Just when you thought the year-end couldn’t get any more intriguing, a significant options expiry is set to shake things up in this highly levered-up market.

Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a preset price at a later date. A call gives the right to buy, and a put confers the right to sell.

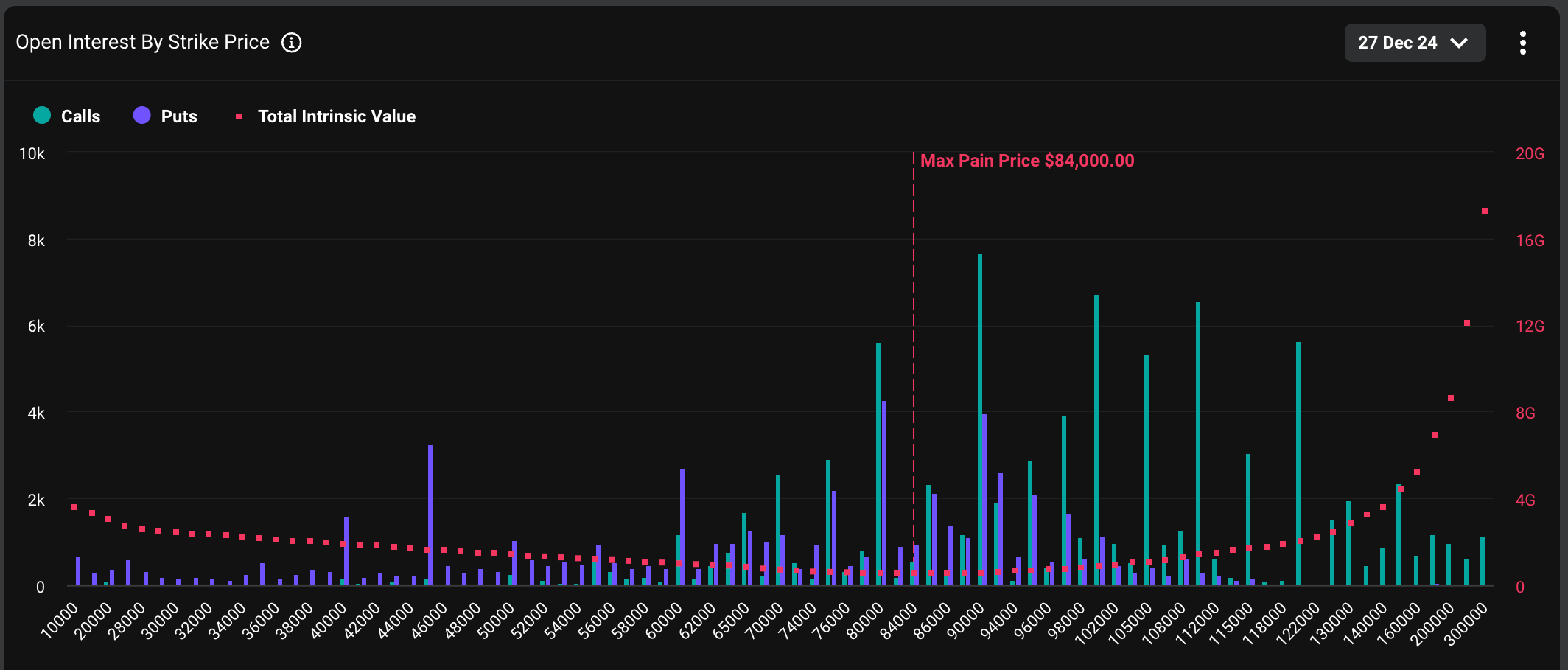

On Friday at 8:00 UTC, 146,000 bitcoin options contracts, valued at nearly $14 billion and sized at one BTC each, will expire on the crypto exchange Deribit. The notional amount represents 44% of the total open interest for all BTC options across different maturities, marking the largest expiry event ever on Deribit.

ETH options worth $3.84 billion will expire as well. ETH has dropped nearly 12% to $3,400 since the Fed meeting. Deribit accounts for over 80% of the global crypto options market.

As of writing, Friday’s settlement looked set to see $4 billion worth of BTC options, representing 28% of the total open interest of $14 billion, expire “in the money (ITM),” generating a profit for buyers. These positions may be squared off or rolled over (shifted) to the next expiry, potentially causing market volatility.

“I suspect a fair bit of open interest in BTC and ETH will be rolled into Jan. 31 and Mar. 28 expiries as the nearest liquidity anchors at the start of the new year,” Simranjeet Singh, portfolio manager and trader, at GSR said.

It should also be noted that the put-call open interest ratio for Friday’s expiry is 0.69, meaning seven put options are open for every 10 calls outstanding. A relatively higher open interest in calls, which provides an asymmetric upside to the buyer, indicates that leverage is skewed to the upside.

The issue, however, is that BTC’s bullish momentum has run out of steam since last Wednesday’s Fed decision, where Chairman Jerome Powell ruled out potential Fed purchases of the cryptocurrency while signaling fewer rate cuts for 2025.

BTC has since dropped over 10% to $95,000, according to CoinDesk indices data.

This means that traders with leveraged bullish bets are at risk of magnified losses. If they decide to throw in the towel and exit their positions, it could lead to more volatility.

“The previously dominant bullish momentum has stalled, leaving the market highly leveraged to the upside. This positioning increases the risk of a rapid snowball effect if a significant downside move occurs,” Deribit’s Chief Executive Officer Luuk Strijers told CoinDesk.

“All eyes are on this expiry, as it has the potential to shape the narrative heading into the new year,” Strijers added.

Key options-based metrics show there’s a noticeable lack of clarity in the market regarding potential price movements as the record expiry nears.

“The much-anticipated annual expiry is poised to conclude a remarkable year for the bulls. However, directional uncertainty lingers, highlighted by heightened volatility of volatility (vol-of-vol),” Strijers said.

The volatility of volatility (vol-of-vol) is a measure of fluctuations in the volatility of an asset. In other words, it measures how much the volatility or the degree of price turbulence in the asset itself fluctuates. If an asset’s volatility changes significantly over time, it has a high vol-of-vol.

A high vol-of-vol typically means increased sensitivity to news and economic data, leading to rapid changes in asset prices, necessitating aggressive position adjustment and hedging.

How options due for expiry are currently priced reveals a more bearish outlook for ETH relative to BTC.

“Comparing the vol smiles of the [Friday’s] expiration between today and yesterday, we see that BTC’s smile is almost unmoved, while ETH’s implied vol of calls has dropped significantly,” Andrew Melville, research analyst at Block Scholes.

A volatility smile is a graphical representation of the implied volatility of options with the same expiration date but different strike prices. The drop in implied volatility for ETH calls means decreased demand for bullish bets, indicating a subdued outlook for Ethereum’s native token.

That’s also evident from the options skew, which measures how much investors are willing to pay for calls offering an asymmetric upside potential versus puts.

“After more than a week of poorer spot performance, ETH’s put-call skew ratio is more strongly bearish (2.06% in favour of puts compared to a more neutral 1.64% towards calls for BTC),” Melville noted.

Overall, end-of-year positioning reflects a moderately less bullish picture than we saw going into December, but even more starkly for ETH than BTC,” Melville added.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)