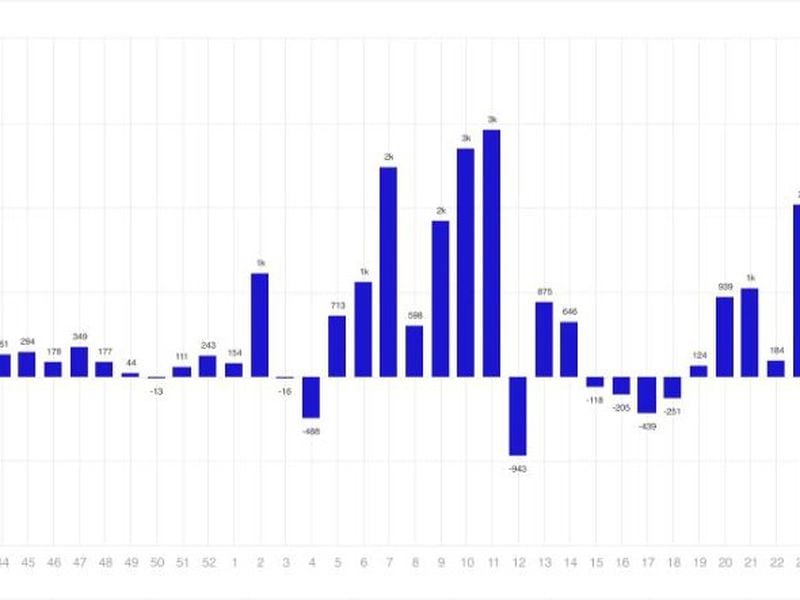

Bitcoin accounted for $398 million of the $441 million of inflows, and CoinShares noted it is unusual for BTC to represent only 90% of the total.

Investment products last registered net inflows in the week ended June 7, when investors added more $2 billion.

Digital asset investment products saw $441 million of net inflows last week, breaking a three-week string of net outflows, according to CoinShares.

The products last registered net inflows in the week ended June 7, when investors added more than $2 billion.

Bitcoin (BTC) accounted for $398 million of inflows. CoinShares noted it is unusual for BTC to represent only 90% of the total. Solana stood out among altcoins, with SOL-linked products registering $16 million.

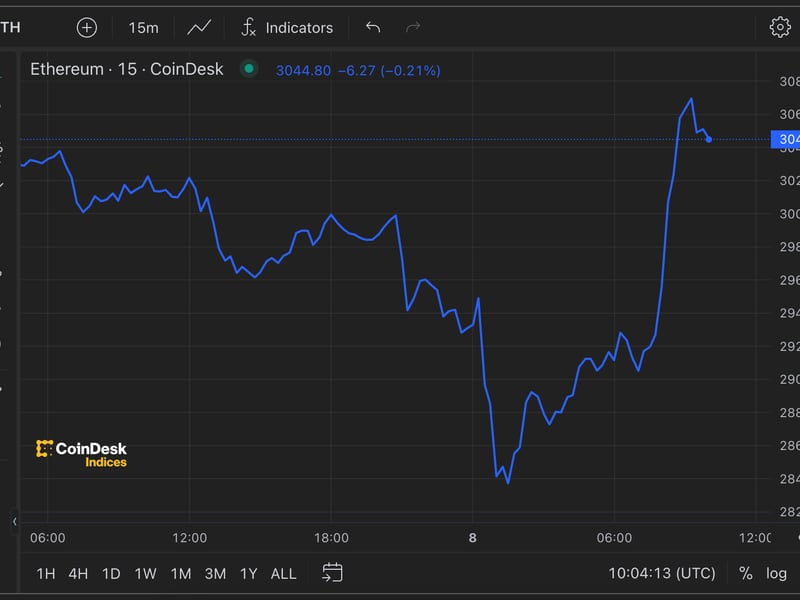

CoinShares attributed the flows to recent price weakness prompted by defunct crypto exchange Mt. Gox preparing to initiate repayments to creditors and the German government’s law-enforcement agency moving large amounts of bitcoin to exchanges.

Investors likely saw this as a buying opportunity, CoinShares said. However, the sentiment was not reflected in blockchain equities, which saw $8 million in outflows to take their year-to-date total to $556 million.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)