BTC

95,967.84

+0.58%

ETH

3,803.40

+6.85%

XRP

2.56

+2.20%

USDT

1.00

+0.04%

SOL

233.57

+5.26%

BNB

764.07

+19.33%

DOGE

0.41349039

+2.47%

ADA

1.20

+0.71%

USDC

1.00

-0.01%

STETH

3,800.50

+6.75%

TRX

0.35368585

+37.33%

AVAX

54.66

+9.62%

TON

7.09

+7.90%

SHIB

0.0₄30151

+8.63%

LINK

26.22

+10.07%

XLM

0.50621377

+0.06%

WBTC

95,778.75

+0.76%

HBAR

0.29635212

-8.74%

BCH

565.53

+7.35%

SUI

3.67

-4.55%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Dec 4, 2024, 3:09 p.m. UTCPublished Dec 4, 2024, 12:00 p.m. UTC

What to know:

You are currently viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

It was only a matter of time before the bitcoin bull market reignited excitement in the DeFi sector, and guess what? Chatter is heating up about a potential “carry trade” that uses DeFi protocol Ethena’s yield-bearing staked USDe (sUSDe) to borrow stablecoins like USDC and USDT from the lending giant Aave.

Story continues below

Those stablecoins are then flipped back for USDe, yielding a sweet return from the juicy spread between sUSDe’s near 30% annualized yield and AAVE’s variable borrowing rates, currently less than 20%. The return is way better than ether’s staking yield of under 4% and the U.S. 10-year Treasury’s 4.24%.

If the trade becomes popular, the arbitrage window could eventually close, with borrowing rates potentially matching the yield on sUSDe, according to the pseudonymous observer Clouted. Keep an eye on this one.

As for market leader bitcoin, the largest cryptocurrency has bounced back to nearly $97,000 as of writing — a level we’ve seen several times since mid-November — after testing dip demand around $93,500 on Tuesday. Prices on Korean exchanges are back in sync with their global counterparts after Tuesday’s flash crash caused by the announcement of martial law.

Traders are eagerly awaiting Fed Chairman Powell’s speech later today, plus Friday’s nonfarms payroll report, hoping for a boost in bitcoin price volatility. With BTC’s Coinbase premium returning, the case for renewed bullishness looks promising unless Powell throws cold water on December rate-cut expectations.

Meantime, beware of engagement farming on social media. Some X accounts are buzzing about record short positions in CME’s ether futures, claiming it’s suppressing ether prices. That might not be so. Most of those shorts could be a part of the popular price-neutral cash-and-carry arbitrage strategy that includes long positions in the spot market or spot ETFs. It’s no coincidence that Farside Investors data shows there’s been a net inflow of $714 million into U.S.-listed ether ETFs in the past seven trading days.

Looking at the broader market, Aptos has hit a milestone with its DeFi total value locked surpassing $1 billion, a staggering 19-fold growth year-on-year. The number of transactions and the average cost to transact on the Avalanche C-Chain are at their highest since April and August, just as the Avalanche9000 upgrade approaches, according to data source Artemis.

Tron’s TRX token and the on-chain perpetual options protocol GammaSwap’s GS token have reached record highs, while a whale sold a whopping 240 billion PEPE, according to Lookonchain data. Decentralized exchange PancakeSwap has launched “PancakeSwap Springboard” to create and list tokens, taking the page out of Pumpfun’s book. Expect more speculative froth.

In traditional markets, keep your eye on risk-off signals. The yen remains upbeat and Wall Street executives are aggressively reducing their stocks, driving the ratio of insider sellers to buyers to nearly 6x, according to the Kobeissi Letter. So stay alert out there!

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s Services ISM Report on Business. Services Purchasing Managers Index (PMI) Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:40 p.m.: Fed Chair Jerome H. Powell is taking part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

- Governance votes & calls

- Ethereum staking platform RocketPool to hold monthly community call at 10 a.m.

- Autonolas (OLAS) proposal to launch new bonding products on Base blockchain ends 3 p.m.

- Qubic lowers token transaction fees from 1 million QUBIC tokens to 100 QUBIC, worth fractions of a penny.

- Unlocks

- Taiko unlocked 11% of circulating supply, worth over $10 million at current rates, at 5 a.m.

- Token Launches

- StrawberryAI is to launch mainnet on Dec. 5, time unspecified.

