BTC

106,833.18

+3.35%

ETH

3,961.53

+1.05%

XRP

2.51

+2.92%

USDT

0.99994168

+0.03%

SOL

218.48

-1.68%

BNB

719.47

-0.06%

DOGE

0.40887483

+0.98%

USDC

0.99989150

-0.02%

ADA

1.11

+0.97%

STETH

3,957.10

+1.03%

TRX

0.29408707

+2.30%

AVAX

49.49

-2.28%

LINK

29.43

+0.55%

SHIB

0.0₄27380

-1.56%

TON

6.10

-4.81%

WBTC

106,505.83

+3.61%

SUI

4.71

+2.26%

XLM

0.43217222

+0.41%

HBAR

0.28700414

-2.16%

BCH

547.59

+1.32%

By Omkar Godbole|Edited by Sheldon Reback

Updated Dec 16, 2024, 12:46 p.m. UTCPublished Dec 16, 2024, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

Imagine you have a rare collectible. It’s aged like fine wine, but only shows the original price tag. That’s how U.S. companies have been told to value their bitcoin … stuck in the past instead of reflecting its true worth. As of today, that changes.

Story continues below

Yes, today is when the FASB fair value accounting rule, which passed in 2023, takes effect, allowing companies to report their bitcoin holdings at fair market value instead of the purchase price. The change gives firms more control over how they classify these assets and may accelerate corporate adoption. Note, though, the new standard doesn’t apply to NFTs, wrapped tokens or internally generated digital assets.

Alex Kuptsikevich, an analyst at The FXPro, said, quoting a JPMorgan report, that publicly traded companies have already begun implementing a MicroStrategy-like strategy to add BTC to their balance sheets.

The rule change might also explain why BTC spiked above $106,000 in Asia, boosted further by President-elect Donald Trump’s assurance to create a strategic BTC reserve and a short squeeze on Deribit.

The price has now pulled back to around $104,500, probably due to concern the Fed’s much anticipated rate cut this Wednesday will come with projections for fewer reductions next year. BTC is trading at a discount on Coinbase compared with Binance, a sign of weaker demand in the U.S., a CryptoQuant tracker shows.

Looking more broadly, ETH failed to establish a foothold above $4,000 amid reports of large withdrawals of staked ether from Lido Finance. Payments-focused XRP traded more than 2% lower, weakening a bullish technical pattern. Ripple CTO David Schwartz raised concerns about FOMO-driven volatility before the debut of the company’s RLUSD stablecoin, which it plans to use for cross-border payments alongside XRP. Early price fluctuations and high pre-launch bids don’t quite reflect the true market value, Schwartz said.

On a brighter note, Solana’s industry-beating revenue generation has been grabbing eyeballs. Ryan Watkins, co-founder of Syncracy Capital, said: “Solana generated a staggering $431 million in fees over the past 30 days – more than all other Layer 1s combined!” Solana now captures 53% of the global layer 1 fee pool, largely driven by the surge in AI activity. Still, the token dipped 3%, threatening to break below the 50-day SMA, a key indicator for near-term market trends.

Chainlink’s LINK defied the weakness in major tokens, rising 4% thanks to whale buying. Data from LookOnChain revealed that a whale withdrew 429,999 LINK, worth over $12 million, over the weekend.

Lastly, in traditional markets, the yield on the 10-year Treasury note looks to break out of a prolonged downtrend as observers anticipate a hawkish Fed rate cut this week. This hardening of yields could inject volatility into risk assets, including cryptocurrencies. So, stay alert!

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 16, 9:45 a.m.: December’s S&P Global Flash US PMI data is released. Composite PMI Prev. 54.9.

- Dec. 17, 8:30 a.m.: Statistics Canada releases November’s Consumer Price Index (CPI) report.

- Inflation Rate YoY Prev. 2%.

- Core Inflation Rate Prev. 1.7%.

- Dec. 18, 2:00 p.m.: The Federal Open Market Committee (FOMC) releases its fed funds target rate, currently 4.50%-4.75%. The CME’s FedWatch tool indicates that interest-rate traders assign a 97.1% probability of a 25 basis-point cut. Press conference starts at 2:30 p.m. Livestream link.

- Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its interest rate decision. Short-term interest rate Est. 0.25% vs. Prev. 0.25%.

- Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest rate decision. Bank Rate Est. 4.75% vs Prev. 4.75%.

- Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final).

- GDP Growth Rate QoQ Est. 2.8% vs Prev. 3.0%.

- GDP Price Index QoQ Est. 1.9% vs Prev. 2.5%.

- Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November’s Personal Income and Outlays report.

- Personal Consumption Expenditure (PCE) Price Index YoY Prev. 2.3%.

