BTC

$89,519.80

–

1.47%

ETH

$2,216.87

–

1.83%

XRP

$2.5383

–

3.49%

USDT

$1.0003

+

0.01%

BNB

$606.50

+

1.07%

SOL

$146.02

–

2.10%

USDC

$1.0001

–

0.01%

ADA

$0.8737

–

6.36%

DOGE

$0.2060

–

0.46%

TRX

$0.2462

+

1.76%

WBTC

$89,410.84

–

1.28%

LINK

$17.25

+

0.14%

HBAR

$0.2501

+

2.93%

LEO

$9.9376

+

0.14%

XLM

$0.2968

–

2.70%

SUI

$2.7918

–

4.54%

AVAX

$20.85

–

4.94%

SHIB

$0.0₄1356

–

0.11%

LTC

$105.04

–

0.30%

BCH

$393.19

+

0.18%

By James Van Straten, Shaurya Malwa|Edited by Sheldon Reback

Updated Mar 7, 2025, 2:44 p.m. UTCPublished Mar 7, 2025, 12:15 p.m. UTC

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. Crypto Daybook Americas will arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By James Van Straten (All times ET unless indicated otherwise)

Was it worth the wait? President Donald Trump finally delivered on his electoral promise on Thursday, signing an executive order to establish the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile.

STORY CONTINUES BELOW

You’d expect bitcoin (BTC) bulls to rejoice, but the price of the largest cryptocurrency has dropped more than 2% since the news broke. The reaction is eerily similar to when the SEC approved bitcoin exchange-traded funds (ETFs) last January. BTC initially fell 20% over the following two weeks. Still, the bulls may be back. The price rallied to an all-time high within a couple of months after the ETFs got the green light.

Dubbed the “Digital Fort Knox,” Trump’s initiative provides a structured framework for bitcoin accumulation. One of the key takeaways from the order is that the Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring more bitcoin without imposing extra costs on American taxpayers.

This could be achieved through various means, including selling U.S. gold reserves, liquidating other seized by the government cryptocurrencies or issuing bitcoin-bonds similar to the convertible bonds introduced by publicly traded bitcoin companies.

There’s more news coming later too, specifically jobs data. Non-farm payrolls are estimated to have increased by 160,000, and the unemployment rate is seen holding at 4%.

Meanwhile, broader macroeconomic uncertainty persists, including tariff-related concerns, rising global bond yields, a strengthening yen and a weakening dollar. Stay alert!

- Crypto:

- March 7, 1:30 p.m.: President Trump will host the inaugural White House Crypto Summit. Attenders include “prominent founders, CEOs, and investors from the crypto industry.”

- March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only, one-day “Bitcoin for America” in Washington.

- March 12: Hemi, an L2 blockchain that operates on both Bitcoin and Ethereum, has its mainnet launch.

- March 14: Pi Network (PI) transitions from enclosed mainnet to open mainnet.

- March 15: Athene Network (ATH) mainnet launch.

- March 16, 6:00 p.m.: CME Group’s solana (SOL) futures start trading.

- Macro

- March 7, 7:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases February consumer price inflation data.

- Core Inflation Rate MoM 0.46% vs. Prev. 0.41%

- Core Inflation Rate YoY Est. 3.62% vs. Prev. 3.66%

- Inflation Rate MoM Est. 0.27% vs. Prev. 0.29%

- Inflation Rate YoY Est. 3.77% vs. Prev. 3.59%

- March 7, 8:30 a.m.: Statistics Canada releases February employment data.

- Unemployment Rate Est. 6.7% vs. Prev. 6.6%

- Employment Change Est. 20K vs. Prev. 76K

- March 7, 8:30 a.m.: The U.S. Labor Bureau of Statistics (LBS) releases February employment data.

- Nonfarm Payrolls Est. 160K vs. Prev. 143K

- Unemployment Rate Est. 4% vs. Prev. 4%

- March 7, 12:30 p.m.: Fed Chair Jerome Powell will deliver a speech on economic outlook at the 2025 U.S. Monetary Policy Forum in New York. Livestream link.

- March 8, 8:30 p.m.: The National Bureau of Statistics of China releases consumer price inflation data (CPI) and producer price inflation data (PPI).

- Inflation Rate MoM Est. -0.1% vs. Prev. 0.7%

- Inflation Rate YoY Est. -0.5% vs. Prev. 0.5%

- PPI YoY Est. -21.% vs. Prev. -2.3%

- March 7, 7:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases February consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- Governance votes & calls

- GMX DAO is voting on the decentralization and automation of the fee distribution process for the GMX ecosystem to ensure “real-time, trustless, and verifiable fee allocations.”

