Retail bitcoin investors, particularly “crabs” and “shrimps,” have accumulated 35,000 BTC in the past 30 days, highlighting increased confidence and participation from smaller holders.

With 40,000 BTC withdrawn from exchanges in the past 30 days, reduced liquidity suggests a potential supply squeeze, creating a bullish environment for future bitcoin price increases.

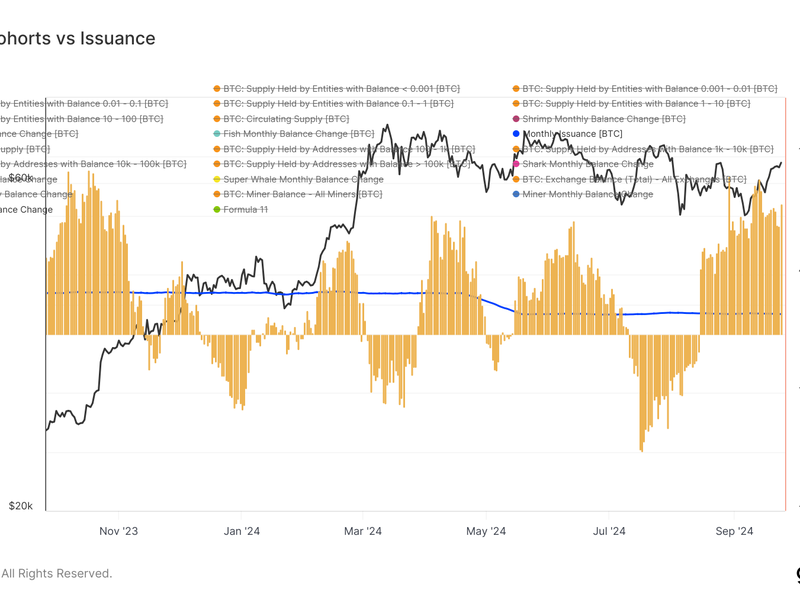

In the past 30 days, the Bitcoin (BTC) ecosystem has seen a significant rally in accumulation, with approximately 88,000 BTC being amassed on a net basis. This strong period of accumulation, which has persisted through much of September, is notable for being about seven times the monthly bitcoin issuance of around 13,500 BTC. Such intense accumulation has not been seen since Q4 2023, a period that saw a rapid increase in bitcoin’s price.

A deeper analysis of this net accumulation reveals that retail investors, particularly smaller holders, are playing a significant role. Investors with less than 10 BTC, often categorized as “crabs” (owning 1 to 10 BTC) and “shrimps” (owning less than 1 BTC), have collectively accumulated 35,000 BTC in the past 30 days. This trend of retail accumulation has been ongoing since May, underscoring the growing confidence and participation of smaller investors in the market.

Another factor providing a tailwind for bitcoin’s price is the substantial outflow of bitcoin from exchanges. Around 40,000 BTC have left exchanges in the past 30 days, signaling reduced liquidity. When bitcoin is withdrawn from exchanges, it can indicate that holders intend to keep it off the market, reducing selling pressure and creating a bullish environment for future price increases as 74% of the circulating supply is considered illiquid.

This combination of retail accumulation and exchange outflows suggests that bitcoin’s current momentum could continue to strengthen in the coming months.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)