BTC

90,764.65

-3.35%

ETH

3,056.47

-5.64%

USDT

0.99903692

-0.07%

XRP

2.35

-5.33%

BNB

660.59

-4.20%

SOL

175.53

-5.83%

DOGE

0.31626819

-5.67%

USDC

1.00

+0.01%

ADA

0.89645865

-8.99%

TRX

0.21741530

-8.13%

AVAX

33.45

-8.80%

SUI

4.32

-9.47%

TON

5.03

-6.37%

XLM

0.39877407

-6.61%

WBTC

90,636.50

-3.28%

SHIB

0.0₄20092

-6.92%

LINK

18.14

-8.93%

HBAR

0.26016798

-7.11%

LEO

9.13

-1.36%

BCH

409.03

-7.55%

By Omkar Godbole, Oliver Knight|Edited by Aoyon Ashraf

Jan 13, 2025, 11:56 a.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

Risk assets are trading down as the dollar index and Treasury yields benefit from Friday’s blowout nonfarm payrolls report and the Palisades Fires posing a risk to the insurance sector and some P&C companies.

BTC is down 2%, changing hands in the key support zone of $90,000 and $93,000, with alternative cryptocurrencies posting bigger losses as usual. ETH has dropped to the lowest since Dec. 21 and the risk-off has clouded XRP’s bullish technical outlook (see TA section). Whales likely accumulated XRP over South Korea-based Upbit over the weekend. AI coins is the worst performing sub-sector of the past 24 hours. In traditional markets, futures tied to the S&P 500 point to negative open alongside continued downside volatility in the British pound and emerging market currencies.

The risk-off sentiment, however, didn’t stop Michael Saylor from indicating a potential for another bitcoin purchase as he shared an update on MicroStrategy’s bitcoin purchase tracker. If it would put a dent into the negative market sentiment, is another story. “The firm’s purchase last Monday amounted to approximately $100 million, which had limited market impact, but underscores the firm’s ongoing demand,” Valentin Fournier, analyst at BRN said.

Other things being equal, the risk of BTC losing the support zone appears high as some investment banks believe the Fed rate-cutting cycle is over, with Bank of America suggesting a potential for a rate hike. Per some observers, the consensus is that prices will deflate to $70K, followed by a renewed rally.

Meanwhile, the 30-day moving average of the Coinbase-Binance BTC price differential, which has a knack of marking major price tops, has slipped to the lowest since at least 2019, a sign of weaker stateside demand.

Over the near term, the crypto market is likely to focus on President-elect Donald Trump’s inauguration on Jan. 20 and the ongoing FTX claim distributions, according to Coinbase Institutional.

- Crypto

- Jan. 13: Solayer (LAYER) “Season 1” airdrop snapshot for staking participants, liquidity providers, and partner ecosystem users.

- Jan. 15: Derive (DRV) to create and distribute new tokens in token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Jan. 17: Primary listing of SOLV, the native token of Solv Protocol.

- Macro

- Jan. 13, 2:00 p.m.: The U.S. Department of the Treasury releases December 2024’s Monthly Treasury Statement report. Monthly budget deficit Est. $62B vs. Prev. $367B.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%.

- Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

- Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

- PPI YoY Est. 3.4% vs. Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

- Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Est. 0.2% vs. Prev. -0.1%.

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

- Jan. 17, 5:00 a.m.: Eurostat releases December 2024’s Eurozone inflation data.

- Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

- Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

- Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

- Governance votes & calls

- Aave community propose adjusting borrow rate for its GHO stablecoin from 10.50% to 9.00%.

- Aavegotchi DAO has an active vote on modifying ETH sell ladder parameters due to “significant underperformance” by ETH.

- Jan. 14: Mantra community call with its co-founder

- Unlocks

- No major unlocks scheduled today.

- Jan. 14: Arbitrum (ARB) to unlock 0.93% of its circulating supply, worth $70.65 million.

- Jan. 15: Connex (CONX) to unlock 376% of its circulating supply, worth $84.5 million.

- Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worth $2.19 billion.

- Token Launches

- No major token launches scheduled today.

- Jan. 15: Derive (DRV) will launch, with 5% of supply going to sENA stakers.

Jan. 16: Solayer (LAYER) to host token sale followed by five months of points farming. - Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

- Day 8 of 14: Starknet, an Ethereum layer 2, is holding its Winter Hackathon (online).

