BTC

$79,169.21

+

3.27%

ETH

$1,569.48

+

5.78%

USDT

$0.9997

+

0.02%

XRP

$1.9036

+

7.32%

BNB

$558.29

+

3.44%

USDC

$0.9999

–

0.00%

SOL

$109.26

+

8.97%

DOGE

$0.1516

+

9.63%

TRX

$0.2351

+

4.60%

ADA

$0.5893

+

8.62%

LEO

$8.9735

+

0.83%

TON

$3.1058

+

3.31%

LINK

$11.44

+

7.07%

XLM

$0.2295

+

5.55%

AVAX

$17.01

+

10.12%

HBAR

$0.1569

+

15.75%

SUI

$2.0415

+

12.17%

SHIB

$0.0₄1119

+

2.78%

OM

$6.2916

+

3.58%

BCH

$278.58

+

7.48%

By James Van Straten, Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Apr 8, 2025, 11:15 a.m.

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. Crypto Daybook Americas will arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By James Van Straten (All times ET unless indicated otherwise)

One thing markets despise is uncertainty, and right now it’s coming from all corners of the globe, largely fueled by Trump’s tariffs.

STORY CONTINUES BELOW

Markets rebounded somewhat on Tuesday following Monday’s bloodbath in Asia and Europe, but it was more of a relief rally than a true recovery. At the heart of the conflict are the U.S. and China, both refusing to be the first to blink — even if it means prolonged uncertainty and pain for global markets.

As markets took a breather from the turmoil, crypto skeptics were quick to point out how bitcoin’s (BTC) safe haven narrative — bolstered by its resilience late last week — quickly unraveled on Monday when the price crashed to $75,000.

While that’s true, expecting the bitcoin price to remain unaffected was overly optimistic. During crises investors historically rush to cash, liquidating even traditional havens investments such as gold. Monday was no exception. Still, bitcoin has shown lower beta than U.S. equities since the tariff announcement.

In the bigger picture, bitcoin is holding up fairly well. The Nasdaq is down over 22% from its all-time high, while bitcoin is off by 28%. In previous episodes — like the yen carry-trade unwind in August 2024 or the COVID crash in March 2020 — bitcoin suffered far deeper relative losses.

Since the New York market closed on Wednesday, BTC has declined 8.4%, outperforming the S&P 500’s 10% drop and the Nasdaq’s 11% fall.

“What matters is that BTC’s beta to broader risk assets appears meaningfully lower in this sell-off than in previous ones. This suggests a growing recognition of bitcoin’s potential role as a non-sovereign store of value during periods of economic stress,” David Lawant, head of research at FalconX, said in an email.

Monday’s trading session also included an episode of “short-term madness” driven by false reports about a 90-day tariff delay. The markets spiked and then promptly crashed back down after the reports were refuted. Stay alert!

- Crypto:

- April 8: Teucrium 2x Long Daily XRP ETF (XXRP) lists on NYSE Arca.

- April 9: The Mercury network upgrade gets applied to the Neutron (NTRN) mainnet, migrating it from Cosmos Hub’s Interchain Security to a fully sovereign proof-of-stake network.

- April 9, 10 a.m.: U.S. House Financial Services Committee hearing on updating U.S. securities laws to take into account digital assets. Livestream link.

- April 10, 10:30 a.m.: Status conference for former Terraform Labs CEO Do Kwon at the U.S. District Court for the Southern District of New York.

- April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable on “Tailoring Regulation for Crypto Trading” in Washington.

- Macro

- April 9, 12:01 a.m.: The Trump administration’s higher individualized tariffs on imports from top U.S. trade deficit countries take effect.

- April 9, 8:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases March consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.48%

- Core Inflation Rate YoY Prev. 3.65%

- Inflation Rate MoM Prev. 0.28%

- Inflation Rate YoY Prev. 3.77%

- April 9, 12:01 p.m.: China’s 34% retaliatory tariffs on U.S. imports take effect.

- April 9, 2:00 p.m.: The Fed releases minutes of the FOMC meeting held March 18-19.

- April 9. 8, 9:30 p.m.: China’s National Bureau of Statistics (NBS) releases March’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. -0.2%

- Inflation Rate YoY Est. 0% vs. Prev. -0.7%

- PPI YoY Est. -2.3% vs. Prev. -2.2%

- April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. Livestream link.

- April 14: Salvadoran President Nayib Bukele will join U.S. President Donald Trump at the White House for an official working visit.

- Earnings (Estimates based on FactSet data)

- No earnings scheduled.

- Governance votes & calls

- Uniswap DAO is discussing a proposal to support v4 expansion with the creation of ENS subdomains to track BSL license exemptions and official deployments, granting the Uniswap Foundation a blanket license to deploy v4 on target chains.

