-

MicroStrategy’s $42 billion bitcoin acquisition strategy has some risks, the report said.

-

CoinShares said financing conditions need to remain favorable and there needs to be investor demand for the company’s convertible debt.

-

MicroStrategy is tied to its bitcoin holdings, the asset manager said.

MicroStrategy’s (MSTR) ambitious plan to buy $42 billion more worth of bitcoin (BTC) is not without risks, CoinShares said in a research blog Monday.

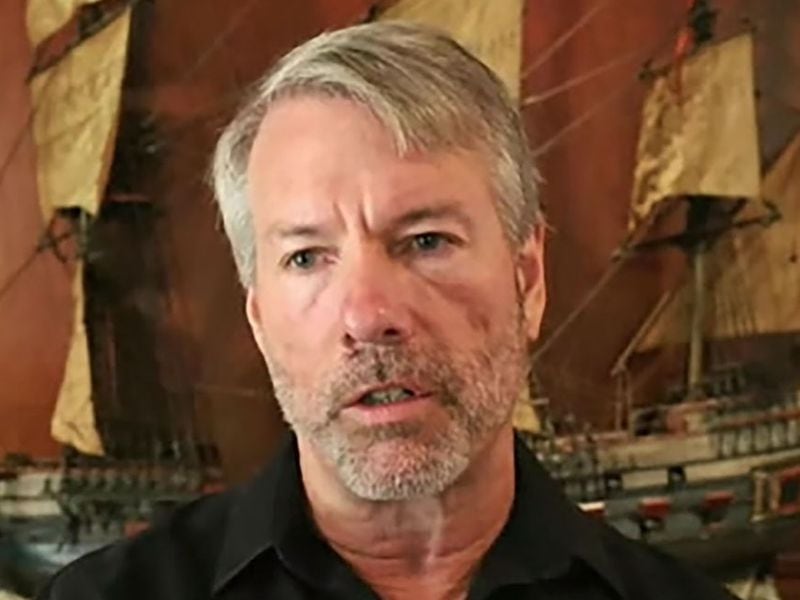

The company, founded by Michael Saylor, announced a $21 billion at-the-money offering of its own stock last week to raise capital to buy more bitcoin. This is part of a larger plan to buy another $42 billion of the world’s largest crypto over the next three years.

MicroStrategy’s ability to successfully execute on its bitcoin acquisition plan is dependent upon a number of factors, according to CoinShares.

The software company needs “financing conditions to remain favourable, and necessitates demand for their convertible notes,” analysts Alexandre Schmidt and Satish Patel wrote.

The cost of servicing its debt is also rising. CoinShares noted that in 2021, MicroStrategy was able to raise debt at zero-coupon convertibles, but these coupon rates have since been rising with new issues.

The report said MicroStrategy is also “tied to its bitcoin holdings,” adding that there is a risk that if the company chooses to sell some of its bitcoin pile, its valuation premium could disappear. However, Michael Saylor said previously that he is not interested in selling his company’s bitcoin holding, saying, “Bitcoin is the exit strategy.”

Furthermore, any disposals could also trigger tax events, which could be sizable, the report said, adding that in the future, the firm could be taxed on unrealized gains related to its crypto stack.

The company’s “bitcoin business may have outgrown its software business,” CoinShares said, adding that cash flows from the legacy operations may not be enough to cover future coupon payments.

The firm’s stock has been praised by the investors even after announcing the large financing that will dilute the shareholders. Last week, Wall Street broker Canaccord said that MicroStrategy is one of the best ways for equity investors to gain bitcoin exposure.

The MSTR shares were about 8% higher in early trading on Tuesday as bitcoin price heads towards $70,000.