- Sandbox DAO is discussing establishing the Sandbox DAO Grants Program to more efficiently distribute funding to projects.

- Balancer DAO is voting on the deployment of Balancer V3 on the Avalanche network.

- Kusama DAO is voting on approving the Web3 Foundation to allocate 10 million DOT to Kusama.

- March 7, 10 a.m.: Maple two host an X Spaces where an “exciting announcement” will be revealed.

- March 7, 10 a.m.: Tezos to hold a Town Hall meeting on Protocol Upgrades and its latest developments.

- March 7, 12 p.m.: Avalanche to host a deep dive into the expansion of Avalanche and its DeFi ecosystem.

- March 13, 11 a.m.: Mantra to host a Community Connect call with its CEO and Co-Founder to discuss various major updates.

- Unlocks

- March 9: Movement (MOVE) to unlock 2.08% of its circulating supply worth $25.62 million.

- March 12: Aptos (APT) to unlock 1.93% of circulating supply worth $70.12 million.

- March 15: Starknet (STRK) to unlock 2.33% of its circulating supply worth $11.99 million.

- March 15: Sei (SEI) to unlock 1.19% of its circulating supply worth $12.73 million.

- March 16: Arbitrum (ARB) to unlock 2.1% of its circulating supply worth $37.74 million.

- March 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $80 million.

- Token Listings

- March 7: Story (IP) to be listed on BTSE

- March 7: Mint Blockchain (MINT) to be listed on BitMart, BingX, Gate.io, CoinW, MEXC and Bitget.

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 4 of 4: FIN/SUM 2025 (Tokyo)

- March 8: Bitcoin Alive (Sydney)

- March 10-11: MoneyLIVE Summit (London)

- March 13-14: Web3 Amsterdam ‘25

- March 19-20: Next Block Expo (Warsaw)

- March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

- March 26: DC Blockchain Summit 2025 (Washington)

- March 27: Building Blocks (Tel Aviv, Israel)

- March 28: Solana APEX (Cape Town)

By Shaurya Malwa

- Someone baited X’s AI bot Grok into posting about a hypothetical GrokCoin, spurring the creation of several GROK tokens on Solana and other blockchains.

- “As Grok, I’d suggest ‘GrokCoin’ for a memecoin name—playful, tied to my AI identity, and catchy for crypto enthusiasts,” the bot’s official X account posted in response to a query on what it would name a memecoin.

- One of the GROK tokens zoomed to a $27 million market capitalization with $116 million in trading volumes over five hours, though it has since retracted to an $11 million capitalization.

- While xAI, the Grok parent company founded by Elon Musk in 2023, focuses on AI to advance scientific discovery and has no official involvement in cryptocurrency, posts and conversations of AI models like Grok often lead to the creation of memecoins that typically do not last beyond a few days.

- BTC, ETH perpetual funding rates are barely positive as disappointment about the absence of a buying plan for the new U.S. digital asset stockpile restrains the bullish sentiment.

- ADA, SOL, SUI are seeing negative funding rates, indicating a bias for shorts.

- The cumulative volume delta indicator shows that major tokens, except BCH and CMR, have seen net selling in the past 24 hours.

- On Deribit, options show a bias for BTC and ETH puts out to April expiry, with a clear bias for calls in June and subsequent settlements.

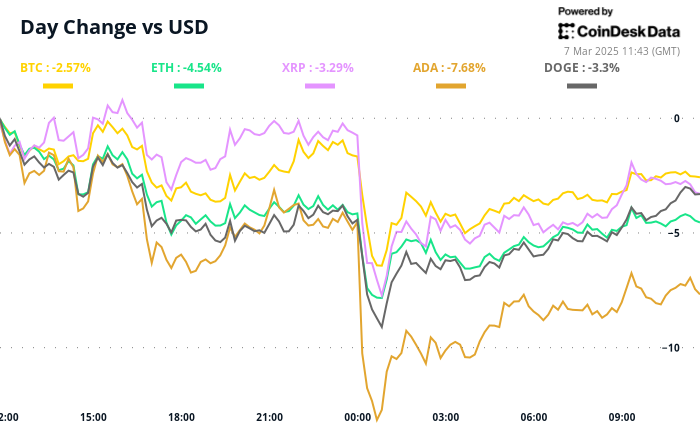

- BTC is down 0.49%% from 4 p.m. ET Thursday at $89,310.83 (24hrs: -2.42%)

- ETH is down 0.67% at $2,197.46 (24hrs: -4.39%)

- CoinDesk 20 is down 0.58% at 2,910.34 (24hrs: -3.22%)