- Dec. 3 – 4: FT’s Global Banking Summit (London)

- Dec. 4 – 5: India Blockchain Week 2024 Conference (Bangalore, India)

- Dec. 4 – 5: W3N 2024 (Narva, Estonia)

- Dec. 6: Digital Finance Summit Summit 2024 (Brussels)

- Dec. 7: Bitcoin Baden 2024 (Baden, Switzerland)

- Dec. 9 – 12: Abu Dhabi Finance Week 2024 (Abu Dhabi, UAE)

- Dec. 9 – 13: Luxembourg Blockchain Week 2024

- Dec. 12 – 13: Global Blockchain Show (Dubai)

- Dec. 12 – 14: Taipei Blockchain Week 2024 (Taipei, Taiwan)

- Dec. 16 – 17: Blockchain Association’s Policy Summit (Washington)

By Shaurya Malwa

“Dino coins” from as long ago as 2018 are catching a bid in a refreshing move away from memecoins.

Several tokens popularized back during what was arguably the first altcoin bull market are following XRP’s 400% price rally over the past 30 days with rallies of their own for no immediately apparent reason.

Stellar (XLM), bitcoin cash, eos (EOS), tron (TRX) and Hedera (HBAR) have gained at least 50% over the past week, CoinGecko data shows, in a move that has outperformed bitcoin and nearly every “new” token that is being promoted or hyped on Crypto Twitter.

The term “dino coins” reflects a narrative shift where older cryptocurrencies are no longer seen as outdated but as resilient, seasoned projects. This shift can be attributed to their survival through multiple market cycles, which gives them a certain credibility among newer, less-proven offerings.

- The bitcoin and ether annualized three-month futures basis on offshore exchanges remain flat at around 15%. On the CME, ETH boasts a slightly higher basis at 17%, with BTC at 14%, offering attractive returns to cash and carry traders.

- Positioning in ETH remains elevated, with global futures and perpetual open interest at a record high of 338,680. The BTC market has cooled, with open interest pulling back to 609,470, down 8% from the peak of 663,710 seen last month.

- On decentralized options protocol Derive, a trader collected $1.66 million in premiums by selling bitcoin March expiry calls at strikes in the $105,000 to $130,000 range.

- Short-term BTC calls are trading at a slight discount to puts, but long-term options continue to show a bull bias. ETH calls are expensive relative to puts across the curve. (Data source: Amberdata, VeloData, Derive, Deribit)

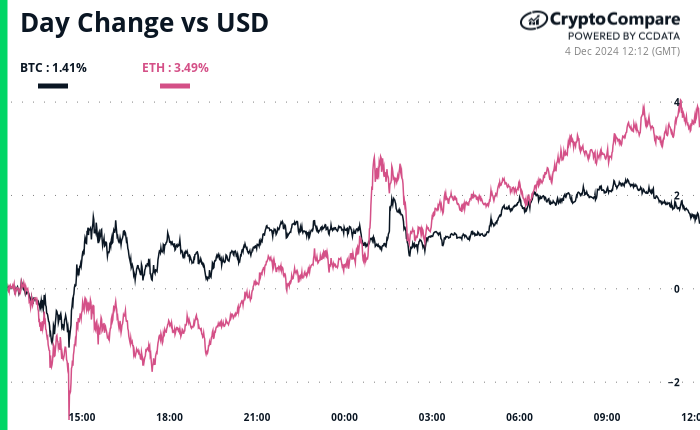

- BTC is up 0.9 % from 4 p.m. ET Tuesday to $96,460.42 (24hrs: +0.64%)

- ETH is up 3.46% at $3,734.92 (24hrs: +3.22%)

- CoinDesk 20 is up 2.39% to 3,954.73 (24hrs: +2.54%)

- Ether staking yield is up 30 bps to 3.46%

- BTC funding rate is at 0.0264% (28.9% annualized) on Binance

- DXY is up 0.13% at 106.46

- Gold is unchanged at $2,646.45/oz

- Silver is down 0.41% to $30.86/oz

- Nikkei 225 closed unchanged at 39,276.39

- Hang Seng closed unchanged at 19,742.46

- FTSE is down 0.43% at 8,323,87.87

- Euro Stoxx 50 is up 0.4% at 4,897.96

- DJIA closed -0.17% to 44,705.53

- S&P 500 closed unchanged at 6,049.88

- Nasdaq closed +0.83% at 19,480.91

- S&P/TSX Composite Index closed +0.18% at 25,635.73

- S&P 40 Latin America closed +0.44% at 2,327.36

- U.S. 10-year Treasury was unchanged at 4.22%

- E-mini S&P 500 futures are up 0.24% to 6078.50

- E-mini Nasdaq-100 futures are up 0.56% to 21405.00

- E-mini Dow Jones Industrial Average Index futures are up 0.48% at 45016

- BTC Dominance: 55.17% (-0.61%)

