BTC

102,858.53

+4.11%

ETH

3,185.29

+2.78%

XRP

3.15

+9.62%

USDT

1.00

+0.04%

SOL

238.10

+5.69%

BNB

674.66

+2.48%

USDC

1.00

-0.01%

DOGE

0.33428850

+4.46%

ADA

0.96101470

+9.27%

TRX

0.24726548

+4.12%

LINK

23.98

+7.16%

AVAX

34.09

+2.90%

WBTC

102,522.61

+3.60%

XLM

0.41132470

+6.17%

TON

4.93

+1.83%

HBAR

0.31766129

+4.57%

SUI

3.85

+7.77%

SHIB

0.0₄19017

+6.93%

LEO

9.50

-0.33%

LTC

114.43

+7.21%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Jan 27, 2025, 6:31 p.m. UTCPublished Jan 28, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market is showing signs of stabilizing, with bitcoin recovering to $102,000 and positive signals from futures tied to the Nasdaq. Leading the recovery among major cryptocurrencies is XRP, up 11%, followed by SOL with a 7% increase. AI coins, hit hard on Monday, are posting gains of as much as 4%.

Risk sentiment is likely being supported by skepticism surrounding the claims of Chinese tech startup DeepSeek, which asserts it spent only $6 million to develop its competitor to ChatGPT. Critics speculate the figure omits costs associated with earlier research and experimentation on architectures, algorithms and data. Additionally, a concept rooted in the Jevons Paradox suggests that advancements in efficiency often lead to increased usage rather than reduced consumption, leading to net positive growth in the industry.

That’s good news for bitcoin and the broader crypto industry because they align with the narrative of U.S. exceptionalism, particularly given President Trump’s crypto-friendly stance and plans to establish a strategic digital asset reserve.

Speaking of the strategic reserve, Arizona lawmakers have advanced a bill that would permit government entities or public funds to invest up to 10% of their capital in bitcoin and other digital assets.

The broader outlook remains bullish, with on-chain data pointing to capitulation of weak hands and continued accumulation by large investors.

“According to CryptoQuant data, the share of investors with a balance of at least 1,000 BTC who purchased coins in the last 155 days increased from 43% to 60%, reflecting the emergence of large players amid optimistic sentiment,” said Alex Kuptsikevich, chief market analyst at the FxPro.

QCP Capital expects this week to test BTC’s correlation with equities, particularly as a favorable regulatory environment offers potential support. Stay alert!

- Crypto:

- Jan. 28, 1:00 p.m.: Hedera (HBAR) network upgrade (v0.57.5).

- Jan. 29: Cardano’s Plomin hard fork network upgrade.

- Jan. 29: Ice Open Network (ION) mainnet launch.

- Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork network upgrade (v1.0.14)

- Feb. 4: MicroStrategy (MSTR) Q4, FY 2024 earnings.

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 PEPE.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

- Feb. 6, 8:00 a.m.: Shentu Chain network upgrade (v2.14.0).

- Feb. 12: Hut 8 Corp. (HUT) Q4 2024 earnings.

- Feb. 15: Qtum (QTUM) hard fork network upgrade at block 4,590,000.

- Feb. 18 (after market close): Semler Scientific (SMLR) Q4 2024 earnings.

- Feb. 20: Coinbase Global (COIN) Q4 2024 earnings.

- Macro

- Jan. 28, 8:30 a.m.: The U.S. Census Bureau releases December Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders.

- MoM Est. 0.8% vs. Prev. -1.1%.

- Jan. 28, 1:00 p.m.: The Fed releases December’s H.6 (Money Stock Measures) report.

- Money Supply Prev. $21.45T.

- Jan. 29, 12:00 a.m.: Japan’s Cabinet Office releases January’s Consumer Confidence Survey.

- Est. 36.5 vs. Prev. 36.2.

- Jan. 29, 4:00 a.m.: The European Central Bank (ECB) releases Monetary Developments in the Euro Area for December.

- M3 Money Supply YoY Est. 3.8% vs. Prev. 3.8%.

- Jan. 29, 8:45 a.m.: The Bank of Canada (BoC) releases the (quarterly) Monetary Policy Report.

- Jan. 29, 9:45 a.m.: The BoC announces its interest-rate decision.

- Est. 3% vs. Prev. 3.25% followed by a press conference at 10:30 a.m.

- Jan. 29, 2:00 p.m.: The Federal Open Market Committee (FOMC) announces the U.S. central bank’s interest-rate decision.

- Target Range for the Federal Funds Rate Est. 4.25% to 4.5% vs. Prev. 4.25% to 4.5% followed by a press conference at 2:30 p.m. Livestream link.

