BTC

100,842.50

+1.73%

ETH

3,638.47

-0.06%

XRP

2.43

+1.30%

USDT

0.99988344

+0.01%

BNB

726.15

+1.18%

SOL

214.02

-1.24%

DOGE

0.38529594

+0.06%

USDC

0.99995049

+0.00%

ADA

1.14

+5.35%

TRX

0.26905737

+1.53%

AVAX

43.12

-2.37%

SUI

5.14

-1.97%

LINK

23.20

-2.76%

TON

5.68

-0.97%

SHIB

0.0₄23767

-1.47%

XLM

0.45445788

-0.13%

WBTC

100,762.20

+1.50%

HBAR

0.31641462

+1.21%

BCH

468.89

-0.39%

UNI

14.78

-2.13%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Jan 7, 2025, 12:01 p.m. UTCPublished Jan 7, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

It’s still early in 2025, and already we’re seeing a significant divergence between bitcoin and the S&P 500.

BTC is looking to secure a foothold above $100,000, and its Deribit-listed options are indicating a bullish bias. The same can’t be said of the S&P 500, which has a history of providing risk-on/off cues to risk assets, including BTC.

According to Cboe data, the SPX options skew now reflects greater downside risk than it did a year ago.

The defensive positioning in stocks perhaps stems from concerns that President-elect Donald Trump’s Jan. 20 inauguration could be a “sell-the-news” event. Risk-taking has picked up across financial markets in the past two months in anticipation of pro-corporate and pro-economy reforms under Trump’s presidency, and profit-taking cannot be ruled out.

“Broadly speaking, we see some cracks in the data and think that Trump’s inauguration later this month has a decent chance of being a ‘sell the news’ event after nearly three months of unbridled economic optimism across most sectors,” Bruce J Clark, head of rates America at Informa Connect, said on LinkedIn.

That raises the question: How will BTC react? After all, expectations of regulatory clarity under Trump have already seen the cryptocurrency rally to over $100,000 from $70,000 in just two months. A Jan. 20 broader market sell-off could pull down the dollar index and the bond yields, potentially supporting BTC.

For now, there are several factors supporting BTC. For instance, the $400 billion in liquidity sucked out of the system in the final two weeks of 2024 is likely to return, greasing asset prices, according to the LondonCryptoClub newsletter. Plus, some of the capital flows from China could find a home in cryptocurrencies.

Bitcoin is again trading at a premium on Coinbase, reflecting stronger Stateside demand while miners are expected to cut back on sales.

“The Net Unrealized Profit and Loss (NUPL) for miners remains very positive, hovering around 0.5, suggesting that miners are still in a strong position, with substantial unrealized profits and a preference to hold onto their BTC at this stage,” analysts at Bitfinex told CoinDesk.

In the broader market, some traders are dabbling with December 2025 ETH calls at strikes as high as $11,000. Ether is currently trading below $4,000. Over 70 of the top 100 coins by market value were up on a 24-hour basis at press time. Need more evidence of risk-on?

That said, keep an eye on the bond market rout, which is fast spreading outside the U.S. Early today, the Japanese 10-year bond yield rose to a 13-year high while its 30-year British counterpart was on the verge of hitting the highest since the late 1990s. That can suck the wind out of risk assets. Stay alert!

- Crypto

- Jan. 7: Dusk (DUSK) mainnet launch.

- Jan. 8: Bybit terminates withdrawal and custody services to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) to create and distribute new tokens in token generation event.

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

Jan. 15: Derive (DRV) token generation event. - Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 7, 8:55 a.m.: U.S. Redbook YoY for the week ended Jan. 4. Prev. 7.1%.

- Jan. 7, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November 2024’s Job Openings and Labor Turnover Summary (JOLTS) report.

- Job openings Est. 7.65M vs. Prev. 7.744M.

- Job quits Prev. 3.326M.

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” at the Lectures of the Governor Event, Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

- Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

- Governance votes & calls

- The dYdX DAO voted to wind down its FTM-USD market over the Sonic token migration. Spartan Council is holding a similar vote.

- Unlocks

- Jan. 7: Ethereum Name Service to unlock 1.46% of its total locked supply, worth $53.5 million.

- Jan. 8: Flare to unlock 1.61% of its circulating supply, worth $47.15 million.

