BTC

$80,403.24

–

6.87%

ETH

$2,134.70

–

9.13%

USDT

$1.0001

+

0.01%

XRP

$2.0417

–

8.75%

BNB

$572.71

–

6.37%

SOL

$133.71

–

4.86%

USDC

$1.0006

–

0.02%

DOGE

$0.1868

–

10.99%

ADA

$0.6022

–

10.76%

TRX

$0.2253

–

1.77%

WBTC

$80,246.34

–

6.83%

LTC

$119.47

–

8.37%

LINK

$13.84

–

11.54%

AVAX

$20.99

–

8.93%

LEO

$9.2397

+

1.42%

SUI

$2.6367

–

9.48%

TON

$3.2612

–

5.99%

XLM

$0.2640

–

9.15%

HBAR

$0.1883

–

6.32%

SHIB

$0.0₄1327

–

10.08%

By Omkar Godbole|Edited by Sheldon Reback

Updated Feb 27, 2025, 1:35 p.m. UTCPublished Feb 28, 2025, 12:15 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. Crypto Daybook Americas will arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

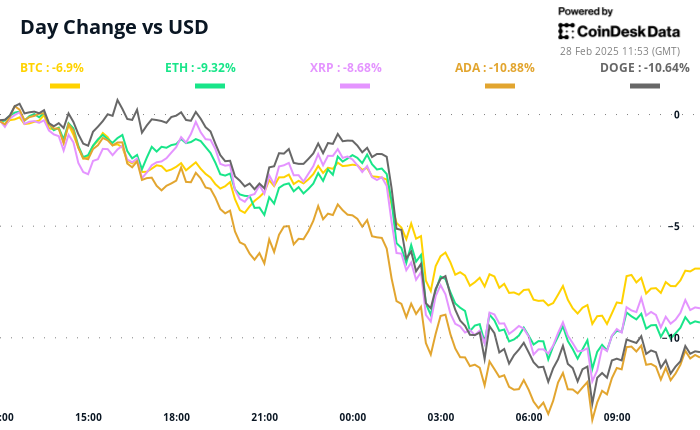

It’s the dip that keeps on dipping. Bitcoin took another hit early Friday, falling below $80,000 and taking February’s decline to over 20%. That spurred a bloodbath in the broader crypto market, with ether sliding below $2,100, a level it managed to hold since August.

STORY CONTINUES BELOW

It’s not just crypto. Increased volatility in cryptocurrencies mirrors trends in traditional markets. Compare the 10% jump in the Volmex BVIV, which tracks the 30-day implied volatility in bitcoin, with the equal increase in the MOVE index, which measures the implied volatility of U.S. Treasury notes. The VIX, Wall Street’s so-called fear gauge, has risen by 14%.

These movements, coupled with a sell-off in growth-sensitive commodity currencies like the Australian, New Zealand and Canadian dollars, are indicative of jitters in the macroeconomy, primarily driven by renewed concerns over potential Trump tariffs, prompting a rotation towards less volatile assets.

“U.S. domestic policies have become unstable, and the White House seems happy to take advantage of this instability,” said Griffin Ardern, head of options trading and research at crypto financial platform BloFin. “Given the challenges investors face in obtaining accurate forward-looking guidance, many are more inclined to hold low-volatility assets … Traders need to liquidate positions to reduce their exposure to specific assets before transitioning to other markets, which explains the decline across almost all asset classes, including cryptocurrencies.”

Volatility looks set to remain heightened, with President Donald Trump reportedly scheduled to speak later on Friday. In the meantime, those hoping for a significant rebound in risk assets based on personal consumption data may be disappointed because anticipated soft readings could be overshadowed by tariff concerns and rising forward-looking inflation metrics.

While the outlook may seem gloomy, more positive developments could occur once the macro dust settles. Notably, this week there was progress on the regulatory front, with the SEC dropping charges against Uniswap, one of the leading decentralized exchanges, and mulling the same regarding its issues with Consensys.

As Evgeny Gaevoy, CEO of leading market maker Wintermute, pointed out at Consensus Hong Kong last week, many are overlooking the evolving attitude of the SEC, and this is a factor the market has yet to fully price in.

Plus, the decline in the basis in the CME bitcoin and ether futures, a sign of weakening demand, has stalled and from a technical analysis perspective, bitcoin is fast closing toward a potential demand zone. So, stay alert!

