BTC

100,767.85

+6.43%

ETH

3,811.87

+7.67%

USDT

1.00

+0.03%

XRP

2.42

+24.29%

SOL

230.27

+12.58%

BNB

697.83

+7.03%

DOGE

0.41238813

+11.93%

USDC

0.99987838

-0.02%

ADA

1.09

+18.45%

STETH

3,810.24

+7.71%

TRX

0.28424520

+12.44%

AVAX

47.86

+14.98%

SHIB

0.0₄28820

+17.50%

TON

6.28

+13.63%

LINK

23.91

+17.20%

WBTC

100,461.57

+6.25%

XLM

0.43264786

+17.84%

SUI

4.25

+21.42%

HBAR

0.29934978

+16.51%

BCH

546.75

+12.13%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Dec 11, 2024, 3:38 p.m. UTCPublished Dec 11, 2024, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

If you’re waiting for a spark to ignite a Santa rally in bitcoin and the wider crypto market, today’s U.S. inflation release might just be it.

Story continues below

Initially, I wasn’t sure the report matters anymore. Obsessing over prices feels so 2022, when inflation was through the roof and the Fed squarely focused on interest-rate hikes to tame the beast. Recently, though, CPI has been below 3% and the Fed has cut rates, focusing on balancing employment and price stability.

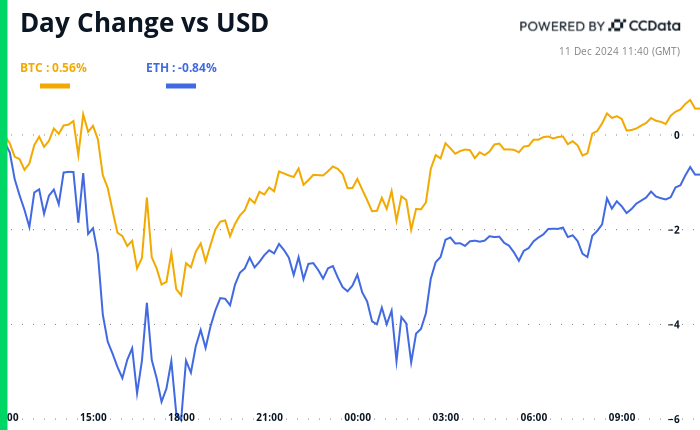

The November report is expected to show a slight uptick in price pressures and there are two reasons to keep an eye on it. Firstly, BTC bulls and bears are having a showdown near the all-important $100,000 level and might look to fundamental/macro news to reassert themselves. A softer-than-expected inflation print will likely validate Fed rate cut bets, potentially strengthening the bull grip for a sustained move above $100K. ETH might see bigger gains, having experienced a classic “throwback,” or a bullish retest of a breakout point, near $3,600 in the last 24 hours.

But if the data comes in hotter than estimated, especially the core figure, it could add to the dollar’s bull momentum and energize bitcoin bears, who have an advantage heading into the data release. Data shared by Hyblock Capital overnight showed a 50% order-book imbalance, with more limit sells than buys. Cardano’s ADA is also feeling the pinch, with slippage spikes hinting at worsening liquidity.

The second reason is that the U.S. Treasury market has been a picture of calm recently, with its volatility gauge, MOVE, plunging to 85 from 136. So, what better than CPI to stir it up again, sending ripples across financial markets. Let’s see how it goes. Bank of America said it expects the report to breed equity market volatility.

Looking past inflation, I want to reiterate the importance of watching the Far-East. Reuters reports that China could allow the yuan to depreciate next year in response to President-elect Donald Trump’s proposed tariffs. While that may drive Chinese investors toward crypto, as the popular narrative says, a rapid decline might force the PBOC to intervene, inadvertently strengthening the dollar and tightening global financial conditions. That’s typically not great news for risk assets like BTC.

Elsewhere, Bloomberg’s observers said that Nasdaq might add MicroStrategy (MSTR) to its index, which might inject $2.1 billion of buying demand into the stock. MSTR has been literally borrowing dollars to buy BTC, becoming a leveraged bet on the cryptocurrency. But remember, leverage works both ways; what goes up faster can also come down harder.

That’s plenty of macros to chew on today. Stay alert!

- Crypto:

- Dec. 13: The annual Nasdaq-100 reconstitution. Changes to the index, if any, are announced on this day. MicroStrategy (MSTR), the world’s largest corporate holder of bitcoin, is widely expected to be added to the index.