- Jan. 8: Ethena to unlock 0.42% of its ENA circulating supply, worth $14.7 million.

- Jan. 8: Optimism to unlock 0.33% of its OP circulating supply, worth $9.3 million.

- Token Listings

- Jan. 7: Sonic SVM (SONIC) to be listed on Bitget, KuCoin, and MEXC at 7 a.m.

- Jan. 10: Lava Network (LAVA) to be listed on KuCoin and Bybit at 5 a.m.

- Jan. 10: Bybit to delist FTM (FTM) at 5 a.m..

- Day 2 of 14: Starknet, the Ethereum layer 2 is holding its Winter Hackathon (online).

- Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

- Jan. 18: BitcoinDay (Naples, Florida)

- Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 21: Frankfurt Tokenization Conference 2025

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Feb. 3: Digital Assets Forum (London)

- Feb. 18-20: Consensus Hong Kong

By Shaurya Malwa

Ethereum co-founder Vitalik Buterin has offloaded a stash of memecoins sent to him by various communities to fund a charity, on-chain data shows.

In the past two days, Buterin has sold $940,900 worth of lesser-known memecoins for the USDC stablecoin and ether. The NEIRO, ESTEE, MARVIN, EBULL, MSTR, and TERMINUS tokens brought in at least $57,000 worth of USDC, while other tokens were sold for less than $40,000.

Just over $916,000 was whisked away to a multisign wallet, likely tied to the charity Kanro, according to SpotOnChain.

Communities often send tokens to Buterin mainly to gain exposure and leverage his influence in the crypto space.

But Buterin’s known philanthropy also plays a role. Communities send tokens expecting him to donate them, indirectly supporting charity. Back in October, Buterin said he would donate any tokens sent to him to charitable causes, though he added that he didn’t support the act.

“Anything that gets sent to me gets donated to charity too (thanks moodeng!), he said. “The 10B from today is going to anti-airborne-disease tech), though I truly prefer if you guys send to charity directly, maybe even make a DAO and get your community directly engaged in the decisions and process.”

- BTC and ETH basis on the CME are little changed around 10% and 13%, respectively, with open interest ticking up, but staying well short of record highs.

- The broader market perpetual funding rates remain in a range near an annualized 10%.

- BTC and ETH calls continue to trade pricier than puts, but the largest block trade for the day leaned bearish, involving a long position in the $100,000 put expiring Jan. 31 financed by selling the $90,000 put expiring in June.

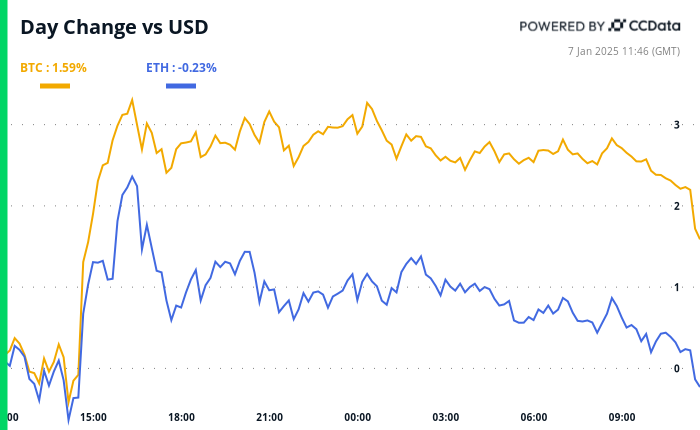

- BTC is down 0.23% from 4 p.m. ET Monday to $101,428.11 (24hrs: +2.72%)

- ETH is down 0.28% at $3,658.61 (24hrs: +0.62%)

- CoinDesk 20 is down 0.34% to 3,726.76 (24hrs: +1.95%)

- CESR Composite Ether Staking Rate is up 15 bps to 3.2%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.23% at 108.01

