. 28 to fund a long position in the $3,200 put with the same expiry.

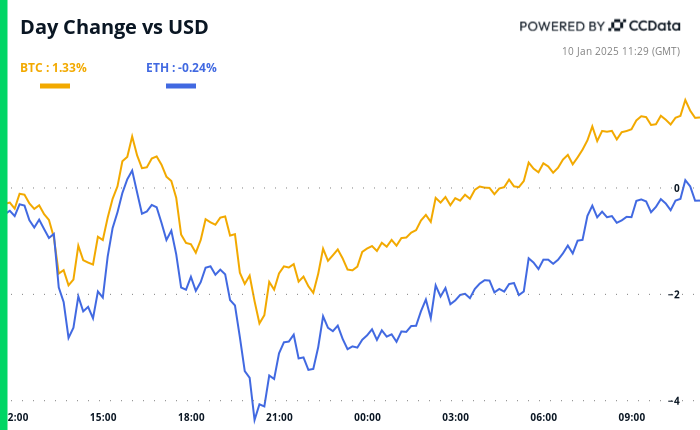

- BTC is up 3.06% from 4 p.m. ET Thursday to $94,967.46 (24hrs: +1.52%)

- ETH is up 3.46% at $3,306.56 (24hrs: +0.11%)

- CoinDesk 20 is unchanged at 3,375.16(24hrs: -0.74%)

- Ether staking yield is down 1 bp to 3.14%

- BTC funding rate is at 0.0013% (1.38% annualized) on Binance

- DXY is unchanged at 109.18

- Gold is up 0.91% at $2,708.1/oz

- Silver is up 1.3% to $31.19/oz

- Nikkei 225 closed -1.05% at 39,190.4

- Hang Seng closed -0.92% at 19,064.29

- FTSE is down 0.18% at 8,304.75

- Euro Stoxx 50 is up 0.19% at 5,027.38

- DJIA closed on Thursday +0.25% at 42,635.20

- S&P 500 closed +0.16% at 5,918.25

- Nasdaq closed +0.83% at 19,480.91

- S&P/TSX Composite Index closed unchanged at 19,478.88

- S&P 40 Latin America closed +0.27% at 2,210.99

- U.S. 10-year Treasury is up 2 bps at 4.71%

- E-mini S&P 500 futures are unchanged at 5,948.00

- E-mini Nasdaq-100 futures are unchanged at 21,313.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 42,846.0

- BTC Dominance: 58.02

- Ethereum to bitcoin ratio: 0.034

- Hashrate (seven-day moving average): 772 EH/s

- Hashprice (spot): $54.3

- Total Fees: 6.6 BTC/ $653,353

- CME Futures Open Interest: 497,207 BTC

- BTC priced in gold: 35.2 oz

- BTC vs gold market cap: 10.09%

- BTC has bounced to $95K, having held the head-and-shoulders (H&S) neckline support Thursday.

- Prices need to move above $102,750, the lower high or the right shoulder created Monday to signal a renewed bullish outlook.

- A UTC close under the horizontal support line would confirm the H&S top and shift focus to deeper support at $75,000.

- MicroStrategy (MSTR): closed on Thursday at $331.7 (-2.85%), up 2.03% at $338.44 in pre-market.

- Coinbase Global (COIN): closed at $260.01(-1.63%), up 0.73% at $261.91 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.85 (-2.79%)

- MARA Holdings (MARA): closed at $18.34 (-3.83%), up 0.93% at $18.51 in pre-market.

- Riot Platforms (RIOT): closed at $12.02 (-3.14%), up 0.83% at $12.12 in pre-market.

- Core Scientific (CORZ): closed at $14.05 (-0.5%), up 1% at $14.19 in pre-market.

- CleanSpark (CLSK): closed at $10.09 (-5.79%), up 1.09% at $10.20 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15(-4.93%).

- Semler Scientific (SMLR): closed at $50.19 (-9.14%), unchanged in pre-market.

U.S. exchanges were closed on Jan.9 in a national day of mourning for former President Jimmy Carter, who passed away on December 29, 2024.

The ETF data below is from Jan.8 and remains unchanged.

Spot BTC ETFs:

- Daily net flow: $676 million

- Cumulative net flows: $31.70 billion

- Total BTC holdings ~ 1.080 million.

Spot ETH ETFs

- Daily net flow: $132.6 million

- Cumulative net flows: $733.6 million

- Total ETH holdings ~ 3.077 million.

Source: Farside Investors

- The chart shows the top 10 chains of the month in terms of the net volume of assets received using a crypto bridge.

- Coinbase’s layer 2 scaling solution leads the pack with net inflows of $208 million followed by Solana’s distant second $92 million.

- The Bitcoin Iceberg: Buyers Await Beneath the Bearish Surface (CoinDesk): Bitcoin faces selling pressure from inflation concerns, while strong bids at lower prices suggest potential stabilization. Traders and investors await the U.S. nonfarm payrolls report for Federal Reserve policy cues.

- Polymarket’s Customer Data Sought by CFTC Subpoena of Coinbase, Source Says (CoinDesk): The U.S. CFTC has allegedly subpoenaed Coinbase for data on Polymarket customers amid legal battles with blockchain-powered prediction markets. Coinbase has apparently warned users it may disclose the requested information.

- Standard Chartered Debuts Crypto Services in Europe With New License (Cointelegraph): On Thursday, Standard Chartered launched crypto custody services in Europe via Luxembourg, using it as an E.U. regulatory entry point under the Markets in Crypto-Assets (MiCA) framework.

- China Swap Curve Inverts as Traders Dial Back Rate-Cut Bets (Bloomberg): China’s money markets anticipate delayed monetary easing to protect the yuan, deepening a rare swap curve inversion as policymakers struggle to balance currency stability and economic support.

- Japan November Household Spending Falls As Price Pressures Persist (Reuters): Japan’s November spending decline eased, but rising prices and stagnant wages limit consumption recovery, leaving analysts skeptical about real wage growth or a Bank of Japan rate hike this month.

- Whitehall Braced for Spending Cuts After UK Hit by Bond Market Turmoil (Financial Times): The U.K. faces rising borrowing costs as 10-year gilt yields hit 4.93%, the highest since 2008, and the pound drops to a year-low, prompting warnings of tighter government budgets.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.