This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,075.25 +1.1%

Bitcoin (BTC): $63,851.97 +0.27%

Ether (ETH): $2,63297 +0.62%

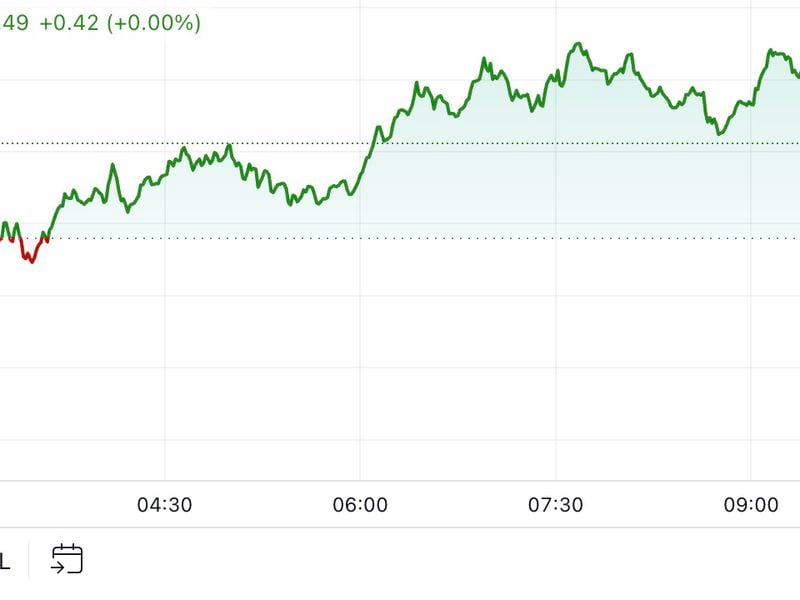

S&P 500: 5,762.48 +0.42%

Gold: $2,648.98 +0.52%

Nikkei 225: 38,651.97 +1.93%

Crypto markets were muted during the first half of the Asia trading day owing to public holidays in China, Hong Kong and South Korea. Bitcoin traded around $63,900, an increase of about 0.5% in the last 24 hours, while ether rose just over 1% to $2,635. The wider digital asset market gained 0.2%, according to the CoinDesk 20 Index. China and Hong Kong are both off for China’s national holiday, which is a week-long affair known as Golden Week in mainland China and one day in Hong Kong. South Korea is closed for Armed Forces day, a holiday introduced this year.

Traders have locked in almost $1 billion in bullish bets of bitcoin reaching $100,000 on derivatives exchange Deribit. The dollar value of the number of active call options contracts at the $100,000 strike price was over $993 million, the highest among all other BTC options listed on the exchange, according to data source Deribit Metrics. The second most popular option was the $70,000 call, boasting an open interest of over $800 million. “The highest open interest across all expirations appears at $100K and $70K for bitcoin, which some market participants interpret as supporting the bullish sentiment that seems to be pervading the market,” crypto trading firm Wintermute said in a note shared with CoinDesk.

The digital assets sector continues to outperform the stock market this year, with bitcoin leading the charge, broker Canaccord said. The broker noted that the world’s largest cryptocurrency finished the last quarter up around 140% year-on-year, outperforming ether which gained about 60% and the S&P 500 stock index, which rose almost 30%, over the same period. If bitcoin follows historical patterns it tends to rally 6-12 months following the halving, and reach new highs 2-6 months later, meaning a potential rally could start between now and April, the broker said. Bitcoin is still performing like other risk assets for now, and is reacting positively to the “lower-rate environment,” analysts led by Michael Graham wrote.

The chart shows the dollar value of the total transfer volume over the Bitcoin blockchain since 2015.

The level of economic activity remains depressed relative to previous bull market peaks.

Source: Lance Roberts

– Omkar Godbole

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)