- Core PCE Price Index YoY 2.8%.

- Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

- Governance votes & calls

- Avalanche’s (AVAX) Etna upgrade is scheduled to go live on Dec. 16 at 12 p.m. The upgrade aims to make it cheaper to transact and run validators on the network

- Arbitrum DAO is voting on allocating 22 million ARB ($22.8 million) to cover operating costs for OpCo, an entity it can use to create a more structured approach to governance. The vote closes Dec. 19.

- Livepeer (LPT) will have an open ecosystem call on Dec. 17. Discussion will revolve around updates, products, and treasury

- Synapse (SYN) DAO is voting on allocating 50,000 OP tokens ($127,500) to establish and incentivize liquidity on Velodrome. It is targeting $3 million to $5 million in TVL over a three-month period. The vote concludes Dec. 16.

- Unlocks

- Cardano (ADA) will unlock $19.75 million worth of tokens on Dec. 16, representing 0.05% of circulating supply.

- Arbitrum (ARB) will unlock $94.05 million worth of tokens on Dec. 16, representing 2.34% of circulating supply.

- DYdX (DYDX) will unlock $11.7 million worth of tokens on Dec. 17, representing 0.57% of circulating supply.

- Token Launches

- Binance announced that data sovereignty platform Vana (VANA) will release a token on the launchpool. Trading starts Dec. 16.

- Day 1 of 2: Blockchain Association’s Policy Summit (Washington D.C.)

- Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

- Jan. 18: BitcoinDay (Naples, Florida)

- Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 21: Frankfurt Tokenization Conference 2025

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

By Francisco Memoria

Solana-based decentralized exchange Raydium’s annualized fees have reached a major milestone above $2 billion, according to data from Artemis. Revenue for the year is now around $355 million, making it the second-largest decentralized application by that metric. Only collateralized-debt protocol Sky is bigger.

The numbers belie a slowdown in the industry. Pump.fun has dropped its livestream feature and the memecoin craze has eased.

That comes through in the number of active addresses using the platform, which has dropped nearly 50% from its peak, as did trading volumes and fees. Daily revenue, which on Nov. 18 topped $2 million for the first time, is now struggling to reclaim the $1 million threshold. It was $585,000 on Dec. 15.

Even so, activity on the DEX remains elevated. Daily transactions on Raydium still hover between 10 million and 12.5 million, exploding from just over 1 million at the beginning of the year. The protocol’s native token RAY also hasn’t suffered, having risen 7% in the past month to remain above the $5 support zone.

- The futures basis for BTC and ETH has climbed to levels we saw during the initial breakthrough of $100,000, making cash and carry trades increasingly attractive. Expect continued strong inflows into the spot ETFs as a result.

- AAVE’s perpetual open interest has increased 7% in 24 hours, the most among major coins. The cumulative volume delta (CVD), however, has declined, indicating net selling pressure in the market.

- Looking at BTC options expiries extending to Jan. 31, we’re seeing calls trading at less than a 2.5 volatility premium to puts, a decline from last week’s 4-5 premium. It seems traders aren’t jumping on the latest surge to record highs quite as eagerly. It’s similar in ETH options.

- Notable traders include a BTC bull call spread involving $115,000 and $125,000 strikes expiring Jan. 31 and a large short position in ETH $4,100 call expiring on Dec. 20.

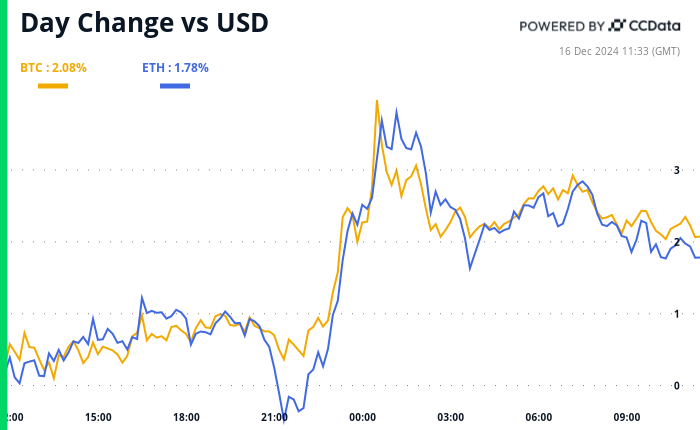

- BTC is up 3.4% from 4 p.m. ET Friday to $104,645.81 (24hrs: +2.33%)

- ETH is up 1.38% at $3,951.85 (24hrs: +2.36%)

- CoinDesk 20 is down 0.94% to 3,954.73 (24hrs: +0.27%)

- Ether staking yield is unchanged at 3.04%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 107.00