- Gold is up 0.63% at $2,655/oz

- Silver is up 1.58% to $30.82/oz

- Nikkei 225 closed +1.97% at 40,083.3

- Hang Seng closed -1.22% at 19,447.58

- FTSE is down 0.22% at 8,231.7

- Euro Stoxx 50 is up 0.45% to 5,009.08

- DJIA closed Monday unchanged at 42,706.56

- S&P 500 closed +0.55% at 5,975.38

- Nasdaq closed +1.24% at 19,864.98

- S&P/TSX Composite Index closed -0.29% at 24,999.8

- S&P 40 Latin America closed +2.13% at 2,199.88

- U.S. 10-year Treasury was up 2 bps at 4.618

- E-mini S&P 500 futures are up 0.1% to 6,026.5

- E-mini Nasdaq-100 futures are unchanged at 21,761.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,011

- BTC Dominance: 57.55%

- Ethereum to bitcoin ratio: 0.036

- Hashrate (seven-day moving average): 792 EH/s

- Hashprice (spot): $59.4

- Total Fees: 6.6 BTC/ $665,000

- CME Futures Open Interest:495,641 BTC

- BTC priced in gold: 38.5 oz

- BTC vs gold market cap: 10.95%

- The rally in longer-duration bond yields shows no signs of stopping.

- The 30-year Treasury yield has topped the horizontal resistance from the April 2024 high.

- Should it hold at that level, the focus will shift to the 2023 high above 5%.

- MicroStrategy (MSTR): closed on Monday at $379.09 (+11.61%), unchanged in pre-market.

- Coinbase Global (COIN): closed at $287.76 (+6.32%), down 0.91% at $285.09 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.83 (+1.32%)

- MARA Holdings (MARA): closed at $20.55 (+4.63%), down 1.75% at $20.19 in pre-market.

- Riot Platforms (RIOT): closed at $12.89 (+4.46%), down 1.47% at $12.70 in pre-market.

- Core Scientific (CORZ): closed at $15.12 (-1.69%), down 0.13% at $15.10 in pre-market.

- CleanSpark (CLSK): closed at $11.43 (+5.83%), down 1.14% at $11.3 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.15 (+1.63%), down 0.96% at $25.90 in pre-market.

- Semler Scientific (SMLR): closed at $58.94 (-0.17%), down 1.49% at $58.06 in pre-market.

Spot BTC ETFs:

- Daily net flow: $978.6 million

- Cumulative net flows: $36.89 billion

- Total BTC holdings ~ 1.134 million.

Spot ETH ETFs

- Daily net flow: $128.7 million

- Cumulative net flows: $2.77 billion

- Total ETH holdings ~ 3.618 million.

Source: Farside Investors

- The chart shows ether’s $4,000 call is now the most popular option on Deribit, with an open interest of $336 million.

- Also, note the activity in higher strike calls at $10,000 and $15,000.

- Bitcoin Traders Eye $109K as Trump Anticipation Builds, BTC ETFs Rake in Nearly $1B (CoinDesk): Bitcoin rebounded from December lows after surpassing $102,000, with U.S.-listed spot BTC ETFs attracting nearly $1 billion in inflows on Monday.

- FTX EU Sold to Backpack Exchange, Plans Regulated Crypto Derivatives Push Across Europe (CoinDesk): Backpack Exchange announced the $32.7 million acquisition of FTX E.U., aiming to become the first regulated exchange in the E.U. to offer perpetual crypto futures.

- Dollar Edges Toward One-Week Low as Market Ponders Trump Tariffs (Reuters): The U.S. dollar index (DXY) eased toward a one-week low amid speculation President-elect Donald Trump’s tariffs may be less aggressive than promised, despite his denials.

- Canada Tilts Right as Inflation Claims Trudeau as Latest Victim (Bloomberg): Justin Trudeau resigned as Canada’s prime minister as inflation, poor economic growth, housing unaffordability and controversial immigration policies eroded public confidence, boosting Conservative prospects of winning the next federal election.

- Bitcoin Miners Stockpile Coins to Ride Out Profit Squeeze (Financial Times): Some U.S. bitcoin miners, including MARA and Riot, are retaining all mined bitcoin for their treasury and using raised funds and profits to buy more while diversifying into AI-driven operations to offset rising costs and competition.

- This Crypto Fund Blew Past Bitcoin’s 121% Price Gain in 2024 (CoinDesk): Pythagoras’ Alpha Long Biased Strategy outperformed bitcoin’s 121% gain in 2024 by combining a core bitcoin position for long-term growth with machine-learning-driven momentum and long-short strategies, achieving a 204% return.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)