BTC

$97,821.21

1.17%

ETH

$2,657.31

0.05%

USDT

$1.0003

0.00%

XRP

$2.4490

0.52%

SOL

$204.92

1.48%

BNB

$607.72

3.77%

USDC

$1.0000

0.01%

DOGE

$0.2525

1.16%

ADA

$0.7036

0.41%

TRX

$0.2390

1.31%

WBTC

$97,507.07

0.92%

LINK

$18.86

1.06%

AVAX

$25.51

1.98%

SUI

$3.2397

5.15%

XLM

$0.3190

2.47%

TON

$3.8048

0.08%

SHIB

$0.0₄1597

1.11%

HBAR

$0.2401

1.17%

LTC

$118.75

10.80%

LEO

$9.5945

0.67%

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

Updated Feb 10, 2025, 12:03 p.m. UTCPublished Feb 10, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By Omkar Godbole (All times ET unless indicated otherwise)

Despite the increasing rhetoric surrounding President Donald Trump’s tariffs, bitcoin (BTC) is holding steady alongside positive cues from foreign exchange risk barometers like AUD/JPY. Later today, Trump is due to impose 25% tariffs on steel and aluminum imports on top of additional metal duties.

STORY CONTINUES BELOW

This market stance ahead of an impending tariff escalation contrasts starkly with the risk aversion observed a week ago, when Trump fired the first tariff shot. Perhaps market participants think he’s using aggressive tactics to negotiate trade deals rather than committing to sustained tariffs. This notion has gained traction following lat Monday’s decision to suspend tariffs on Mexico and Canada for 30 days, hinting at a more strategic approach to trade negotiations.

According to QCP Capital, the current market stability could embolden Trump to take a tougher stance. “A feedback loop is emerging — President Trump, highly sensitive to market reactions, is facing a market increasingly calling his bluff. This could embolden him further, adding another layer of volatility,” QCP said in a Telegram broadcast.

It will be interesting to see how this develops.

There’s a social media post doing the rounds that shows record open short positions in the CME-listed cash-settled ether futures. Those shorts are not necessarily outright bearish bets and are likely components of carry trades, where investors hold long positions in ETFs while shorting CME futures. Note that the ETH ETF inflows surged last week. It’s possible some of the shorts are investors hedging against long altcoin bets amid concerns over the number of coins and impending large unlocks.

Over the weekend, Base member Kabir.Base.eth refuted claims that the sequencer Coinbase had been selling ETH earned as fees, adding a layer of transparency to its operations.

In another notable development, Archange Touadéra, president of the Central African Republic, reportedly issued a new memecoin that saw a trader turn $5,000 into an astonishing $12 million in less than three hours, achieving a remarkable return of 2,450x, according to LookOnChain data.

Meanwhile, litecoin (LTC) continues to shine as the top-performing cryptocurrency of the past 24 hours, up 9%.

On the macroeconomic front, the surge in the U.S. consumer inflation expectations raises concerns about the likelihood of a prolonged pause in Federal Reserve’s rate cuts. Plus, the U.S. Consumer Price Index (CPI) is due for release on Wednesday. Stay alert!

- Crypto:

- Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

- Feb. 14: Dynamic TAO (DTAO) network upgrade goes live on the Bittensor (TAO) mainnet.

- Feb. 14, 2:30 a.m. (Estimate): Qtum (QTUM) hard fork network upgrade.

- Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

- Feb. 21: TON (The Open Network) will become the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

- Macro

- Feb. 11, 2:30 p.m.: U.S. House Financial Services Subcommittee (“Digital Assets, Financial Technology, and Artificial Intelligence”) hearing titled “A Golden Age of Digital Assets: Charting a Path Forward.” Witness include Jonathan Jachym, who is Kraken’s deputy general counsel. Livestream link.

- Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Prev. 3.2%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

- Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

- Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. House Financial Services Committee. Livestream link.

- Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

- Core PPI MoM Est. 0.3% vs. Prev. 0%

- Core PPI YoY Prev. 3.5%

- PPI MoM Est. 0.2% vs. Prev. 0.2%

- PPI YoY Prev. 3.3%

- Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

- Initial Jobless Claims Est. 215K vs. Prev. 219K

- Earnings

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.15

- Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, $0.05

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase Global (COIN), post-market, $1.89

- Governance votes & calls

- Aave DAO is discussing recognizing HyperLend as a friendly fork of Aave deployed on the Hyperliquid EVM chain, as well as the deployment of Aave v3 on Ink, Kraken’s layer-2 rollup network.

