By , |Edited by

Jul 8, 2025, 7:45 p.m.

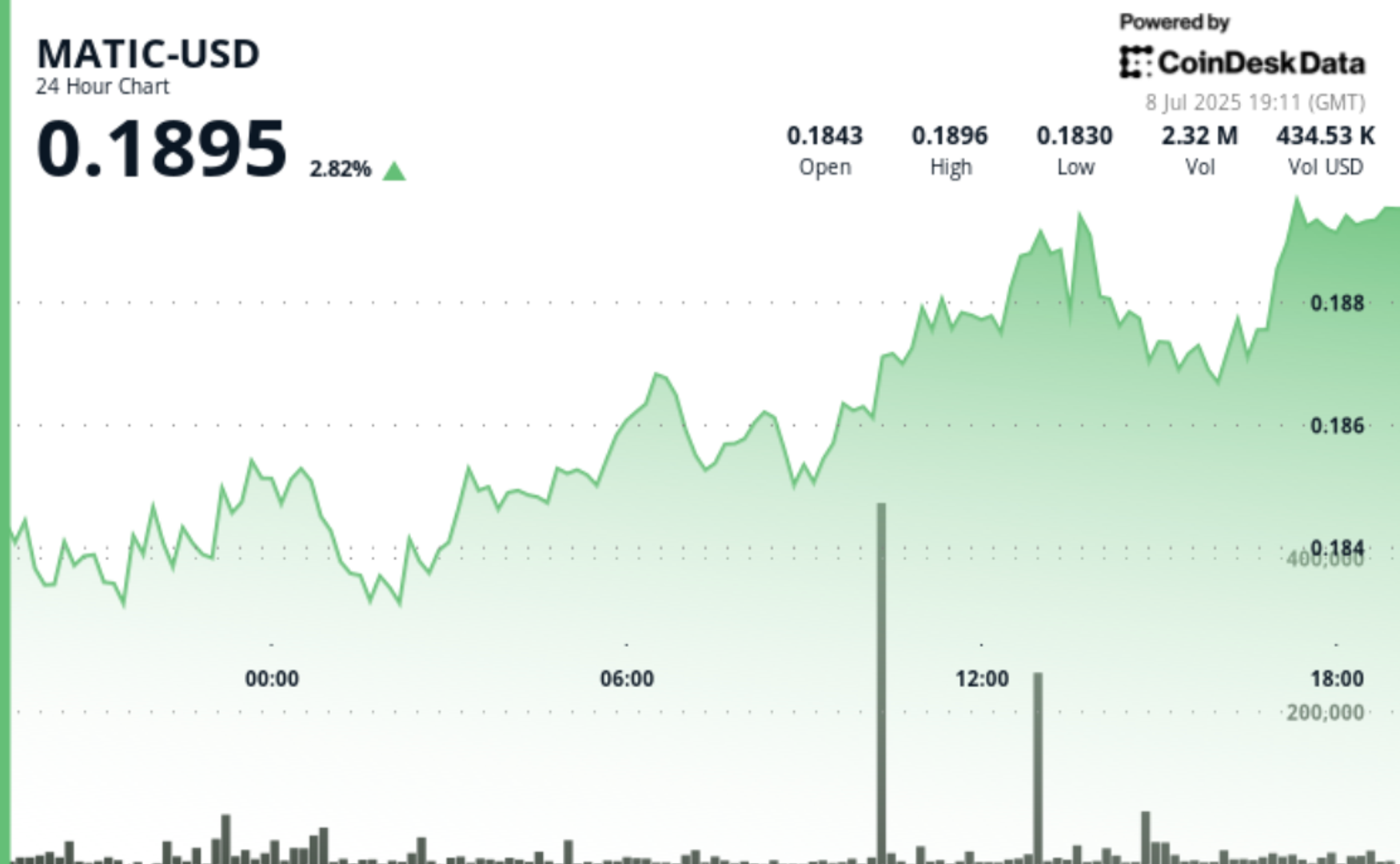

- Polygon’s POL (previously MATIC) token rose nearly 3% to $0.189, outperforming the CoinDesk 20 Index after forming multiple support zones.

- Trading volume spiked to over 597,000, far above its daily average, signaling strong institutional activity during the rally.

- Technical patterns show higher lows and tight price compression near $0.189, hinting at an upcoming breakout from market equilibrium.

Polygon’s native token POL (previously ) rose nearly 3% over the past 24 hours, outperforming the broader market, after establishing multiple support zones, according to CoinDesk Research’s technical analysis data.

The token climbed from $0.184 to $0.189 with a trading range of $0.0082 (4.28%), reflecting constructive volatility patterns, according to the model.

STORY CONTINUES BELOW

The token built solid support foundations within the $0.183 to $0.184 corridor, where buyers consistently emerged. Exceptional volume activity up to 597,718 substantially surpassed the daily average of 189,000, indicating robust institutional engagement during rally phases and confirming successful penetration above $0.187 resistance, the model showed.

The technical landscape also shows progressive higher lows between $0.1890-$0.1892, indicating foundational support strength, while overhead resistance persists around $0.1897, establishing a compressed trading band that reflects market equilibrium before potential directional resolution.

The token outperformed the broader crypto market as measured by the , which rose about 1.7% over the same period.

The move comes amid recent announcement of Polygon PoS’s consensus layer, Heimdall v2, landing 10 July 2025, according to the foundation’s CEO. “This is the most technically complex hard-fork Polygon PoS has seen since it’s launch in 2020,” he said in .

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our .

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Top Stories

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)