The difficulty of mining bitcoin has reached an all-time high of 92.6 terahashes, increasing by over 10% since early July, which could strain miners’ profitability due to higher operational costs.

Increased mining difficulty might pressure miners financially, potentially leading to more bitcoin being sold to cover costs. However, some say there’s no direct correlation between mining difficulty and bitcoin price.

The next bitcoin difficulty adjustment is estimated to occur on Sept. 27, decreasing the bitcoin mining difficulty to 77.12 T, as per Coinwarz.

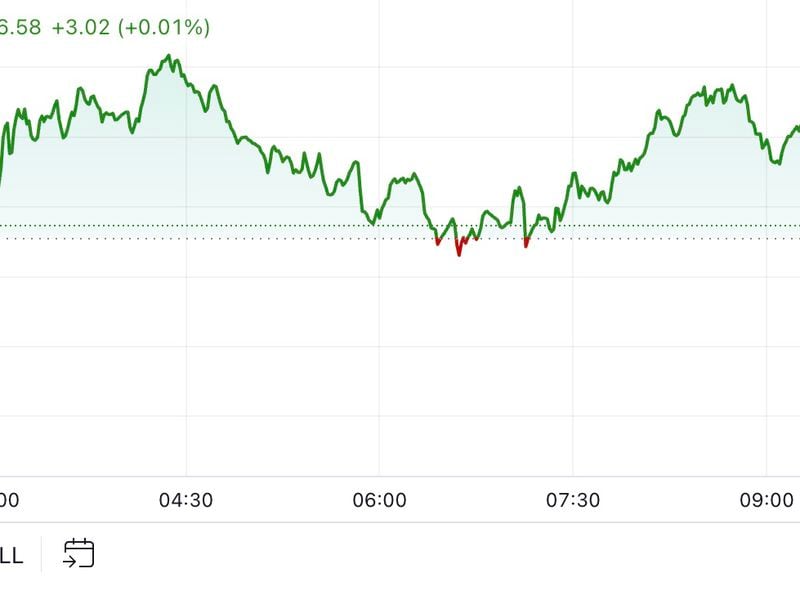

The computational power required to bring new bitcoin (BTC) into existence has surged to a fresh lifetime high in a move that could spell trouble for miners and impact prices.

Mining difficulty hit 92.6 terahashes late on Wednesday, Coinwarz data shows, rising by four units in a month and more than 10% since early July.

Difficulty (denoted by terahashes) measures the computation power used to process blocks on a proof-of-work blockchain, such as bitcoin, broadly referring to how and time-consuming it is to find the right hash for each block. Entities, often referred to as miners, use extensive computing systems to mine blocks and are rewarded with bitcoin – which is sold on the open market to cover costs and turn a profit.

The network automatically adjusts the difficulty of mining new blocks to the blockchain every 2,016 blocks, or roughly every two weeks. This is based on the number of miners and their combined hashpower – which measures how much computing power a network uses.

The next bitcoin difficulty adjustment is estimated to occur on Sept. 27, decreasing the bitcoin mining difficulty from 92.67 T to 77.12 T, as per Coinwarz.

A bump in mining difficulty can dampen profits for bitcoin mining companies as costs required to keep operations going significantly increase – straining an already difficult environment for such firms.

“Revenue has been under pressure for many mining firms post-halving,” Augustine Fan, head of insights at SOFA, told CoinDesk in a Telegram message Thursday. “We believe, however, that the recent selling pressure is primarily from trading stopouts and ETF outflows.”

Some traders, meanwhile, say bitcoin price action could be impacted based on general market conditions and how miners deal with the difficulty increase.

“There is no clear cause-and-effect relation between mining difficulty and BTC price. Higher mining difficulty will indeed cause stress on the miners’ but how they react to such stress is up to individual miners,” Peter Chung, head of research at Presto, told CoinDesk in a Telegram message.

“Over the long-run, miners deal with rising difficulty levels by upgrading the equipment and/or pursuing other cost rationalization measures (e.g. seeking cheaper electricity cost, etc). Historically, when you average it out, BTC price showed no meaningful correlation with this particular variable,” Chung said.

Presto research analyst Min Jung, however, said that selling pressure could be on the cards based on overall market sentiment.

“If equities weaken and the overall financial markets show signs of weakness, it could lead to selling pressure, driven by the belief that it is better to take a loss now than later,” Jung said in a message.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)