This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,119.85 +1.91%

Bitcoin (BTC): $68,334.71 -0.07%

Ether (ETH): $2,708.13 +2.27%

S&P 500: 5,864.67 +0.4%

Gold: $2,735.45 +0.51%

Nikkei 225: 38,954.60 -0.07%

Bitcoin rose above $69,000 at the start of the Asian morning before retreating slightly to trade around $68,350. BTC’s jump led to higher prices throughout the rest of the crypto market, with SOL rising nearly 5% to $166.50. The broader digital asset market, as measured by the CoinDesk 20, is 1.9% higher in the last 24 hours. Traders’ attention is increasingly turning to the U.S. election, now barely two weeks away, with the pro-crypto candidate Donald Trump heavily favored on predictions site Polymarket. Risk assets such as bitcoin are – expected to be aided by macroeconomic factors in Japan and China, according to Singapore-based QCP Capital.

ApeCoin (APE), the Bored Ape Yacht Club-affiliated ERC-20 cryptocurrency used for governance and transactions in the ApeCoin ecosystem, has doubled in value over the weekend, topping $1.5 for the first time since April, according to CoinDesk data. The rally comes as the ApeCoin team debuted the highly anticipated blockchain network ApeChain Sunday. The ApeChain bridges also went live on Sunday, allowing users to transfer their tokens to ApeChain and automatically earn a staking yield on APE, ETH and stablecoins. The decision to bring native staking yield to APE likely galvanized investor interest in the token, according to Markus Thielen, head of 10x Research.

London-based pensions giant Legal & General is plotting a route into tokenization, which has become popular among traditional finance firms. The tokenization narrative accelerated after the arrival of BlackRock, the largest asset manager in the world, on the scene with its BUIDL fund on the Ethereum blockchain. Others are available from Franklin Templeton, State Street and Abrdn. “We are evaluating ways to make the Legal & General Investment Management Liquidity funds available in tokenized format,” said Ed Wicks, global head of trading at Legal & General Investment Management. “Digitization of the funds industry is key to improving efficiency, reducing cost and making a broad range of investment solutions available to a wider range of investors. We look forward to continued progress in this space.”

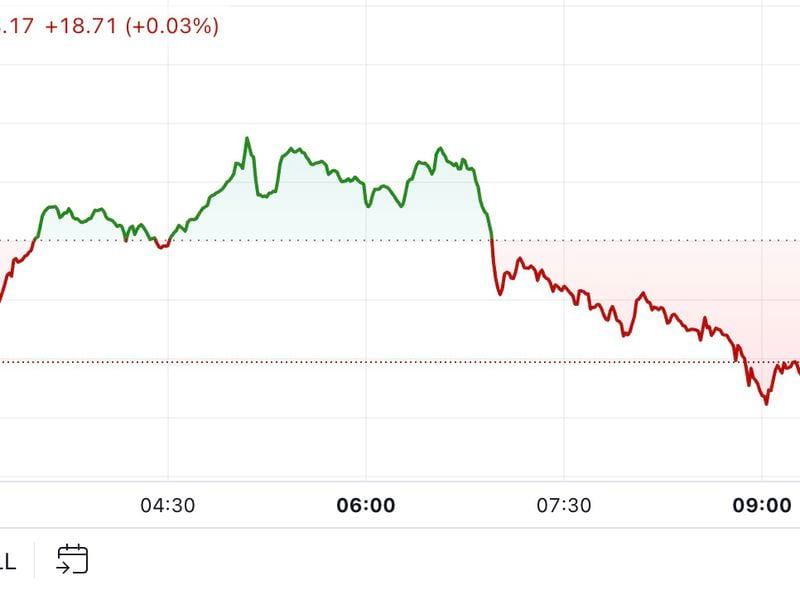

Gold has set a new lifetime high of $2,736 per ounce, extending the four-day winning streak.

“This move into gold (away from treasuries and bonds) may foreshadow a shift toward BTC, with investors looking for risk-on assets in a lower-yield environment,” Mena Theodorou, co-founder at crypto exchange Coinstash, said in an email.

Source: TradingView

– Omkar Godbole

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)