- Sky DAO is discussing, among other things, onboarding Arbitrum One to the Spark Liquidity layer, increasing the PSM2 rate limits on Base, and minting 100 million USDS worth of sUSDS into Base to accommodate for growth on the network.

- Feb. 10, 10:30 a.m.: OKX to hold a listings AMA with Chief Marketing Officer Haider Rafique and Head of Product Marketing Matthew Osofisan.

- Feb. 12, 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

- Unlocks

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $71.14 million.

- Feb. 10: Berachain (BERA) to unlock 12.08% of circulating supply worth $66.07 million.

- Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $23.80 million.

- Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.2 million.

- Token Launches

- Feb. 10: Analog (ANLOG) to be listed on Bitget, Gate.io, MEXC and KuCoin.

- Feb. 12: Avalon (AVL) and Game 7 (G7) to be listed on Bybit.

- Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

- Feb. 25: HederaCon 2025 (Denver)

By Shaurya Malwa

- Various memecoins raffled around the world from Asia to America, bringing back signs of a frenzy that tends to grip the crypto market every few months.

- BNB Chain’s TST token, originally created in a tutorial, skyrocketed to a $300 million market cap following mentions by Binance founder Changpeng Zhao. The token gained popularity in Chinese communities, posts show.

- David Portnoy of U.S.-based Barstool Sports promoted JAILSTOOL as market watchers accused him of using his social influence to pump the lowcap token, which peaked at over $200 million before settling at a $78 million market cap.

- The Central African Republic issued its own memecoin, CAR, aiming to support national development and increase the country’s global visibility.

- Basis in BTC and ETH CME futures dipped below 10%, which may translate into slower inflows into the ETFs.

- Perpetual funding rates on offshore exchanges for most major coins remain marginally bullish between an annualized 5% to 10%. XLM stands out as having the most negative funding rate — in excess of -20% — reflecting a bias for shorts.

- Front-end ETH puts trade a vol premium of two to five points relative to calls, exhibiting downside fears. BTC front-end options also show a put bias, according to data source Amberdata.

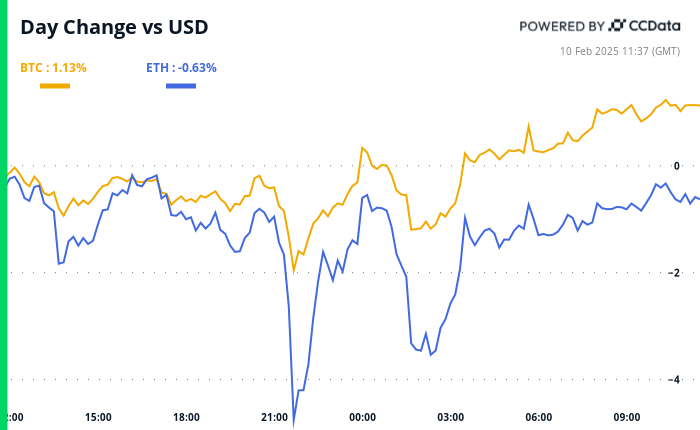

- BTC is up 1.80% from 4 p.m. ET Friday to $97,805.98 (24hrs: -1.01%)

- ETH is down 0.79% at $2,647.53 (24hrs: -0.63%)

- CoinDesk 20 is up 2.92% to 3,209.42 (24hrs: +0.19%)

- CESR Composite Staking Rate is down 3 bps to 2.97%

- BTC funding rate is at 0.0087% (9.48% annualized) on Binance

- DXY is up 0.12% at 108.16

- Gold is up 1.44% at $2,902.17/oz

- Silver is up 1.29% to $32.22/oz

- Nikkei 225 closed unchanged at 38,801.17

- Hang Seng closed up 1.84% at 21,521.98

- FTSE is up 0.53% at 8,746.63

- Euro Stoxx 50 is up 0.34% at 5,343.63

- DJIA closed -0.99% to 44,303.40

- S&P 500 closed -0.95% at 6,025.99

- Nasdaq closed -1.36% at 19,523.40

- S&P/TSX Composite Index closed -0.36% at 25,442.91

- S&P 40 Latin America closed -1.10% at 2,410.24

- U.S. 10-year Treasury went up 4 bps to 4.48%

- E-mini S&P 500 futures are up 0.46% at 6,077

- E-mini Nasdaq-100 futures are up 0.70% at 21,742

- E-mini Dow Jones Industrial Average Index futures are up 0.35% at 44,576

- BTC Dominance: 61.70% (0.05%)