- Bancor DAO is discussing the expansion of its taker fee to 0.001% on stable-to-stable trades on Sei v2 to make Carbon DeFi more competitive.

- April 8, 12 p.m.: Lido to host a Lido Node Operator Community Call.

- April 10, 10 a.m.: Hedera to host a community call discussing the HBR Foundation joining ERC3643, the non-profit’s standards, and the Header Asset Tokenization Studio.

- April 11, 3 p.m.: Zcash to host a town hall on lockbox distribution & governance.

- April 14, 10 a.m.: Stacks to host a livestream with recent announcements from the project.

- Unlocks

- April 8: Tensor (TNSR) to unlock 35.96% of its circulating supply worth $14.44 million.

- April 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $15.84 million.

- April 12: Aptos (APT) to unlock 1.87% of its circulating supply worth $51.01 million.

- April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating supply worth $21.18 million.

- April 15: Starknet (STRK) to unlock 4.37% of its circulating supply worth $15.79 million.

- April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $25.22 million.

- Token Listings

- April 8: Avalanche (AVAX) to be listed on Coins.ph.

- April 9: IOST airdrop claims portal for a roughly 1.7 billion IOST token airdrop to open.

- April 10: Ren (REN), KonPay (KON), and Symbol (XYM) to be delisted from Bybit.

- April 22: Hyperlane to airdrop its HYPER tokens.

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 1 of 2: Digital Accord Summit 2025 (Paris)

- Day 1 of 3: Paris Blockchain Week

- April 8: Seine & Crypto Connect (Paris)

- April 9: Blockchain & Finance – Evolution or Revolution? (Paris)

- April 9: FinTech and Banking Unconference Colombia 2025 (Bogota)

- April 9-10: FIBE Fintech Festival Berlin 2025

- April 9-10: Mexico Finance & Fintech Summit 2025 (Mexico City)

- April 9-10: Middle East Resilient Banking and Payments Symposium 2025 (Abu Dhabi)

- April 10: Bitcoin Educators Unconference (Nashville)

- April 10: FinXtex Malaysia 2025 (Kuala Lumpur)

- April 10: Institutional Crypto Conference (New York)

- April 10: SheFi Sumit 2025 (Seoul)

- April 10-11: BITE-CON 2025 Conference (Miami)

- April 10-11: 2025 Fintech and Financial Institutions Research Conference (Philadelphia)

- April 11-12: Strategy’s OPNEXT Conference (Tysons, Va.)

- April 12: Ethereum Argentina (Córdoba)

- April 12-13: DeSci London 2025

By Shaurya Malwa

- Fartcoin (FART) jumped 30% to extend monthly gains over 130%.

- The absurdly-named token extended a multiday run the broader crypto market staged a relief rally, displaying signs of steady buying demand from traders.

- Speculators keep an eye on continual strength in memecoins, especially when they tend to buck market trends, because the tokens tend to jump higher after a sell-off in the market. This can create possible profit opportunities for short-term traders, with some eyeing a move higher for the token in coming weeks.

- FART, among some crypto circles, is a symbol of the absurd and a light-hearted rebellion against the grim financial forecasts. It holds no intrinsic value, but enjoys a cult following — possibly driving buying demand even as the market falls.

- Bitcoin CME futures basis is holding firm above an annualized 5% amid the macro turmoil.

- CME options skew, however, is showing bias for downside protection, or puts.

- Together, both metrics show cautious sentiment without signaling panic, according to Thomas Erdösi, head of product at CF Benchmarks.

- On Deribit, BTC and ETH put biases have moderated, but BTC implied volatility term structure remains in backwardation, indicating persistent fears of wild price swings in the short-term.

- In BTC options, the $70K put is now the most popular strike, boasting a notional open interest of $957 million. That’s a 180-degree shift from the bias for $100K-$120K strike calls early this year.

- Most of the top 25 coins, excluding TRX, HBAR, LINK and DOT, have seen a drop in perpetual futures open interest in the past 24 hours.

- BTC is unchanged from 4 p.m. ET Monday at $78,894.34 (24hrs: +2.61%)

- ETH is down 0.32% at $1,514.40 (24hrs: +5.22%)

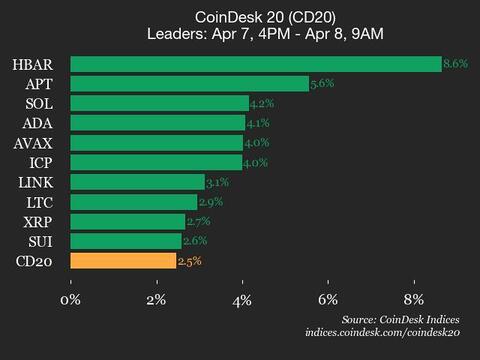

- CoinDesk 20 is up 0.8% at 2,268.01 (24hrs: +4.76%)