- Gold is up 0.83 at $2,678.00/oz

- Silver is up 1.44% to $31.16/oz

- Nikkei 225 closed unchanged at 39,457.49

- Hang Seng closed -0.88% at 19,795.49

- FTSE is down 0.41% at 4,947.81

- Euro Stoxx 50 is up 0.4% at 4,897.96

- DJIA closed on Friday -0.17% to 43,828.06

- S&P 500 closed unchanged at 6,051.09

- Nasdaq closed +0.12% at 19,926.72

- S&P/TSX Composite Index closed -0.54% at 25,274.30

- S&P 40 Latin America closed -1.26% at 2,320.17

- U.S. 10-year Treasury was unchanged at 4.38%

- E-mini S&P 500 futures are up 0.19% to 6,067.00

- E-mini Nasdaq-100 futures are up 0.29% to 21,859.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,901.00

- BTC Dominance: 57.50% (24hrs: +0.57%)

- Ethereum to bitcoin ratio: 0.0377 (24hrs: -0.37%)

- Hashrate (seven-day moving average): 796 eh/s

- Hashprice (spot): $63.2

- Total Fees: 9.6 BTC/ $980,000

- CME Futures Open Interest: 200,830

- BTC priced in gold: 39.4oz

- BTC vs gold market cap: 11.24%

- Bitcoin sitting in over-the-counter desk balances: 406,400 BTC

- The benchmark bond yield looks set to break through a trendline that represents a downtrend from October 2023 highs.

- The golden cross of the 50- and 200-day SMAs suggests it might just do, suggesting tough times for risk assets.

- MicroStrategy (MSTR): closed on Friday at $408.67 (+4.2%), up 5.51% at $431.20 in pre-market.

- Coinbase Global (COIN): closed at $310.58 (-0.76%), up 2.2% at $317.46 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.96 (+5.5%)

- MARA Holdings (MARA): closed at $22.73 (+0.66%), up 3.61% at $23.55 in pre-market.

- Riot Platforms (RIOT): closed at $12.99 (+5.35%), up 2.77% at $13.35 in pre-market.

- Core Scientific (CORZ): closed at $15.55 (+0.06%), up 2.06% at $15.87 in pre-market.

- CleanSpark (CLSK): closed at $12.02 (-2.51%), up 2.33% at $12.30 in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.36 (-1.79%), up 3.33% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $67.17 (-6.5%), up 4.26% at $70.03 in pre-market.

Spot BTC ETFs:

- Daily net inflow: $428.9 million

- Cumulative net inflows: $35.57 billion

- Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Daily net inflow: $23.6 million

- Cumulative net inflows: $2.26 billion

- Total ETH holdings ~ 3.514 million.

Source: Farside Investors

- Decentralized lending giant AAVE’s market is on fire as net inflows soared to an impressive $500 million in the past week.

- This represents increased risk-taking in the crypto market.

- Bitcoin Soars to Record High Above $106K, Then Retreats as Hawkish Fed Rate Cut Looms (CoinDesk): Bitcoin surged to $106,000 as traders anticipated a 25-basis-point Fed rate cut on Wednesday despite concerns about a slower pace of easing in 2025.

- Bitcoin Traders Now Target $120K as Bullish ‘Santa Claus Rally’ Gains Steam (CoinDesk): Traders see bitcoin extending its upward trajectory toward the $120,000 level, powered by speculation about a federal bitcoin reserve, growing institutional interest and seasonal patterns.

- MicroStrategy to Enter Nasdaq 100, Exposing Bitcoin-Linked Stock to Billions in Passive Investment Flows (CoinDesk): MicroStrategy (MSTR) will join the Nasdaq 100 index on Dec. 23, making it a required holding for all ETFs tracking the index, such as Invesco’s $300 billion QQQ Trust.

- China’s Key Bond Yield Hits Fresh Record Low as Data Disappoints (Bloomberg): China’s 10-year sovereign yield fell to 1.71% Monday as weak economic data fueled expectations of further stimulus, with analysts predicting possible rate cuts by the People’s Bank of China to counter deflation.

- The Fed’s Game Plan on Interest-Rate Cuts Keeps Shifting (The Wall Street Journal): Federal Reserve Chair Jerome Powell, needing to balance inflation concerns, labor market signals and market expectations, faces internal divisions ahead of a potential third interest-rate cut this week.

- Yuan’s Fall Would Be a Gift to Bank of Japan (Reuters): Chinese leaders are considering weakening the yuan to offset potential U.S. tariffs, which could pressure Asian currencies but help the Bank of Japan by supporting yen depreciation ahead of its Wednesday policy meeting.

UPDATE (Dec. 16, 12:43 UTC): Adds Token Talk section.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)