Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

As an ETF, BlackRock’s Bitcoin Trust incurs an expense ratio of 0.25%, while MicroStrategy charges no such fee to shareholders.

MicroStrategy benefits from revenue generated by its analytics business, providing financial stability beyond its bitcoin holdings.

MSTR has the ability to raise capital via debt and equity offerings, while IBIT is reliant on direct investor inflows.

Disclosure: The writer owns shares in MicroStrategy.

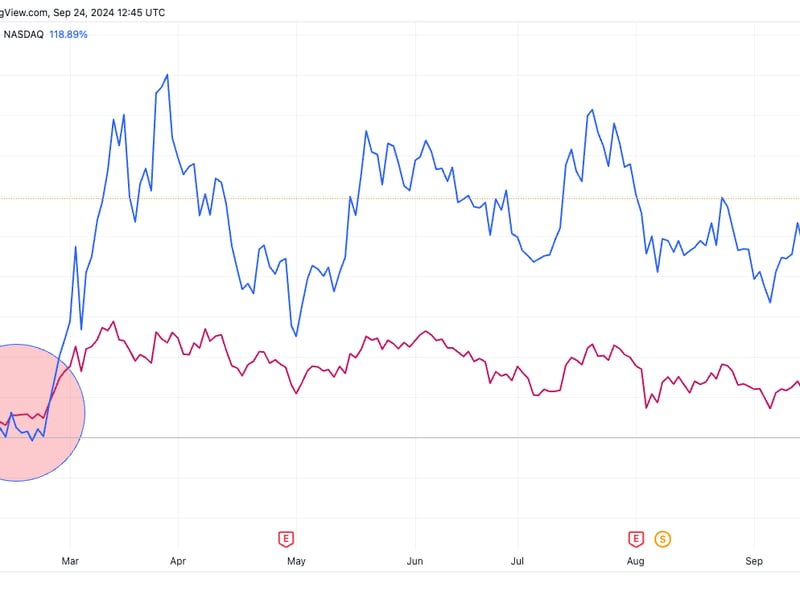

The launch of U.S. bitcoin exchange-traded funds on Jan. 11, 2024, has become one of the year’s most significant financial events. These ETFs, including the BlackRock iShares Bitcoin Trust (IBIT), have collectively attracted $17.7 billion in net inflows since their debut, according to Farside data. IBIT, to some, has emerged as a competitor to MicroStrategy (MSTR), a company renowned for its substantial bitcoin holdings and dual business model. Led by Executive Chairman Michael Saylor, MicroStrategy currently holds 252,220 bitcoins, valued at approximately $16 billion. Year-to-date, MicroStrategy’s stock has risen 119% compared to IBIT’s 35%, reflecting a more than threefold outperformance.

From the opening of the ETFs until around Feb. 23, IBIT outperformed MicroStrategy as investors either shifted capital to the new funds or took profits on what had been a large run higher in MSTR’s stock in the weeks prior to Jan. 11.

This trend of profit-taking spread to bitcoin as well, as long-term holders (those holding bitcoin for 155 days or more) sold approximately one million bitcoin from December 2023 through the first quarter of 2024, according to Glassnode data.

There are several key reasons for MicroStrategy’s impressive returns and its ability to outperform IBIT. One of the first factors is fees. ETFs come with an expense ratio—currently 0.25% for IBIT—which acts as a drag on returns. In contrast, MicroStrategy does not charge such a fee to shareholders, making it more attractive over time in terms of cost efficiency.

Furthermore, MicroStrategy operates as a business that generates revenue beyond its bitcoin thesis, primarily through its analytics operations. This diversification allows the company to produce free cash flow and could provide some cushioning during bitcoin’s drawdowns even as the stock outperforms during the token’s rallies. Since bitcoin’s all-time high in March, bitcoin has decreased by 13% and IBIT is down 14%, while MicroStrategy has declined by 15%.

Additionally, MicroStrategy has the flexibility to increase its bitcoin per share through debt or equity offerings. For example, it recently upsized a convertible note offering from $700 million to $1.01 billion, using the proceeds to acquire more bitcoin—something IBIT cannot do directly, unless it sees more inflows from investors.

Mark Palmer, Senior Research Analyst at Benchmark, said MicroStrategy’s recent financial strategies, such as issuing convertible bonds and retiring high-interest debt, have improved its financial flexibility and made the stock more efficient access to capital markets compared to other bitcoin-buying stocks.

“A strong case could be made that MSTR following the convert issuance and senior notes retirement had more flexibility to access the capital markets than it had prior to it given its lighter interest burden and increased holdings of unencumbered bitcoins,” said Palmer, who has a buy rating on the stock and price target of $215.

In terms of marketing and visibility, MicroStrategy has also maintained a higher ranking in Google search trend than IBIT, signaling better recognition and interest. This gap has, however narrowed of late, as options trading on IBIT have now been approved by the U.S. Securities and Exchange Commission’s (SEC).

UPDATE (Sept. 24, 16:47 UTC): Adds comments from Benchmark analyst on MicroStrategy’s capital market access.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)