-

Bitcoin futures open interest on the CME exchange has hit 218,000 BTC ($21.3 billion).

-

The cryptocurrency’s market cap is closing in on a historic $2 trillion.

-

CME growth is largely coming from active and direct participants, K33 research says.

Bitcoin (BTC), the largest token by market capitalization, is approaching a $2 trillion market cap for the first time after its price added $30,000 since Donald Trump won the U.S. presidential election at the beginning of the month.

Currently at $1.93 trillion, a price of about $101,000 per bitcoin would achieve this landmark. The BTC price crossed $97,000 for the first earlier Thursday, and its market dominance reached a high of just below 61.8%.

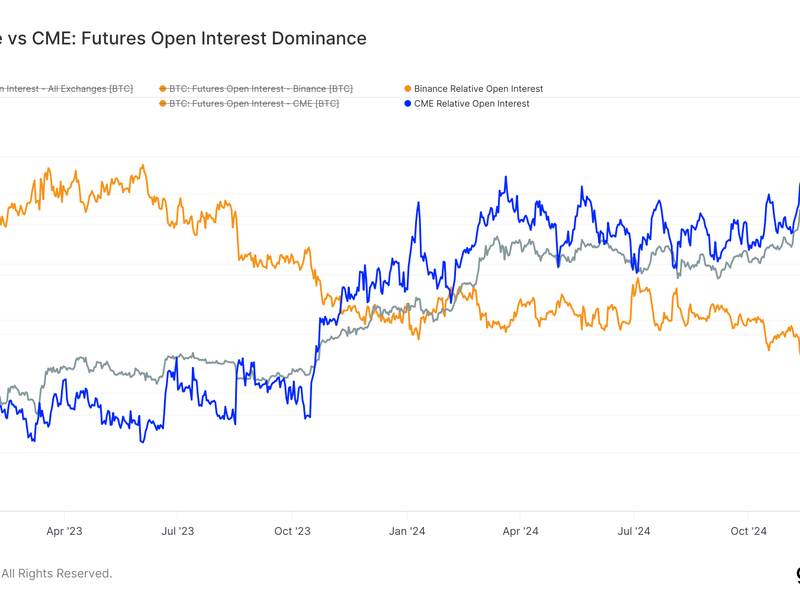

According to Coinglass data, bitcoin futures open interest (OI) on the Chicago Mercantile Exchange (CME) hit a record 218,000 BTC ($21.3 billion), more than a third higher than before the Nov. 5 election. Rising open interest when prices are also ratcheting higher is a sign of bullish sentiment in the market.

“The relentless surge in CME open interest shows no sign of stopping; back-to-back all-time highs,” Velte Lunde, head of research at K33, wrote in a post on X. “To contextualize, the growth in CME OI over the past 15 days is larger than the average notional open interest on CME in any year before 2022.”

Lunde noted that active and direct market participants are behind the rally. This cohort engages directly with the futures market, whereas other growth could have come from futures-based exchange-traded funds (ETFs) such as the ProShare Bitcoin ETF (BITO), as CoinDesk reported last month.

The introduction of options tied to U.S. spot ETFs should also help CME futures grow.

“CME open interest crosses 200k BTC, with active market participants continuing to be the force moving exposure higher. Expect CME futures to continue to thrive with the launch of ETF options”, Lunde wrote.

The larger bitcoin’s role and the more intertwined it becomes with the traditional financial (TradFi) system, the more likely volatility will decline over time. We have seen this over the past few years, as realized volatility has decreased from over 100% to approximately 40%, according to Glassnode data.

Cash-margin contracts are also at an all-time high. These contracts use stablecoins or U.S. dollars as the underlying collateral and are inherently not volatile. That’s in contrast with crypto collateral, which is volatile by nature.

CME uses only cash margin for futures open interest, while retail-focused exchanges such as Binance are prepared to accept crypto margin. Glassnode data shows that the CME dominates the futures open interest market by 33%, a margin that is still growing.

Glassnode data also shows that the percentage of futures contracts that are margined in crypto and not in cash is at an all-time low of just 16%. The lower the number, the less volatility we should see in the bitcoin price.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NAT3YQIMRBGKJC5ASNWSC55S34.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)