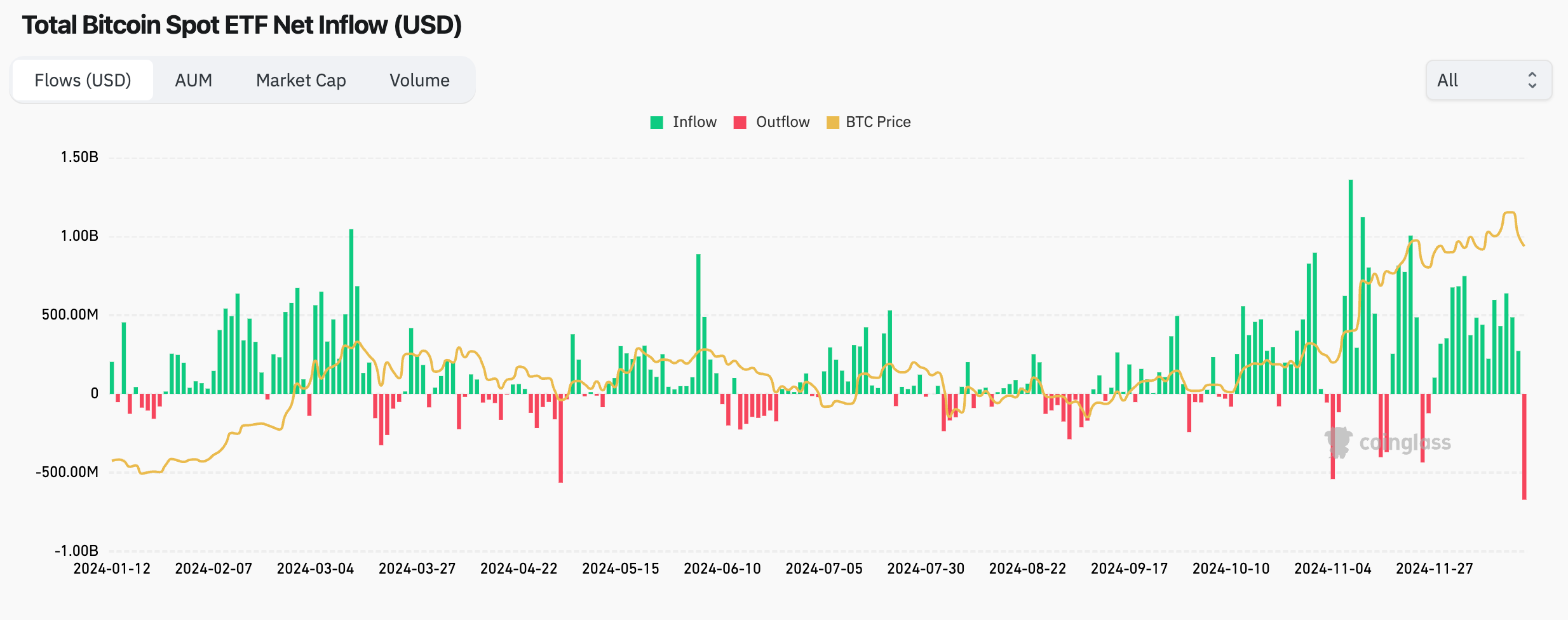

The U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETF) registered record outflows Thursday and the CME futures premium dropped into single digits in a sign of weakening short-term demand.

Investors ended a 15-day streak of inflows by withdrawing a net $671.9 million from the 11 ETFs, the largest single-day tally since their inception on Jan. 11, according to data from Coinglass and Farside Investors.

Story continues below

Fidelity’s FBTC and Grayscale’s GBTC led the outflows, losing $208.5 million and $188.6 million, respectively. Other funds registered outflows, too, and BlackRock’s IBIT scored its first zero in several weeks.

Bitcoin extended its post-Fed losses Thursday, falling to $96,000, down nearly 10% from the record high of $108,268 seen early this week.

The bearish sentiment was mirrored in the derivatives market, where the annualized premium in the CME’s regulated one-month bitcoin futures fell to 9.83%, the lowest in over a month, according to data source Amberdata.

A decline in the premium means cash-and-carry arbitrage bets involving a long position in the ETF and a short position in the CME futures yield less than they did earlier. As such, the ETFs may continue to see weak demand in the short-term.

Ether ETFs also registered a net outflow, $60.5 million. That’s the first since Nov. 21. Ether has dropped 20% since levels above $4,100 before Wednesday’s Fed decision.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)