BTC

$85,060.83

+

0.80%

ETH

$1,601.96

+

0.79%

USDT

$0.9997

–

0.02%

XRP

$2.0874

–

1.24%

BNB

$591.86

+

1.19%

SOL

$134.79

+

1.50%

USDC

$0.9997

–

0.00%

TRX

$0.2495

–

0.52%

DOGE

$0.1581

+

1.38%

ADA

$0.6235

+

1.24%

LEO

$9.0625

–

3.68%

LINK

$12.59

+

1.53%

AVAX

$19.29

+

1.41%

TON

$2.9737

+

2.20%

XLM

$0.2406

+

1.17%

SHIB

$0.0₄1193

+

0.36%

SUI

$2.1473

+

1.81%

HBAR

$0.1638

+

2.99%

BCH

$333.48

+

3.56%

LTC

$75.63

+

0.50%

By Francisco Rodrigues, Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Apr 17, 2025, 11:15 a.m.

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. Crypto Daybook Americas will arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Francisco Rodrigues (All times ET unless indicated otherwise)

President Donald Trump’s “reciprocal tariffs” announcement earlier this month drove the economic trade policy uncertainty index to a record high and sent investors away from risk assets, which include bitcoin (BTC) and other cryptocurrencies.

STORY CONTINUES BELOW

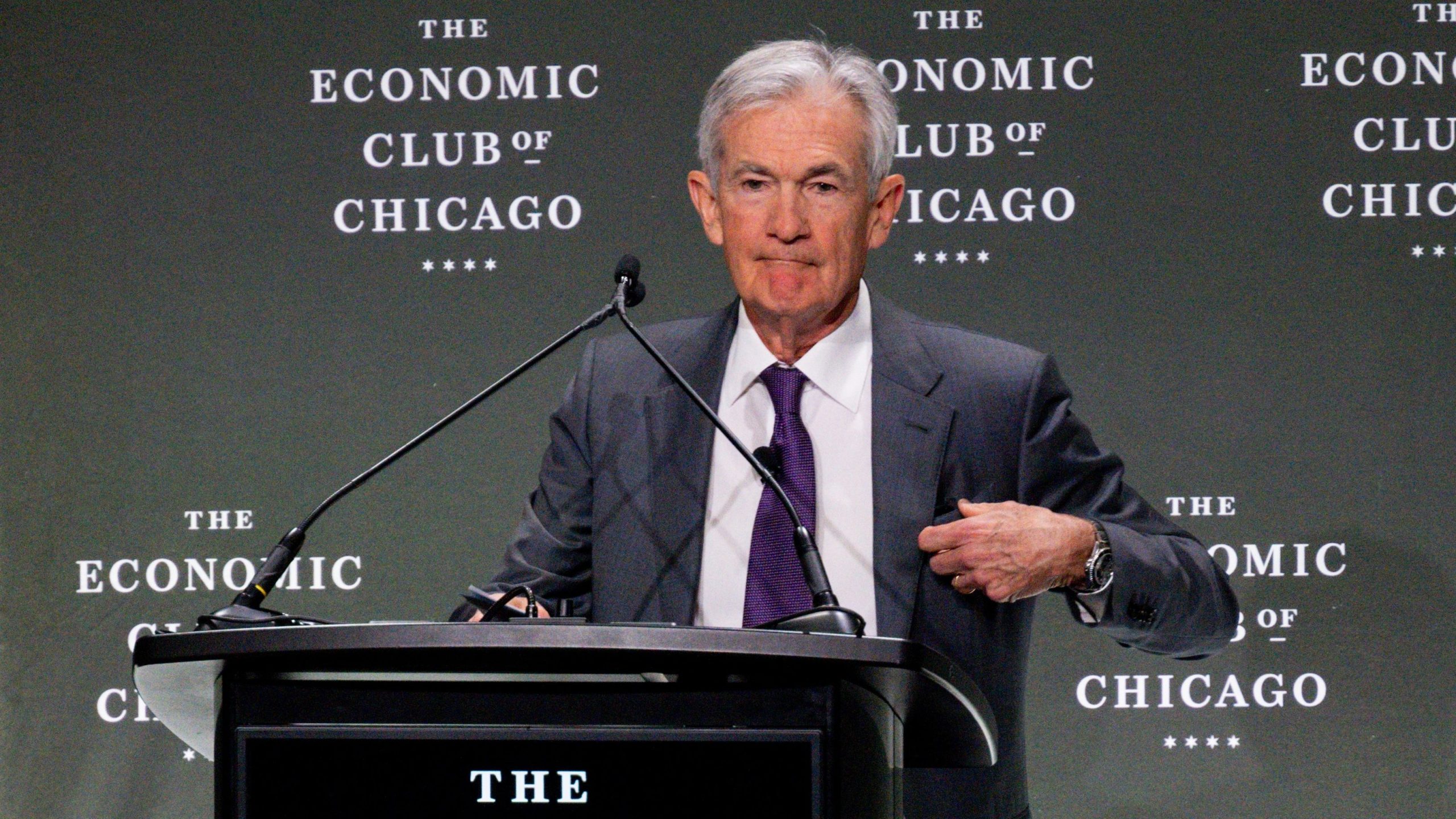

Federal Reserve Chairman Jerome Powell fanned the flames late Wednesday, saying the central bank sees unemployment rising with the economy likely to slow and inflation likely to go up as “some part of those tariffs come to be paid by the public.”

His comments weighed further on risk assets, bringing the Nasdaq down 1.17% and the S&P 500 dropping 2.24% before the closing bell. Still, bitcoin is up more than 1% in the last 24 hours, while the CoinDesk 20 (CD20) index, which captures the broader market, added 1.8%, even though crypto is seen more as gauge of risk than a safe haven.

To Michael Brown, an analyst at Pepperstone, demand for “assets which provide shelter from political incoherence and trade uncertainty” is likely to keep growing, The Telegraph reported.

While bitcoin has outperformed the stock market — up 1% in the past month compared with the Nasdaq’s near 8% drop — institutional investors are piling into gold, the battle-tested safe haven.