- Day 1 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

- Jan. 18: BitcoinDay (Naples, Florida)

- Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 21: Frankfurt Tokenization Conference 2025

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Feb. 3: Digital Assets Forum (London)

- Feb. 18-20: Consensus Hong Kong

By Oliver Knight

- AI agent tokens have suffered a deep correction, with ai16z now trading at $1.02, down more than 60% from its record high set on Jan. 2. Virtual Protocol’s native token (VIRTUAL) has slumped a further 16% over the past 24-hours to compound its recent downtrend, it is now trading at $2.40 after surging to $5.04 on Jan. 2.

- NFT project Azuki has announced the launch of ANIME, a Japanese cartoon-themed token that will distribute 50.5% of the token’s supply to the Azuki community. Azuki employees and advisors will receive 15.62% of supply bound by a vesting schedule.

- Ethena’s ENA token has dropped by 11.4% over the past 24-hours as funding rates for ETH, which Ethena’s business model relies on, is beginning to fall into neutral territory. Ethena still offers a yield of 11% on its stablecoin although it’s unclear how long that rate is sustainable if funding rates continue to fall.

- Ether whales have begun offloading ETH at a loss with one trader selling 10,070 ETH for $33 million at a $1 million loss, the wallet still holds $45 million, on-chain data reported by Lookonchain shows.

- Perpetual funding rates for TRX, AVAX, SUI and TON have flipped negative, indicating a bearish shift in positioning.

- Front-end risk reversals show a strong bias for BTC and ETH protective put options in line with the risk-off sentiment in markets. Screen traders have bought puts at $92K, $90K and $87K in BTC.

- There is notable negative dealer gamma in the range of $90K and $93K, which means these entities might trade in the market’s direction to hedge book, bolstering the move. A similar dynamic exists between $3.2K and $3,450. in the ETH market.

- BTC and ETH DVOLs, measuring 30-day expected price swings, remain in the familiar ranges for the month.

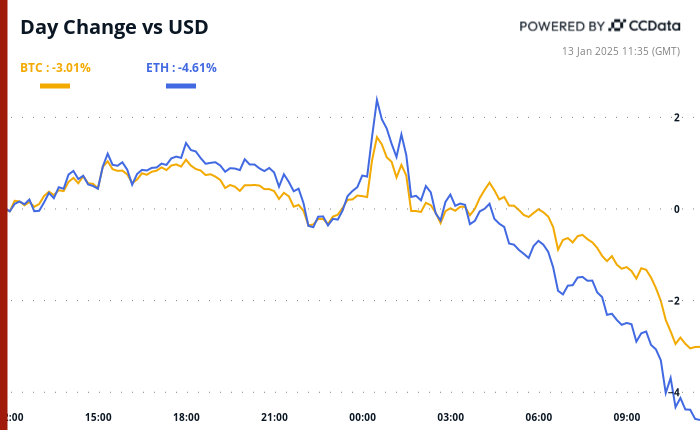

- BTC is down 3.12% from 4 p.m. ET Friday to $91,392.04 (24hrs: -2.67%)

- ETH is down 4.78% at $3,109.45 (24hrs: -4.05%)

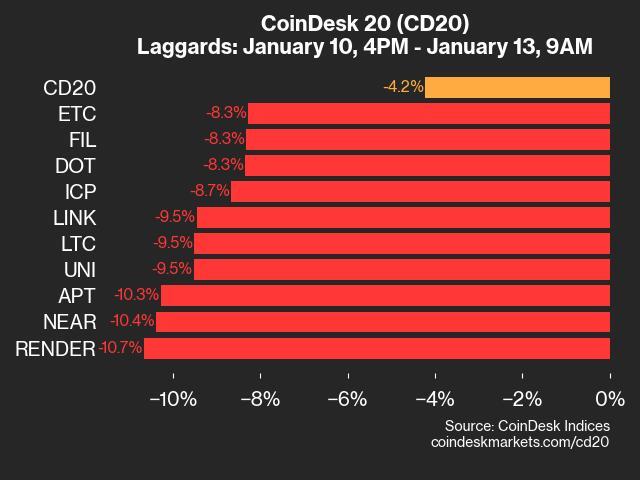

- CoinDesk 20 is down 2.15% to 3,310.23 (24hrs: -3.08%)