- Jan. 28, 8:30 a.m.: The U.S. Census Bureau releases December Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders.

- Governance votes & calls

- Morpho DAO is voting whether to reduce MORPHO rewards by 30% across all assets and networks and set all assets other than those with ETH or USD denominations to have the same reward rate as BTC-denominated assets.

- Sky DAO is voting whether to reduce the WBTC liquidation threshold from 55% to 50% on SparkLend Ethereum.

- Yearn DAO is voting whether to fund and endorse Bearn, a new subDAO aiming to build and launch products on Berachain.

- Unlocks

- Jan. 28: Tribal Token (TRIBL) to unlock 14% of its circulating supply worth $60 million.

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Feb. 1: Sui (SUI) to unlocked about 2.13% of its circulating supply worth $226 million.

- Token Listings

- Jan. 28: Pudgy Penguins (PENGU) and Magic Eden (ME) to be listed on Kraken.

- Jan. 29: Cronos (CRO), Movement (MOVE) and Usual (USUAL) to be listed on Kraken.

- Jan. 29-31: Crypto Peaks 2025 (Palisades, California)

- Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

- Jan. 30-31: Ethereum Zurich 2025

- Jan. 30-31: Plan B Forum (San Salvador, El Salvador)

- Jan. 30 to Feb. 1: Crypto Gathering 2025 (Miami Beach, Florida)

- Jan. 30-Feb. 1: CryptoXR 2025 (Auxerre, France)

- Jan. 30-Feb. 2: Oasis Onchain 2025 (Nassau, Bahamas)

- Jan. 30-Feb. 4: The Satoshi Roundtable (Dubai)

- Feb. 1-28: Mammathon global hackathon for Celestia (online).

- Feb. 3: Digital Assets Forum (London)

- Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

- Feb. 6: Ondo Summit 2025 (New York).

- Feb. 7: Solana APEX (Mexico City)

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: CoinDesk’s Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

- Feb. 25: HederaCon 2025 (Denver)

By Shaurya Malwa

- AI-focused Venice AI (VVV) zoomed to a $1 billion market capitalization on Monday on its appeal of offering private, uncensored AI inference access without per-request fees.

- The Base-based token was listed on Coinbase — one of the rare assets listed on the exchange on the day of launch — which may have helped propel the move.

- Users stake VVV tokens to gain API access to AI stalwart DeepSeek, with ongoing rewards from token emissions.

- CME’s bitcoin and ether futures saw a notable drop in open interest on Monday, as traders de-risked during a sharp slide in Nvidia and other Nasdaq stocks.

- Perpetual funding rates for major coins have stabilized in the range of an annualized 5%-10%. Funding rates for BTC had briefly flipped bearish below zero early Monday.

- BTC calls are pricier than puts across all timeframes, while ETH’s front-end puts trade pricier, reflecting concerns of extended price drops in the next couple of days.

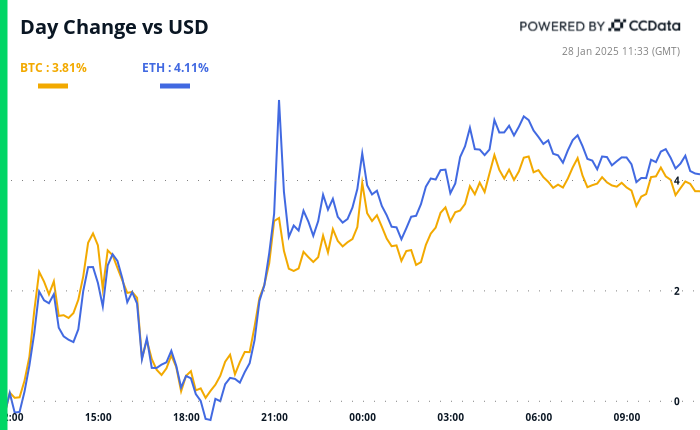

- BTC is up 1.32% from 4 p.m. ET Monday to $98,784.45 (24hrs: +4.07%)

- ETH is up 1.62% at $3,050.20 (24hrs: +4.52%)

- CoinDesk 20 is up 3.2% to 3,536.28 (24hrs: +6.73%)

- CESR Composite Staking Rate is up 18 bps to 3.19%

- BTC funding rate is at 0.0084% (9.2221% annualized) on Binance

- DXY is up 0.57% at 107.95

- Gold is up 0.34% at $2,743.59/oz

- Silver is up 0.35% to $30.16/oz

- Nikkei 225 closed -1.39% at 39,016.87

- Hang Seng closed +0.14% to 20,225.11

- FTSE is up 0.58% at 8,553.75

- Euro Stoxx 50 is up 0.47% at 5,212.71

- DJIA closed on Monday +0.65% to 44,713.58

- S&P 500 closed -1.46% at 6,012.28

- Nasdaq closed -3.07% at 19,341.83

- S&P/TSX Composite Index closed -0.7% at 25,289.15

- S&P 40 Latin America closed +0.34% at 2,330.61

- U.S. 10-year Treasury is up 3 bps at 4.57%

- E-mini S&P 500 futures are up 0.39% at 6070.50

- E-mini Nasdaq-100 futures are up 0.67% at 21,400.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,935.00