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Inflation Rate YoY Est. 2.7% vs Prev. 2.6%

- Core Inflation Rate YoY Est. 3.3% vs Prev. 3.3%

- Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Est. 3.25% vs Prev. 3.75%. A press conference starts at 10:30 a.m. Livestream link

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its latest monetary policy decision (three key interest rates), followed by a press conference at 8:45 a.m.

- Deposit facility interest rate Est. 3.0% vs Prev. 3.25%.

- Main refinancing operations interest rate Est. 3.15% vs Prev. 3.4%.

- Marginal lending facility interest rate Prev. 3.65%.

- Dec. 12, 8:30 a.m. The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Dec. 7. Initial Jobless Claims Est. 220K vs Prev. 224K.

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Governance votes & calls

- The Sandbox DAO is holding a vote to allocate $102,000 in funding to develop Deep Sea, a horror game. The vote will end on Dec. 25.

- Spartan Council is holding a vote on updating trading fee distribution in favor of liquidity providers on Synthetix exchange.

- Unlocks

- Aptos (APT) will unlock $132 million worth of tokens at 16:00 UTC on Dec. 11.

- Arbitrum (ARB) will unlock $88 million worth of tokens on Dec. 16.

- Token Launches

- Fuel Network announced the introduction of a new token (FUEL), with issuance planned within the next two weeks.

- Dec. 9 – 12: Abu Dhabi Finance Week 2024 (Abu Dhabi, UAE)

- Dec. 9 – 13: Luxembourg Blockchain Week 2024

- Dec. 12 – 13: Global Blockchain Show (Dubai, UAE)

- Dec. 12 – 14: Taipei Blockchain Week 2024 (Taipei, Taiwan)

- Dec. 13: Limitless Crypto 2024 (San Juan, Puerto Rico)

- Dec. 16 – 17: Blockchain Association’s Policy Summit (Washington D.C.)

- Jan. 13 – 24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

- Jan. 18: BitcoinDay (Napes, Florida)

- Jan. 21: Frankfurt Tokenization Conference 2025

By Shaurya Malwa

You might find memecoins to be a whimsical part of the crypto market, but they are proving to be serious business for exchange upstarts.

Memecoin trading propelled Solana-based Raydium to top the decentralized exchange (DEX) rankings by volume for the second straight month in November, eclipsing long-time leader Uniswap with $124.6 billion in volume versus $90.5 billion.

Raydium captured over 60% of the daily total DEX volume last month. A significant portion, peaking at 65%, came from trading in memecoins, according to a Messari report released Tuesday.

This growth mirrors a larger shift in the market, with Solana’s daily DEX volume overtaking Ethereum’s. In November, Solana commanded nearly 50% of the DEX activity across all blockchains; Ethereum captured 18%.

Memecoins on Solana are known for their high volatility, attracting traders looking for quick gains, and their speculative nature has led to significant trading volumes. For more on memecoins and Solana, check out the profile of Ansem, the Memecoin King, in CoinDesk’s Most Influential 2024.

The latest trend is AI agents, or meme tokens that claim to use AI for products such as financial research or music creation. Tokens like AI16Z and ZEREBRO have run to market caps in excess of $300 million from under under $10,000 in a few weeks.

Memecoins often start trading on Raydium after hitting market cap thresholds on launch platforms like Pump.fun — the most-used token issuance platform and another of CoinDesk’s most influential — giving it a stream of new tokens every day.

Such activity has minted Raydium developers’ revenue of over $25 million since October, more than $500 million since January. That’s 10 times the $44 million the DEX made in 2023, DefLLama data shows.

A few people are probably wishing the frenzy never ends.

- Perpetual funding rates in small-cap tokens, often considered a proxy for speculative frenzy, are no longer overheated and have normalized to levels seen in bitcoin and ether.

- BTC options flows continue to lean bullish, with notable activity in calls at the $130,000 and $150,000 strikes expiring in February and March, respectively.

- Strong uptake has been seen for ETH $3,300 put expiring Dec. 20 and $3,750 call expiring Dec. 13.

- Friday expiry BTC and ETH puts are trading at a slight premium to calls, reflecting concern of short-term downside volatility.