- Ethereum to bitcoin ratio: 0.0383 (1.78%)

- Hashrate (seven-day moving average): 729 EH/s

- Hashprice (spot): $61.013

- Total Fees: 15.5 BTC/ $1.5 million

- CME Futures Open Interest: 185,485 BTC

- BTC priced in gold: 36.5 oz

- BTC vs gold market cap: 10.40%

- Bitcoin sitting in over-the-counter desk balances: 423,902

XRP’s daily chart shows that while prices set a new high Tuesday, the MACD histogram, a momentum indicator, did not confirm the move, diverging bearishly. It indicates that the bullish momentum has weakened and prices may turn lower.

- MicroStrategy (MSTR): closed on Tuesday at $373.43 (-1.81%), up 3.23% at $385.50 in pre-market.

- Coinbase Global (COIN): closed at $309.35 (+2.3%), up 1.62% at $314.36 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.08 (+5.03%)

- MARA Holdings (MARA): closed at $25.13 (-1.95%), up 2.03% at $25.65 in pre-market.

- Riot Platforms (RIOT): closed at $12.14 (+0.33%), up 0.66% at $12.22 in pre-market.

- Core Scientific (CORZ): closed at $16.42 (+2.24%), up 0.53% at $17.67 in pre-market.

- CleanSpark (CLSK): closed at $13.95 (-3.93%), unchanged in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.56 (-0.25%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $63.63 (+4.81%), up 2% at $64.90 in pre-market.

Spot BTC ETFs:

- Daily net inflow: $676 million

- Cumulative net inflows: $31.70 billion

- Total BTC holdings ~ 1.080 million.

Spot ETH ETFs

- Daily net inflow: $132.6 million

- Cumulative net inflows: $733.6 million

- Total ETH holdings ~ 3.077 million.

Source: Farside Investors

- December’s tally of the daily unique on-chain wallets interacting with AAVE surpassed 13,000, the most since November 2021.

- The increase comes amid increased interest in borrowing stablecoins.

- South Korean Lawmakers Move to Impeach President (Financial Times): South Korea’s opposition initiated proceedings on Wednesday to remove President Yoon Suk Yeol after his failed martial law declaration deepened a political crisis. Around 190 lawmakers plan to debate the impeachment motion on Thursday and vote by the weekend, which could suspend Yoon if two-thirds of parliament supports the move.

- Amid Political Chaos, Bank of Korea Says It Will Boost Short-Term Liquidity and Deploy Measures to Stabilize the FX Market (CNBC): South Korea’s central bank pledged to enhance liquidity and stabilize the currency market after lawmakers overturned President Yoon’s martial law order. Following an emergency meeting Wednesday morning, the bank announced temporary loans as Korean stocks swung sharply, with the MSCI South Korea ETF briefly hitting a 52-week low.

- DCG Confirms Reports Foundry Layoffs, Says It’s 16% of U.S. Employees (CoinDesk): Foundry, a Bitcoin mining pool owned by Digital Currency Group (DCG), laid off 16% of its U.S. staff and a small team in India, correcting earlier reports of larger cuts. The bitcoin hashprice index remains significantly down year-over-year, but has improved slightly in recent months, supported by the cryptocurrency’s rising price.

- Grayscale Files to Convert Solana Trust Into ETF (CoinDesk): Grayscale filed to convert its $134M Solana Trust (GSOL) into an ETF, becoming the fifth firm in the Solana ETF race after Bitwise, VanEck, 21Shares and Canary Capital. The filing follows Grayscale’s successful conversion of its Bitcoin and Ethereum trusts into ETFs earlier this year.

- Move Over XRP’s Korea Narrative, The 400% Price Rally Has Support of Coinbase Whales (CoinDesk): XRP has surged over 400% in 30 days to $2.60, with U.S. investors driving a Coinbase premium of 3%–13% over Binance and Upbit, reflecting stronger buying pressure. However, trading volumes remain much higher in South Korea, where XRP/KRW accounts for 26% of activity on Upbit.

- What to Expect as France’s Government Faces No Confidence Vote (The New York Times): French Prime Minister Michel Barnier faces a likely no-confidence vote that would topple his government, making it the shortest-lived in France’s Fifth Republic. If ousted, Barnier would serve in a caretaker role while President Macron appoints a new prime minister, with the rejected budget forcing temporary fiscal measures to keep the government running.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)