The precious metal is up 11% over the last month and 27% this year to around $3,340 a troy ounce. Bank of America’s Global Fund Manager Survey shows that 49% of fund managers see “long gold” as Wall Street’s most crowded trade, with 42% of fund managers forecasting it to be the best-performing asset of the year.

UBS analysts wrote in a note that the “case for adding gold allocations has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks & diversification away from US assets & the US$,” Investopedia reported.

Gold fund flows have hit $80 billion so far this year, while SoSoValue data shows spot bitcoin ETFs saw $5.25 billion net inflows in January and net outflows since the uncertainty started. Month-to-date, over $900 million left these funds, after February and March saw $3.56 billion and $767 billion of net outflows, respectively. Stay alert!

- Crypto:

- April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

- April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

- April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

- April 21: Coinbase Derivatives will list XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

- April 25, 1:00 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on “Key Considerations for Crypto Custody“.

- Macro

- April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

- Housing Starts Est. 1.42M vs. Prev. 1.501M

- Housing Starts MoM Prev. 11.2%

- April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

- Initial Jobless Claims Est. 225K vs. Prev. 223K

- April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

- Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

- Inflation Rate MoM Prev. -0.1%

- Inflation Rate YoY Prev. 3.7%

- April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

- Earnings (Estimates based on FactSet data)

- Governance votes & calls

- GMX DAO is discussing the establishment of a GMX Reserve on Solana, which would involve bridging $500,000 in GMX to the Solana network and transfering the funds to the GMX-Solana Treasury.

- Treasure DAO is discussing handing authority to the core contributor team to wind down and shutter Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

- April 17, 11 a.m.: Starknet to host a governance call to discuss how to improve Cairo and the “overall dev experience.”