- BTC is up 1.44 % from 4 p.m. ET Tuesday to $98,278.92 (24hrs: +0.53%)

- ETH is up 1.95% at $3,710.30 (24hrs: -0.88%)

- CoinDesk 20 is up 3% to 3,688.50 (24hrs: +1.49%)

- Ether staking yield is up 24 bps to 3.47%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is up 0.31% at 106.73

- Gold is up 1% at $2,724.5/oz

- Silver is up 0.53% to $32.53/oz

- Nikkei 225 closed unchanged at 39,372.23

- Hang Seng closed -0.77% at 20,155.05

- FTSE is unchanged at 8,283.83

- Euro Stoxx 50 is unchanged at 4,950.03

- DJIA closed on Tuesday -0.35% to 44,247.83

- S&P 500 closed -0.3% at 6,034.91

- Nasdaq closed -0.25% at 19,687.24

- S&P/TSX Composite Index closed -0.47% at 25,504.30

- S&P 40 Latin America closed +0.21% at 2,361.59

- U.S. 10-year Treasury was unchanged at 4.24%

- E-mini S&P 500 futures are unchanged at 6,051.00

- E-mini Nasdaq-100 futures are up 0.2% to 21,447.75

- E-mini Dow Jones Industrial Average Index futures are down 0.17% at 44,258.00

- BTC Dominance: 56.88% (-0.11%)

- Ethereum to bitcoin ratio: 0.03782 (0.67%)

- Hashrate (seven-day moving average): 773 EH/s

- Hashprice (spot): $60.19

- Total Fees: 15.87 BTC / $1.55M

- CME Futures Open Interest: 194K BTC

- BTC priced in gold: 35.6 oz

- BTC vs gold market cap: 10.38%

- Bitcoin sitting in over-the-counter desk balances: 432.09K BTC

- The chart shows a successful throwback, or bullish-retest, of a breakout point in ETH.

- An asset typically sees a throwback to crowd out weak hands before staging a strong rally.

- MicroStrategy (MSTR): closed on Tuesday at $377.32 (+3.28%), up 1.77% at $384.00 in pre-market.

- Coinbase Global (COIN): closed at $302.42 (-2.61%), up 3.12% at $311.85 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$25.98 (-2.77%)

- MARA Holdings (MARA): closed at $22.81 (-4.4%), up 1.95% at $23.25 in pre-market.

- Riot Platforms (RIOT): closed at $11.10 (-0.98%), up 1.26% at $11.24 in pre-market.

- Core Scientific (CORZ): closed at $15.78 (-1.62%), up 0.95% at $15.93 in pre-market.

- CleanSpark (CLSK): closed at $12.94 (-4.57%), up 1.47% at $13.13 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.13 (-5.07%), up 3.32% at $28.03 in pre-market.

- Semler Scientific (SMLR): closed at $59.83 (-3.69%), up 1.09% at $60.48 in pre-market.

Spot BTC ETFs:

- Daily net inflow: $438.5 million

- Cumulative net inflows: $34.32 billion

- Total BTC holdings ~ 1.113 million.

Spot ETH ETFs

- Daily net inflow: $305.7 million

- Cumulative net inflows: $1.86 billion

- Total ETH holdings ~ 3.323 million.

Source: Farside Investors

- The Truflation index, which uses data from over 30 sources including Amazon, Walmart and Zillow, to create an index of prices for goods and services, has surged to 2.84%, the highest since September 2023.

- Its a sign of sticky price pressures that may soon show up in the official CPI figures.

- Binance Partners With Circle to Push USDC Stablecoin Adoption Across the Globe (CoinDesk): Binance will adopt Circle’s USDC for its corporate treasury and work with the company to make it easier for customers to use the stablecoin for trading, savings and payments.

- Bitcoin’s $100K Breakout Pause Likely Due to Liquidity Factors and Nvidia’s Stalled Rally (CoinDesk): Bitcoin remains range-bound between $90,000 and $100,000, held back by slowing liquidity inflows and a weakening correlation with Nvidia stock, whose recent momentum has also slowed.

- South Korea’s Martial-Law Chaos Deepens, With a Suicide Attempt and Raids (The Wall Street Journal): South Korea’s political turmoil escalated with the former defense minister’s suicide attempt on Tuesday and a police raid on the presidential office on Wednesday.

- Magic Eden’s $5B Token Airdrop Raises Crypto Wallet Security Questions (CoinDesk): NFT marketplace Magic Eden’s ME token launch faced challenges, including a complex claim process raising security concerns and heavy selling that quickly drove down its price.

- US Stocks Rally Set to Slow as Investor ‘Euphoria’ Fades, Say Big Banks (Financial Times): Wall Street banks expect the S&P 500 to rise only 8% in 2025, reflecting concerns over elevated valuations, slowing AI-related growth, cautious sentiment toward Big Tech and uncertainties tied to President-elect Donald Trump’s policies.

- Bank of England Set to Stay in Central Bank Slow Lane, Keep Rates on Hold (Reuters): Analysts expect the Bank of England to hold the benchmark interest rate at 4.75% on Dec. 19, citing concerns that increased government spending and higher employer taxes in the recent budget may fuel inflation.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)