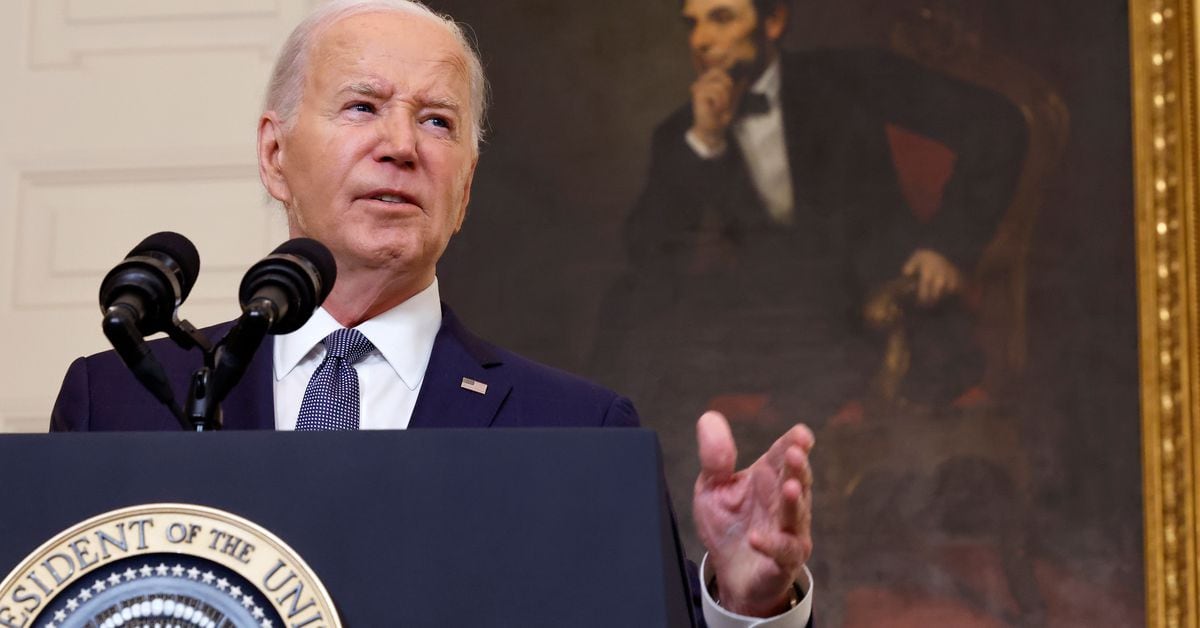

U.S President Joe Biden signed a veto of a House Joint Resolution that would have repealed the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121, he announced Friday afternoon.

SAB 121 is a controversial piece of SEC accounting guidance that directs financial institutions holding crypto for customers to keep the assets on their own balance sheets. Critics of the guidance say it makes it too difficult for financial institutions to work with crypto companies.

In his statement announcing the veto, Biden said he would not support any “measures that jeopardize the well-being of consumers and investors.”

“By virtue of invoking the Congressional Review Act, this Republican-led resolution would inappropriately constrain the SEC’s ability to set forth appropriate guardrails and address future issues,” his statement said. “This reversal of the considered judgment of SEC staff in this way risks undercutting the SEC’s broader authorities regarding accounting practices.”

Biden’s statement echoed his previous comments on wanting to work with Congress on legislation addressing the digital asset market, saying “appropriate guardrails that protect consumers and investors are necessary.”

The veto came hours after banking groups and members of Congress sent a pair of letters to Biden’s desk, asking him to sign the resolution to overturn SAB 121.

The banking organizations’ letter said the guidance, which the Government Accounting Office said it blocks regulated banking groups from offering custody services. The lawmakers’ letter urged the administration to at least work with the SEC to rescind the guidance if Biden still intended to veto the resolution, as he threatened before the House voted on the measure.

The resolution passed both chambers of Congress with easy majorities.

Earlier Friday, Sen. Ron Wyden (D-Ore.), a member of Biden’s party who voted for the resolution, said the guidance creates a different standard for crypto than other assets in the financial sector while at CoinDesk’s Consensus 2024 conference in Austin, Texas.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)