- Ether staking yield is down 16 bps to 2.97%

- BTC funding rate is at -0.0149% (-16.27% annualized) on Binance

- DXY is up 0.35% at 110.04

- Gold is down 0.13% at $2,705.00/oz

- Silver is down 0.84% to $30.83/oz

- Nikkei 225 closed -1.05% at 39,190.40

- Hang Seng closed -1% at 18,874.14

- FTSE is down 0.25% at 82,27.71

- Euro Stoxx 50 is up 0.92% at 4,931.47

- DJIA closed on Friday -1.63% to 41,938.45

- S&P 500 closed -1.54% at 5,827.04

- Nasdaq closed -1.63% at 19,161.63

- S&P/TSX Composite Index closed -1.22% at 24,767.70

- S&P 40 Latin America closed -1.31% at 2,181.96

- U.S. 10-year Treasury is up 2 bps at 4.79%

- E-mini S&P 500 futures are down 0.78% to 5,820.50

- E-mini Nasdaq-100 futures are down 1.18% to 20,767.25

- E-mini Dow Jones Industrial Average Index futures are down 0.48% at 42,022.00

- BTC Dominance: 58.39

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 775 EH/s

- Hashprice (spot): $54.6

- Total Fees: 4.89 BTC/ $462,582

- CME Futures Open Interest: 175,380 BTC

- BTC priced in gold: 34.5 oz

- BTC vs gold market cap: 9.82%

- XRP broke out of a descending triangle pattern Friday, signaling a resumption of the broader uptrend from early November lows.

- However, BTC’s macro-led risk-off action has pushed XRP back to the breakout point.

- Watch out for a potential move back inside the triangle, as failed breakouts are powerful bearish reversal signals.

- MicroStrategy (MSTR): closed on Friday at $327.91 (-1.14%), down 4.95% at $311.67 in pre-market.

- Coinbase Global (COIN): closed at $258.78 (-0.47%), down 4.42% at $247.34 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.07 (+0.82%)

- MARA Holdings (MARA): closed at $17.86 (-2.62%), down 4.59% at $17.04 in pre-market.

- Riot Platforms (RIOT): closed at $12.00 (-0.17%), down 5.25% at $11.37 in pre-market.

- Core Scientific (CORZ): closed unchanged at $14.04, down 3.49% at $13.55 in pre-market.

- CleanSpark (CLSK): closed unchanged at $10.09, down 5.05% at $9.58 in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.11 (-0.17%), down 4.41% at $22.09 in pre-market.

- Semler Scientific (SMLR): closed at $51.36 (+2.33%), down 7.03% at $47.75 in pre-market.

- Exodus Movement (EXOD): closed unchanged at $37.77, down 9.98% at $34.00 in pre-market.

Spot BTC ETFs:

- Daily net flow: $-149.4 million

- Cumulative net flows: $36.22 billion

- Total BTC holdings ~ 1.137 million.

Spot ETH ETFs

- Daily net flow: $-68.5 million

- Cumulative net flows: $2.45 billion

- Total ETH holdings ~ 3.582 million.

Source: Farside Investors, as of Jan. 10.

- The number of Bitcoin Runes minted daily has slipped to a record lows, averaging less than 10% of last year’s figures.

- Runes was a big hit among traders following the Bitcoin blockchain’s reward halving in April last year.

- Runes is similar to Ordinals, allows people to “etch” and mint tokens on-chain.

- Bitcoin Under Pressure as Goldman Trims Fed Rate Cut Expectations, BofA Sees Potential Hike After Blowout Jobs Report (CoinDesk): Bitcoin fell below $93K during Monday’s European trading hours as strong U.S. jobs data spurred investment banks to revise Fed rate cut expectations, with some warning of potential hikes.

- Singapore Blocks Polymarket, Following Taiwan and France (CoinDesk): Over the weekend, Singapore blocked access to Polymarket, labeling it an unlicensed gambling site. This follows similar actions in Taiwan and France, as global scrutiny of the platform grows.

- AI Agent Tokens Reel From a Steep Market Correction (The Block): AI agent tokens plunged over the past week, with AI16Z going from $2.26 to $1.10 and GOAT falling from $0.5 to $0.33, while bitcoin held steady around the $95,000 level.

- Global Bond Tantrum Is a Wrenching and Worrisome Start to New Year (Bloomberg): U.S. Treasury yields are nearing 5%, driven by strong economic growth, persistent inflation, and rising government debt, raising global borrowing costs and reducing demand for riskier investments like stocks.

- Dollar Hits 2-Year High After Robust US Data Pares Back Bets on Rate Cuts (Financial Times): On Monday, the U.S. dollar index hit a two-year high following Friday’s strong U.S. jobs report. Oil prices rose, with Brent reaching $81 and WTI hitting $77.90, on new Russian sanctions.

- ECB Seeking Middle Ground With Rate Cuts, Lane Tells Newspaper (Reuters): The European Central Bank (ECB) plans cautious monetary easing, striving to curb inflation without triggering recession, as wage growth moderates and inflation approaches its 2% target by mid-2025.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.