- Ether CESR Composite Staking Rate is up 77 bps at 3.69%

- BTC funding rate is at 0.0049% (5.3118% annualized) on Binance

- DXY is unchanged at 103.32

- Gold is up 2.19% at $3015.9/oz

- Silver is up 1.9% at $30.07/oz

- Nikkei 225 closed +6.03% at 33,012.58

- Hang Seng closed +1.51% at 20,127.68

- FTSE is up 2.1% at 7,863.79

- Euro Stoxx 50 is up 1.36% at 4,719.66

- DJIA closed on Monday -0.91% at 37,965.60

- S&P 500 closed -0.23% at 5,062.25

- Nasdaq closed +0.1% at 15,603.26

- S&P/TSX Composite Index closed -1.44% at 22,859.50

- S&P 40 Latin America closed -2.94% at 2,227.14

- U.S. 10-year Treasury rate is down 2 bps at 4.16%

- E-mini S&P 500 futures are down 1.58% at 5,178.00

- E-mini Nasdaq-100 futures are up 1.35% at 17,799.50

- E-mini Dow Jones Industrial Average Index futures are up 2% at 38,930.00

- BTC Dominance: 63.46 (-0.11%)

- Ethereum to bitcoin ratio: 0.01980 (0.97%)

- Hashrate (seven-day moving average): 902 EH/s

- Hashprice (spot): $40.50

- Total Fees: 6.59BTC / $510,645

- CME Futures Open Interest: 137,695 BTC

- BTC priced in gold: 26.2 oz

- BTC vs gold market cap: 7.43%

- The chart shows monthly activity in the U.S. 10-year Treasury yield since the 1980s.

- While the crypto community is hoping for a return to the zero-yield era, the chart suggests otherwise, revealing a long-term bullish shift in rates.

- The trend change is evident from the key 50-, 100- and 200-month simple moving averages — which are aligned bullishly one above the other for the first time since the 1980s.

- Elevated rates might be the new normal.

- Strategy (MSTR): closed on Monday at $268.14 (-8.67%), up 1.47% at $272.09 in pre-market

- Coinbase Global (COIN): closed at $157.28 (-2.04%), up 1.72% at $159.98

- Galaxy Digital Holdings (GLXY): closed at C$12.34 (-8.8%)

- MARA Holdings (MARA): closed at $11.26 (-0.35%), up 2.04% at $11.49

- Riot Platforms (RIOT): closed at $7.11 (-0.42%), up 0.28% at $7.13

- Core Scientific (CORZ): closed at $7.02 (-2.23%), up 1.85% at $7.15

- CleanSpark (CLSK): closed at $7.43 (+1.5%), up 0.67% at $7.48

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.41 (+0.73%)

- Semler Scientific (SMLR): closed at $34.15 (0.89%), down 1.02% at $33.80

- Exodus Movement (EXOD): closed at $41.84 (-6.25%), down 5.16% at $39.68

Spot BTC ETFs:

- Daily net flow: -$103.9 million

- Cumulative net flows: $36.07 billion

- Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

- Daily net flow: $0.0

- Cumulative net flows: $2.38 billion

- Total ETH holdings ~ 3.37 million.

Source: Farside Investors

- The chart by CryptoQuant shows daily net flow of BTC from wallets linked with miners.

- On Monday, these wallets registered a cumulative net outflow of 1,627 BTC, the most since Dec. 24.

- According to Bloomberg, the Trump tariffs have disrupted the bitcoin mining industry.

- China Offers First Hint of Devaluation With Weak Renminbi Fix (Financial Times): China set the yuan-dollar rate at its lowest level since September 2023 to counter mounting U.S. tariffs. Analysts say significant devaluation is unlikely.

- First XRP ETF in the U.S. to Go Live on Tuesday With Launch of Teucrium’s Leveraged Fund (CoinDesk): The Teucrium 2x Long Daily XRP ETF lists on NYSE Arca with the ticker XXRP, giving exposure to XRP with 2x leverage. Management fee: 1.85%.

- Cboe Set to Debut New Bitcoin Futures With FTSE Russell (CoinDesk): Cboe Digital plans to introduce a cash-settled bitcoin futures contract April 28.

- WazirX Creditors Back Restructuring Plan to Payback $230M Hack Victims (CoinDesk): If approved by the Singapore High Court, the scheme will initiate payouts within 10 business days followed by phased resumptions of withdrawals and trading, subject to regulatory compliance.

- Russia’s Medvedev Predicts More Countries Will Acquire Nuclear Weapons (Reuters): Russia’s Security Council deputy chair said nuclear disarmament is no longer feasible, even if the Ukraine war ends.

- Trump Order Seeks to Tap Coal Power in Quest to Dominate AI (Bloomberg): Trump is set to sign an executive order directing two federal agencies to ease coal mining limits and label the fuel a critical mineral for national security.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)