This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,930 −0.2%

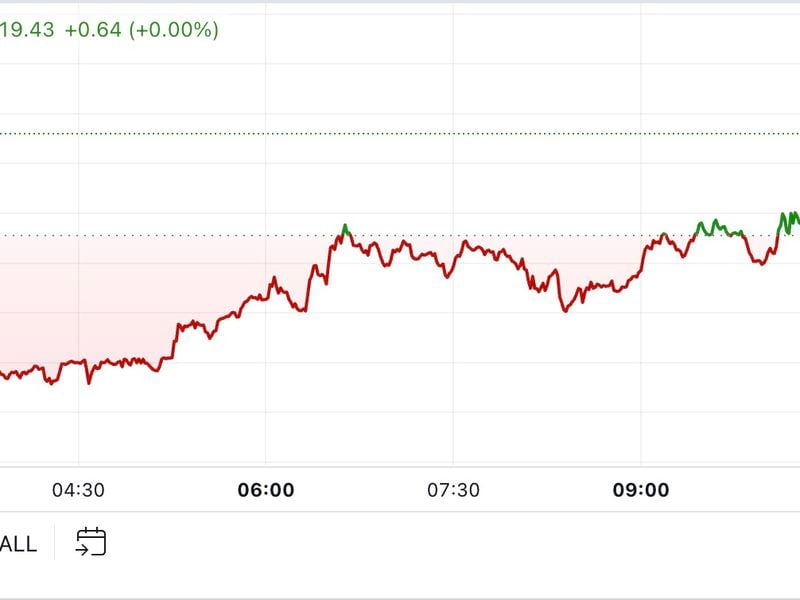

Bitcoin (BTC): $60,150 +0.2%

Ether (ETC): $2,558 +1.2%

S&P 500: 5,592.18 −0.6%

Gold: $2,555 +2.2%

Nikkei 225: 38,362.53 −0.02%

Bitcoin rose above $60,000 during the late European morning following a sharp decline earlier this week. The largest cryptocurrency was trading around $60,350, nearly 6% below its $64,000 starting level Monday. The downward trend may now have halted ahead of another short-term rally. The broader digital asset market has fallen around 0.45% in the past 24 hours, according to CoinDesk Indices data. Ether rose about 1.35% to around $2,550 after spot ether ETFs registered inflows of $5.9 million on Wednesday, ending a nine-day losing streak.

The TON blockchain suffered a second outage in 24 hours late Wednesday on account of activity linked to the DOGS token. The outage lasted just over four hours and follows a six-hour incident on Tuesday, also attributed to DOGS minting. TON’s native token fell below $5.20 when the network crashed, losses it subsequently reversed after service was resumed. The TON token was priced at around $5.60 during the European morning, an increase of over 1.75% in the last 24 hours. The token is still trading below its level prior to the arrest of Telegram CEO Pavel Durov.While Telegram and TON are legally separate entities, the two are closely affiliated as one relies on the other.

Durov’s release on bail on Wednesday cost Polymarket bettors $270,000 in lost winnings. Durov was formally indicted in France and released after he posted a 5 million-euro ($5.6 million) bond while agreeing to report to police twice weekly and to stay in the country. The quick release contrasted with bettors’ overall sentiment that an extended detention was more probable. At one point, the chance of an August release was pegged in the mid-30%s while a release before October was priced 75%-90%. In total, bettors missed out on $270,000 by betting “No” on an August release, and “No” for before October. Likely, bettors had their money on French authorities keeping Durov for as long as possible.

The chart shows the correlation between peaking earnings-per-share (EPS) growth rates and 10% corrections which amplify market volatility.

Nasdaq-listed Nvidia’s shares fell over 7% after hours on Wednesday even after the chipmaker’s earnings beat estimates.

Bitcoin has exhibited a strong positive correlation to NVDA since 2022, so the chipmaker’s stock is one crypto traders watch closely.

Source: MacroMicro

– Jamie Crawley

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)