- BTC Dominance: 59.16 (0.15%)

- Ethereum to bitcoin ratio: 0.031 (-0.32%)

- Hashrate (seven-day moving average): 767 EH/s

- Hashprice (spot): $58.7

- Total Fees: 6.13 BTC/ $616,619

- CME Futures Open Interest: 170,240 BTC

- BTC priced in gold: 37.6 oz

- BTC vs gold market cap: 10.68%

- ETH carved out a candle with a long tail Monday, signaling bear fatigue at intraday lows. That’s often seen as a sign of an impending trend change higher.

- Prices, however, remain trapped in a descending channel, suggesting a bearish outlook.

- MicroStrategy (MSTR): closed on Monday at $347.92 (-1.63%), down 0.36% at $346.66 in pre-market.

- Coinbase Global (COIN): closed at $277.99 (-6.71%), up 0.76% at $280.11 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.36 (-15.87%).

- MARA Holdings (MARA): closed at $18.28 (-8.53%), up 0.63% at $18.40 in pre-market.

- Riot Platforms (RIOT): closed at $11.45 (-15.44%), down 6.87% at $12.61 in pre-market.

- Core Scientific (CORZ): closed at $11.28 (-29.41%), up 2.22% at $11.53 in pre-market.

- CleanSpark (CLSK): closed at $10.31 (-10.62%), up 1.21% at $10.43 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $20.78 (-20.75%), down 3.99% at $21.61 in pre-market.

- Semler Scientific (SMLR): closed at $50.43 (-9.07%).

- Exodus Movement (EXOD): closed at $74 (+20.82%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$457.6 million

- Cumulative net flows: $39.49 billion

- Total BTC holdings ~ 1.157 million.

Spot ETH ETFs

- Daily net flow: -$136.2 million

- Cumulative net flows: $2.67 billion

- Total ETH holdings ~ 3.59 million.

Source: Farside Investors

- Daily trading volume on Solana-based decentralized exchanges has dropped sharply to less than $10 billon from the high of $35 billion registered on Jan. 18, when the TRUMP token debuted and triggered a memecoin frenzy.

- Volumes, however, remain elevated at the average activity levels seen in November and December.

- KuCoin to Pay Nearly $300M Fine After Pleading Guilty to DOJ Charges (CoinDesk): Crypto exchange KuCoin pleaded guilty to operating an unlicensed money-transmitting business, agreeing to pay $297 million in penalties and to exit the U.S. for two years.

- Tuttle Capital Proposes First-Ever Leveraged ETFs of TRUMP, MELANIA, Cardano, Others (CoinDesk): Tuttle Capital Management filed 10 2x leveraged crypto ETF proposals with the SEC, including those tracking TRUMP and MELANIA memecoins.

- Mad Money’s Jim Cramer Says ‘Own Bitcoin, Not MicroStrategy’ (CoinDesk): On Monday’s Mad Money, Jim Cramer endorsed owning bitcoin while cautioning against MicroStrategy, the largest corporate bitcoin holder. Critics frequently interpret his advice as a contrarian indicator.

- Ripple’s CEO Brad Garlinghouse Bats for Diversified U.S. Crypto Reserve (CoinDesk): Ripple CEO Brad Garlinghouse supports a U.S. digital asset reserve representing multiple tokens, not just bitcoin, calling BTC maximalism “the enemy of crypto progress.”

- BOJ to Raise Rates Again by July, Eventually Eye Hike to 1.5%, Says Ex-Policymaker (Reuters): Former Bank of Japan board member Makoto Sakurai predicts the bank will raise interest rates again by mid-2025, targeting 1.5% within two years.

- Dollar Climbs as Trump Puts Tariff Threats Back on the Agenda (Bloomberg): The dollar strengthened against major currencies, with the yen leading losses after falling over 0.9%, as President Trump and Treasury Secretary Scott Bessent reignited tariff concerns.

- OpenAI’s Altman Vows ‘Better Models’ as China’s DeepSeek Disrupts Global Race (Financial Times): On Monday, OpenAI CEO Sam Altman responded to DeepSeek’s generative AI rival to ChatGPT by pledging to accelerate product launches and deliver superior models.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)