- Unlocks

- April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $314.23 million.

- April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $84.4 million.

- April 18: Official Melania Meme (MELANIA) to unlock 6.73% of its circulating supply worth $10.72 million.

- April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $16.52 million.

- April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.03 million.

- April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $126.7 million.

- Token Launches

- April 17: VeThor (VTHO) to be listed on Bybit.

- April 17: Babylon (BABY), AI Rig Complex (ARC), and Alchemist AI (ALCHI) to be listed on Kraken.

- April 22: Hyperlane to airdrop its HYPER tokens.

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: NexTech Week Tokyo

- April 22-24: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

By Shaurya Malwa

- Raydium’s platform for introducing tokens, LaunchLab, went live late Wednesday.

- It directly competes with Pump.fun, which recently pivoted away from Raydium and started its own exchange, PumpSwap, prompting Raydium to introduce a perceived competing platform.

- The Solana ecosystem saw a surge in activity with LaunchLab’s debut, creating over 1,750 tokens shortly after it started up. The price of Raydium’s RAY token rose as much as 10% in the hours afterwards.

- LaunchLab’s dynamic joint curve system offers linear, exponential and logarithmic curves — three types of pricing mechanisms that influence how token values change based on user trading — a shift from the fixed-slope pricing models used in memecoin launch platforms.

- Integration with major Solana trading apps like Axiom, BullX and JupiterExchange enhances LaunchLab’s visibility, potentially driving broader adoption across the ecosystem.

- Open interest in bitcoin futures on the CME reached 138,235 BTC, the highest level the month, as traders re-enter the basis trade. The annualized basis on the CME has climbed to 8%.

- With just over a week remaining until the April options expiry on Deribit, the $100,000 strike remains the most dominant, holding over $315 million in notional open interest.

- The futures perpetual funding rate turned negative again on Wednesday during Fed Chair Powell’s speech. Throughout the week, funding rates have oscillated between positive and negative, highlighting continued short-term uncertainty around bitcoin’s direction.

- BTC is unchanged from 4 p.m. ET Wednesday at $84,312 (24hrs: +0.4%)

- ETH is up 1.26% at $1,593.44 (24hrs: +0.91%)

- CoinDesk 20 is unchanged at 2,459.45 (24hrs: +1.36%)

- Ether CESR Composite Staking Rate is down 1bp bps at 3%

- BTC funding rate is at 0.012% (4.3866% annualized) on Binance

- DXY is up 0.11% at 99.49

- Gold is up 0.35% at $3,338.30/oz

- Silver is down 1.49% at $32.44/oz

- Nikkei 225 closed +1.35% at 34,377.60

- Hang Seng closed +1.61% at 21,395.14

- FTSE is down 0.82% at 8,207.47

- Euro Stoxx 50 is down 0.56% at 4,938.69

- DJIA closed on Wednesday -1.73% at 39,669.39

- S&P 500 closed -2.24% at 5,275.70

- Nasdaq closed -3.07% at 16,307.16

- S&P/TSX Composite Index closed -0.16% at 24,106.80

- S&P 40 Latin America closed +0.32% at 2,345.32

- U.S. 10-year Treasury rate is up 3 bps at 4.31%

- E-mini S&P 500 futures are up 0.9% at 5,353.25

- E-mini Nasdaq-100 futures are up 1.02% at 18,573.25

- E-mini Dow Jones Industrial Average Index futures are up 0.81% at 40,175.00

- BTC Dominance: 63.89 (-0.07%)

- Ethereum to bitcoin ratio: 0.01889 (0.64%)

- Hashrate (seven-day moving average): 905 EH/s

- Hashprice (spot): $43.9

- Total Fees: 5.78 BTC / $482,907

- CME Futures Open Interest: 138,235 BTC

- BTC priced in gold: 25.4 oz

- BTC vs gold market cap: 7.15%

- Bitcoin has bounced cleanly off the golden pocket zone, with the 0.618 and 0.65 Fibonacci levels at $74,995 and $73,213 holding as support.