- Crypto:

- March 1: Spot trading on the Arkham Exchange goes live in 17 U.S. states.

- March 5, 2:29 a.m.: Ethereum testnet Sepolia gets the Pectra hard fork network upgrade at epoch 222464.

- March 15: Athene Network (ATH) mainnet launch.

- March 24, 11:00 a.m.: Bugis network upgrade goes live on Enjin Matrixchain mainnet.

- Macro

- Feb. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases January personal consumption and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- Personal Income MoM Est. 0.3% vs. Prev. 0.4%

- Personal Spending MoM Est. 0.1% vs. Prev. 0.7%

- March 2, 8:45 p.m.: Caixin and S&P Global release February China manufacturing data.

- Manufacturing PMI Prev. 50.1

- Feb. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases January personal consumption and expenditure data.

- Earnings

- Governances votes & calls

- Sky DAO is discussing the reduction of the Smart Burn Engine activity, which would effectively reduce the rate of SKY token buybacks from around 1 million USDS to 400,000 USDS per day.

- Lido DAO is discussing a proposal on an SSV Lido Module (SSVLM), a permissionless staking module, that would distribute staking rewards to node operators, the Lido Protocol and the module operations.

- Feb. 28, 12 p.m.: VeChain (VET) to host a VeChain Builders AMA.

- Unlocks

- Mar. 1: DYdX to unlock 1.14% of circulating supply worth $5.58 million.

- Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating supply worth $12.45 million.

- Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $60.40 million.

- Mar. 2: Ethena (ENA) to unlock 1.3% of circulating supply worth $15.91 million.

- Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating supply worth $12.35 million.

- Mar. 8: Berachain (BERA) to unlock 9.28% of circulating supply worth $73.80 million.

- Mar. 9: Movement (MOVE) to unlock 2.08% of its circulating supply worth $21.4 million.

- Token Listings

- Feb. 28: Worldcoin (WLD) to be listed on Kraken.

- Feb. 28: Zcash (ZEC) and Dash (DASH) are being delisted from Bybit.

- Feb. 28: Sonic SVM (SONIC) to be listed on AscendEX.

- Feb. 28: RedStone (RED) to be listed on Binance and MEXC.

- CoinDesk’s Consensus to take place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 6 of 8: ETHDenver 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest)

- March 8: Bitcoin Alive (Sydney)

- March 10-11: MoneyLIVE Summit (London)

- March 13-14: Web3 Amsterdam ‘25 (Netherlands)

- March 19-20: Next Block Expo (Warsaw)

- March 26: DC Blockchain Summit 2025 (Washington)

- March 28: Solana APEX (Cape Town)

By Shaurya Malwa

- Lazarus Group, the North Korea-backed hacker group, is laundering over $240 million in ether through THORChain, a decentralized cross-chain swap protocol, by converting it mainly to bitcoin.

- THORChain enables cross-chain swaps without wrapped assets, maintaining user custody and securing funds on the blockchain.

- TRX and TRON are seeing negative perpetual funding rates, or dominance of bearish, short positions, as the crypto sell-off deepens. Most other major coins still have positive funding rates.

- On decentralized exchange Derive.xyz, ETH’s options skew for both the 7-day and 30-day options has sharply dropped to -15% and -6% respectively, representing a strong bias for protective puts.

- The way bitcoin options on on Derive were priced at press time showed a 44% chance BTC settling below $80K by the end of June. and just 3.5% chance of prices rising to $150K, talk about the fear in the market.

- On Deribit, BTC and ETH options showed a bias for puts in expiries up to the April end.

- BTC is down 3.3% from 4 p.m. ET Thursday at $80,552.45 (24hrs: -7.09%)

- ETH is down 4.62% at $2,135.58 (24hrs: -9.3%)

- CoinDesk 20 is down 4.63% at 2,821.02 (24hrs: -8.31%)