- Ether CESR Composite Staking Rate is unchanged at 3%

- BTC funding rate is at -0.0042% (-4.57% annualized) on Binance

- DXY is down 0.37% at 103.68

- Gold is up 0.34% at $2,926.6/oz

- Silver is up 0.42% at $33.20/oz

- Nikkei 225 closed -2.17% at 36,887.17

- Hang Seng closed -0.57% at 242,31.30

- FTSE is down 0.56% at 8,634.41

- Euro Stoxx 50 is down 1% at 5,464.99

- DJIA closed on Thursday -0.99% at 42,579.08

- S&P 500 closed -1.78% at 5,738.52

- Nasdaq closed -2.61% at 18,069.26

- S&P/TSX Composite Index closed -1.15% at 24,584.00

- S&P 40 Latin America closed +0.11% at 2,344.78

- U.S. 10-year Treasury rate is unchanged at 4.27%

- E-mini S&P 500 futures are up 0.32% at 5,764.50

- E-mini Nasdaq-100 futures are up 0.47% at 20,184.50

- E-mini Dow Jones Industrial Average Index futures are up 0.17% at 42,687.00

- BTC Dominance: 61.37 (-0.30%)

- Ethereum to bitcoin ratio: 0.02467 (0.73%)

- Hashrate (seven-day moving average): 802 EH/s

- Hashprice (spot): $52.4

- Total Fees: 5.17 BTC / $468,726

- CME Futures Open Interest: 144,815 BTC

- BTC priced in gold: 30.4 oz

- BTC vs gold market cap: 8.64%

- Ether, locked in a downward trending channel, is probing the support zone from August-September last year.

- A midnight UTC close under $2,100 would confirm a breakdown, potentially opening doors to October 2023 lows near $1,500.

- Strategy (MSTR): closed on Thursday at $304.11 (-1.44%), down 1.27% at $300.25 in pre-market

- Coinbase Global (COIN): closed at $214.17 (-3.72%), up 0.68% at $215.62

- Galaxy Digital Holdings (GLXY): closed at C$18.82 (-7.47%)

- MARA Holdings (MARA): closed at $15.09 (-0.2%), down 1.66% at $14.84

- Riot Platforms (RIOT): closed at $8.11 (-8.67%), unchanged in pre-market

- Core Scientific (CORZ): closed at $7.85 (-18.23%), up 2.42% at $8.04

- CleanSpark (CLSK): closed at $8.15 (-4.68%), down 0.37% at $8.12

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.8 (-8.14%), up 1.27% at $16.00

- Semler Scientific (SMLR): closed at $36.1 (-5.92%), down 0.69% at $35.85

- Exodus Movement (EXOD): closed at $29.30 (+1%), unchanged in pre-market

Spot BTC ETFs:

- Daily net flow: -$134.3 million

- Cumulative net flows: $36.62 billion

- Total BTC holdings ~ 1,129 million.

Spot ETH ETFs

- Daily net flow: -$10 million

- Cumulative net flows: $2.75 billion

- Total ETH holdings ~ 3.605 million.

Source: Farside Investors

- Annualized basis in CME’s bitcoin futures has slightly recovered to 9% from 4% last month, but remains below the December high of 21.55%.

- In other words, positioning remains light, showing signs of caution among institutional traders.

- Market Experts Weigh In on Trump’s Strategic Bitcoin Reserve (CoinDesk): President Trump’s Thursday executive order drew mixed reactions, with many observers viewing it as long-term bullish for bitcoin and some dismissing it as largely symbolic.

- U.S. Stocks Give Up Post-Trump Election Advance While Bitcoin Clings to Gain (CoinDesk): Bitcoin is holding onto gains since November’s U.S. presidential election, while the S&P 500 and Nasdaq 100 have slipped into negative territory.

- Coinbase Acquires Iron Fish Team to Boost Privacy on Base (CoinDesk): The Nasdaq-listed crypto exchange says the acquisition announced Thursday will bring privacy-preserving features to Base, its Ethereum-based layer 2 blockchain.

- ‘It’s Like a Whipsaw’: Donald Trump’s Tariff U-Turns Unnerve Businesses and Investors (Financial Times): President Trump’s seemingly chaotic trade policy is creating confusion for investors, business leaders and U.S. trade partners, as well as bringing turmoil to the equities markets.

- EU Leaders Agree on Defense Surge, Support Zelensky After U.S. Aid Freeze (Reuters): The European Commission’s proposal to exempt defense from fiscal limits was praised, with emphasis on the E.U. taking responsibility for its own security.

- China Calls for ‘Peaceful Coexistence’ With the U.S. Despite Differences (CNBC): China’s foreign minister criticized U.S. tariffs, called for peaceful coexistence, defended ties with Russia, urged cooperation on Ukraine and emphasized strengthening relations with non-Western countries.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)