Tokens on the Ethereum ecosystem, including meme coins like MOG and PEPE, surged after Bloomberg analysts raised their odds of spot ether ETF approval.

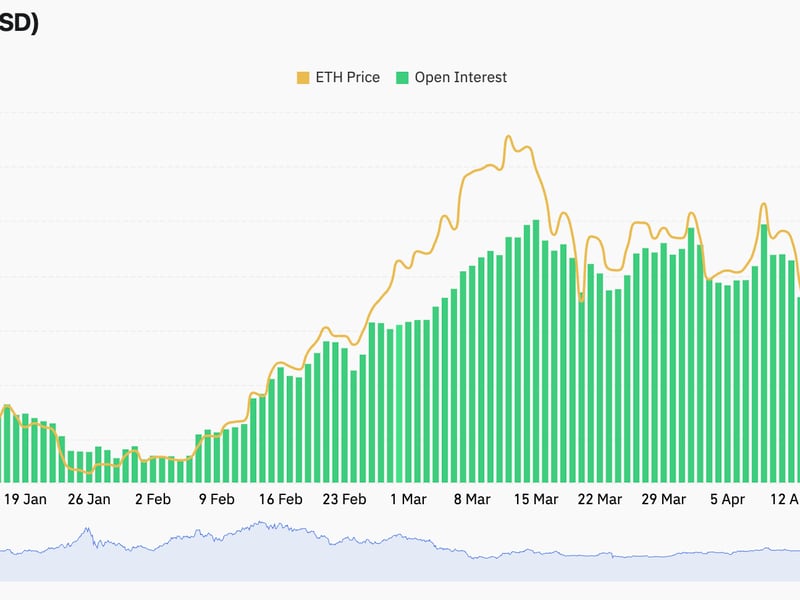

The new odds, 75% vs 20%, contributed to a market-wide jump, with ether rising over 17% in a day and Bitcoin retaking the $71,000 mark.

A bunch of Ethereum ecosystem tokens rocketed in the past 24 hours after two Bloomberg analysts raised their odds on the approval of spot ether (ETH) exchange-traded funds (ETFs) in the U.S.

Among utility projects, staking application Lido’s LDO rose 15%, while the ARB token of Ethereum layer-2 blockchain Arbitrum jumped 18%. DOGE and SHIB added 6%.

Meme tokens have been increasingly seen as a leveraged way to bet on the growth of their underlying blockchain. The gains came after Bloomberg analysts Eric Balchunas and James Seyffart updated the odds of approval to 75% from 20% on Monday, causing a market-wide jump. Ether rose over 17%, while bitcoin retook the $71,000 mark for the first time since early April.

“Established memes are generally high beta for the native token of the chain they’re on, and Mog has established itself as a winner on Ethereum while still trading at a fraction of the next biggest meme (Pepe),” Viro, a Mog core team member, said in an interview over Telegram.

“I think the market sees that there’s quite a lot of room to catch up to Pepe, and that’s why you see the outperformance. If you think memes are good beta; you’ll go for the higher caps like pepe or you’ll slide further down the curve for mog.”

The focus on meme coins as a way of betting on growth isn’t unique to Ethereum. Several Solana-based meme coin tokens surged from December to March as the network’s SOL tokens took off – contributing to ecosystem growth and attention. Also in December, the Avalanche Foundation, a non-profit that maintains the Avalanche blockchain, said it would invest in meme tokens built on the network in recognition of the online culture and memetic value that such tokens can drive among investors.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)