- This area marked the first real retracement from the $109,396 high and has shown strong buyer interest.

- The bounce also coincided with a breakout from the daily downtrend that has been in place since February — a key shift in structure worth noting.

- BTC is now sitting just below the daily 50 and 200 exponential moving averages, which have begun to converge.

- These levels often act as decision points, and with the price pressing right up against them, the next move should offer clearer direction. A clean break and hold above would give bulls more control, while a rejection could see prices head back toward the golden pocket.

- The weekly 50 EMA — currently $78,071 — is also in play and adds to the confluence just below. As long as BTC holds above the broken trendline and continues to defend this cluster of support, short-term momentum remains constructive.

- Strategy (MSTR): closed on Wednesday at $311.66 (+0.3%), up 0.98% at $314.70 in pre-market

- Coinbase Global (COIN): closed at $172.21 (-1.91%), up 0.87% at $173.70

- Galaxy Digital Holdings (GLXY): closed at C$15.58 (+0.84%)

- MARA Holdings (MARA): closed at $12.32 (-2.07%), up 0.81% at $12.42

- Riot Platforms (RIOT): closed at $6.36 (-2.9%), up 0.31% at $6.38

- Core Scientific (CORZ): closed at $6.59 (-3.8%), up 1.67% at $6.70

- CleanSpark (CLSK): closed at $7.28 (+0.0%), up 0.27% at $7.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.91 (-0.58%)

- Semler Scientific (SMLR): closed at $31 (-9.88%)

- Exodus Movement (EXOD): closed at $37.19 (-2.16%), up 2.18% at $38

Spot BTC ETFs:

- Daily net flow: -$171.1 million

- Cumulative net flows: $35.36 billion

- Total BTC holdings ~ 1.10 million

Spot ETH ETFs

- Daily net flow: -$12.1 million

- Cumulative net flows: $2.26 billion

- Total ETH holdings ~ 3.30 million

Source: Farside Investors

- Yesterday, the SOL/ETH ratio surged to a record high, closing at 0.0833 and highlighting sol’s continued strength relative to ether.

- Ether’s weakness also showed in the the ETH/BTC ratio, which slipped to 0.0187, its lowest level since Jan. 6, 2020.

- SOL Jumps 6%, Bitcoin Clings to $84K on Dampened Rate Cut Hopes (CoinDesk): Bitcoin will likely stay between $80,000 and $90,000 as traders await clarity on tariff talks and delayed Fed rate cuts, said BTSE COO Jeff Mei.

- Meloni, Europe’s Trump Whisperer, to Try Her Hand on Tariffs (The Wall Street Journal): Italy’s prime minister is expected to press Trump today on the EU’s “zero-for-zero” proposal, which would eliminate tariffs on industrial goods if both sides agree.

- Nvidia Chief Jensen Huang Flies Into Beijing for Talks (Financial Times): The visit follows a U.S. decision requiring a license to export Nvidia’s H20 chip to China, prompting the company to warn of a $5.5 billion earnings hit.

- China Stocks Face Risk of $800 Billion U.S. Outflows, Goldman Says (Bloomberg): In a full financial decoupling, U.S. investors could dump $800 billion of Chinese stocks while Chinese investors might offload $370 billion of U.S. equities and $1.3 trillion in bonds.

- Bitcoin, the Haven Crypto Bulls Hoped for, Is More a Barometer of Risk: Godbole (CoinDesk): Bitcoin, rather than behaving as a digital gold, has solidified as a proxy for risk, validating FX market participants who track it as a gauge of speculative sentiment.

- Quantum Computing Group Offers 1 BTC to Whoever Breaks Bitcoin’s Cryptographic Key (CoinDesk): A competition is offering one bitcoin to the first person or team to break elliptic curve cryptography (ECC) using Shor’s algorithm on a quantum computer.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)