- Ether CESR Composite Staking Rate is up 4 bps at at 3.06%

- BTC funding rate is at 0.0069% (7.55% annualized) on Binance

- DXY is unchanged 107.32

- Gold is down 0.77% at $2,863.13/oz

- Silver is down 1.09% at $31.15/oz

- Nikkei 225 closed -2.88% at 37,155.50

- Hang Seng closed -3.28% at 22,941.32

- FTSE is up 0.25% at 8,778.39

- Euro Stoxx 50 is down 0.49% at 5,445.93

- DJIA closed on Thursday -0.45% at 43,239.50

- S&P 500 closed -1.59% at 5,861.57

- Nasdaq closed -2.78% at 18,544.42

- S&P/TSX Composite Index closed -0.79% at 25,128.24

- S&P 40 Latin America closed -1.36% at 2,347.52

- U.S. 10-year Treasury rate is down 2 bps at 4.26%

- E-mini S&P 500 futures are up 0.34% at 5896.50

- E-mini Nasdaq-100 futures are up 0.3% at 20667.25

- E-mini Dow Jones Industrial Average Index futures are up 0.33% at 43,438.00

- BTC Dominance: 60.51 (-0.41%)

- Ethereum to bitcoin ratio: 0.02681 (-1.58%)

- Hashrate (seven-day moving average): 844 EH/s

- Hashprice (spot): $48.1

- Total Fees: 8.38 BTC / $715,412

- CME Futures Open Interest: 155,245 BTC

- BTC priced in gold: 27.5 oz

- BTC vs gold market cap: 7.80%

- Ether is at a make or break level of $2,100, which has seen seller exhaustion several times since August last year.

- If the support gives way, it could trigger additional selling by long-term holders, leading to an extended slide.

- MicroStrategy (MSTR): closed on Thursday at $240.05 (-8.82%), down 1.99% at $235.28 in pre-market

- Coinbase Global (COIN): closed at $208.37 (-2.16%), down 3.64% at $200.78

- Galaxy Digital Holdings (GLXY): closed at C$20.28 (+0.6%)

- MARA Holdings (MARA): closed at $13.13 (+5.46%), down 3.43% at $12.68

- Riot Platforms (RIOT): closed at $8.66 (-3.13%), down 3.35% at $8.37

- Core Scientific (CORZ): closed at $10.71 (+6.89%), down 2.24% at $10.47

- CleanSpark (CLSK): closed at $7.51 (-4.7%), down 2.4% at $7.33

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.89 (-1.92%)

- Semler Scientific (SMLR): closed at $40.63 (-7.47%), down 3.03% at $39.40

- Exodus Movement (EXOD): closed at $42.20 (-5.13%), up 0.52% at $42.42

Spot BTC ETFs:

- Daily net flow: -$275.9 million

- Cumulative net flows: $36.85 billion

- Total BTC holdings ~ 1,132 million.

Spot ETH ETFs

- Daily net flow: -$71.2 million

- Cumulative net flows: $2.86 billion

- Total ETH holdings ~ 3.702 million.

Source: Farside Investors

- Daily trading volume on decentralized exchange Uniswap saw a small spike to $3.5 billion on Tuesday as the SEC dropped charges against the protocol.

- Since then, however, volumes have tapered off, probably due to the wider market decline.

- Bitcoin Tumbles to $80K, XRP Loses Key Support as Trump Tariffs Regain Centrality, Dollar Index Rises (CoinDesk): President Donald Trump said 25% tariffs on imports from Canada and Mexico and an additional 10% tariff on Chinese imports will take effect on March 4.

- Bitcoin Sell-Off Could Be a Textbook ‘Breakout and Retest’ Play: Godbole (CoinDesk): Bitcoin’s 15% drop below $80,000 may reflect typical market behavior, where traders test a former resistance level before potentially fueling another rally.

- Trump’s Tariff Onslaught Is Coming Faster Than His Team Can Carry It Out (The Wall Street Journal): Trump’s reciprocal tariff plan, meant to align U.S. trade duties with those of other nations, is facing delays, with an April 2 report expected but full implementation likely months away.

- China Vows ‘All Necessary Measures’ Against New US Tariffs (Bloomberg): China threatened retaliation after President Trump announced an additional 10% tariff on Chinese imports would take effect March 4.

- Sterling Outshines Rivals on Stronger Economic Data (Financial Times): The pound is benefiting from stronger-than-expected U.K. economic data, demand for government bonds, which offer higher yields than U.S. Treasuries, and a perceived lower risk of U.S. tariffs.

- Mexico Sends Major Drug Capos to U.S. as Trump Tariff Threat Looms (Reuters): On Thursday, Mexico carried out its largest extradition in years, sending 29 cartel figures to the U.S. amid pressure over fentanyl smuggling.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)