Dakota will offer returns based on lending through decentralized finance protocols to overcome the drawbacks of centralized lenders.

The company was founded by former Airbnb, Anchorage and Coinbase executives.

It is aimed at businesses, which will pay a monthly fee.

Dakota, which describes itself as a crypto bank that is attempting to right the wrongs of centralized lenders such as Celsius and BlockFi, emerged from stealth on Wednesday.

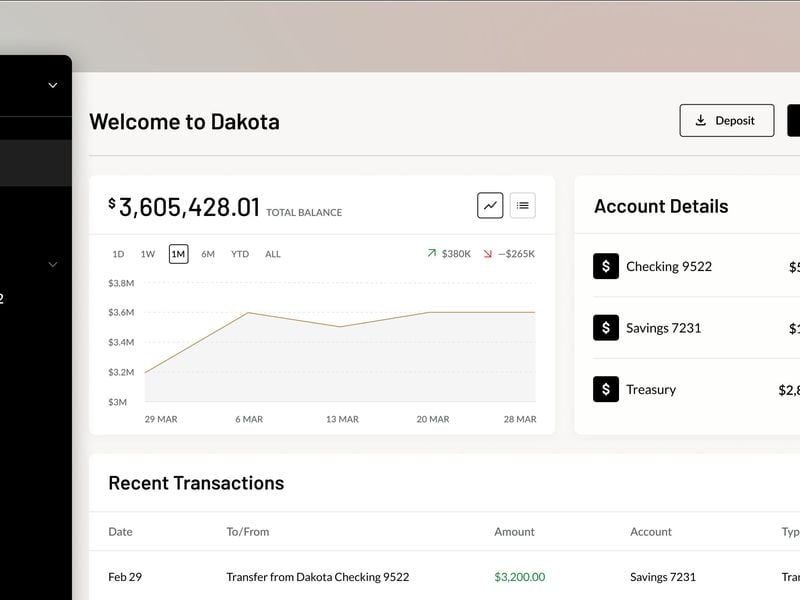

The company, which was founded by a group of former Airbnb, Anchorage and Coinbase Custody executives, offers treasury management, lending and payment services to businesses that pay a monthly fee and gain access to a platform that allows them to lend out their deposited crypto across a selection of decentralized finance (DeFi) protocols.

The model differs from earlier, centralized crypto lenders such as Celsius Network, which filed for bankruptcy in July 2022, and BlockFi, which followed suit four months later, said CEO Ryan Bozarth. In those cases, the companies stood at the center of the process: receiving deposits, lending them out and taking a fee from the interest payment.

At Dakota, the clients make the lending decision and choose which decentralized finance (DeFi) protocol they wish to use. The monthly fee ranges between $150 and $1,500, and clients who choose to lend their deposits can earn returns of up to 9%. Stablecoin holders will receive a yield based on U.S. Treasuries.

“The biggest difference for us is that we only lend out through DeFi protocols and so there is no centralized lending,” Bozarth, who was previously the CEO at Coinbase Custody, said in an interview. “DeFi protocols there is, admittedly, some risk with that, but it’s at least a transparent risk, it’s smart contract risk.”

While Dakota appears to be a novel idea that is solving a problem, the crypto industry is still tending to the scars earned during the collapse of companies including Celsius, BlockFi and FTX.

Celsius filed for bankruptcy in July 2022 despite having $12 billion in assets under management two months prior. The company’s plight was caused by setting an overambitious yield of 17%, which led the firm to use newer and riskier blockchains like Terra. The eventual bankruptcy, like BlockFi’s, left hundreds of thousands of creditors in the dark over whether their deposited funds would ever be returned.

With DeFi, there’s a greater degree of transparency, Bozarth said, pointing to DeFi lending protocol Aave.

“If you look at the last downturn, [Aave] performed perfectly as everyone knew there was nothing to negotiate with, you will be liquidated if you hit this marker and so they worked phenomenally well whereas centralized lenders did not.”

Dakota also caters to the fiat currency market dollar transfers, deposits and withdrawals. These services are designed for treasury-management purposes, with all dollars deposited to the platform being backed by U.S. Treasuries.

One of the largest hurdles for U.S.-based crypto firms is building a product that can comply with varying levels of regulation across jurisdictions. Last year Coinbase (COIN) had to roll out an offshore sector of its company due to restrictions in the U.S.

Dakota’s dollar-based services typically require money transmitter licenses (MTL) in every state. The company will bypass that in the U.S. by using a third party that has an MTL where needed. In Europe, it plans to secure a Virtual Asset Service Provider License (VASP) and each region will have its own regulatory and compliance requirements, some of which will be built in-house by Dakota and third parties will be used for the rest.