- Ethereum to bitcoin ratio: 0.02717 (-0.22%)

- Hashrate (seven-day moving average): 808 EH/s

- Hashprice (spot): $54.1

- Total Fees: 5.04 BTC / $337,318

- CME Futures Open Interest: 164,510

- BTC priced in gold: 33.5 oz

- BTC vs gold market cap: 9.52%

- Shares of Strategy (MSTR) have dived out of a mini rising channel, hinting at an end of the bounce from the Dec. 31 low and potential resumption of a broader pullback from late 2024 highs.

- Prices have found acceptance below the 38.2% Fibonacci retracement of the fourfold rally seen from September to November.

- A golden rule of technical analysis is that for a market to maintain its current trend, it must hold above the 38.2% level. If it fails to do so, the bull trend is said to have ended.

- MicroStrategy (MSTR): closed on Friday at $327.56 (+0.56%), up 2.27% at $334.98 in pre-market.

- Coinbase Global (COIN): closed at $274.49 (+1.52%), up 1.83% at $279.52 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.89 (-0.66%)

- MARA Holdings (MARA): closed at $16.77 (-0.18%), up 1.97% at $17.10 in pre-market.

- Riot Platforms (RIOT): closed at $11.64 (+0.26%), up 1.89% at $11.86 in pre-market.

- Core Scientific (CORZ): closed at $12.56 (+0.24%), up 0.88% at $12.67 in pre-market.

- CleanSpark (CLSK): closed at $11.33 (+9.15%), up 1.5% at 11.50 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15 (+1.71%), up 0.52% at $23.27 in pre-market.

- Semler Scientific (SMLR): closed at $49.20 (-1.44%), up 2.20% at $50.28 in pre-market.

- Exodus Movement (EXOD): closed at $48.37 (+0.75%), +0.52% at 48.62 in pre-market.

Spot BTC ETFs:

- Daily net flow: $171.3 million

- Cumulative net flows: $40.70 billion

- Total BTC holdings ~ 1.176 million.

Spot ETH ETFs

- Daily net flow: No flows reported.

- Cumulative net flows: $3.18 billion

- Total ETH holdings ~ 3.793 million.

Source: Farside Investors

- The yield on 10-year U.S. inflation-indexed securities, the so-called real yield, has dropped by 34 basis points in just over three weeks.

- A continued decline could trigger a search for higher returns, galvanizing demand for risk assets, including BTC.

- Bitcoin HODLer Metaplanet Achieves $35M Unrealized Gains in 2024 Thanks to BTC Treasury (CoinDesk): The Japanese company, which already holds 1,761 bitcoin, said it plans to have 10,000 BTC by year end.

- Bitcoin Indicator That Signaled $70K Breakout Turns Bearish as Trump’s Trade War Rhetoric Grows (CoinDesk): A popular technical indicator is showing bitcoin weakness amid rising U.S. trade-tariff rhetoric. A drop below $90K would confirm persistent bearish momentum.

- US Endowments Join Crypto Rush by Building Bitcoin Portfolios (Financial Times): U.S. foundations and university endowments are ramping up cryptocurrency investments, driven by FOMO and Trump’s pro-crypto stance, despite concerns over price volatility and a lack of regulatory clarity.

- Trump Unveils Plans for 25% Tariffs on Steel, Aluminum Imports (Bloomberg): The U.S. is set to announce 25% tariffs on steel and aluminum imports, and reciprocal tariffs on nations taxing U.S. goods will follow this week.

- Inflation Rises Amid Lunar New Year Spending As European Stocks Benefit (Euronews): China’s January inflation climbed 0.5% YoY, fueled by Lunar New Year spending and stimulus. Persistent PPI deflation and U.S.-China trade tensions remain a concern.

- China’s Strategy in Trade War: Threaten U.S. Tech Companies (The Wall Street Journal): China is reportedly planning to target more U.S. tech giants like Apple and Broadcom with antitrust investigations, aiming to bolster its bargaining position in trade negotiations with the U.S.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)