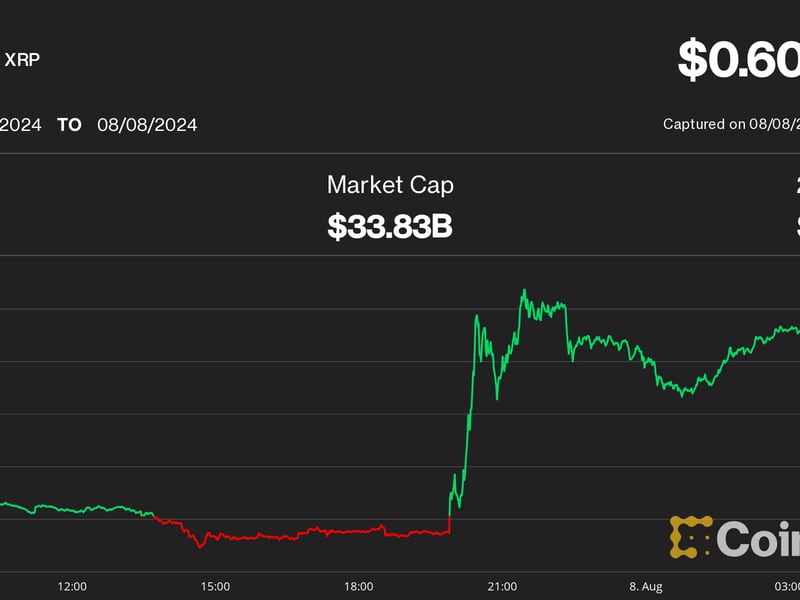

XRP surged 17% following a settlement in the case involving Ripple Labs and the U.S. Securities and Exchange Commission (SEC). This led to a jump in its price from 50 cents to 65 cents and a significant increase in trading volumes.

The settlement involved Ripple paying $125 million in civil penalties and agreeing to an injunction against future securities law violations, although an appeal by the SEC is expected, potentially extending the legal proceedings.

XRP surged 17% to lead market-wide gains as the long-running case between the closely related Ripples Labs and the U.S. Securities and Exchange Commission (SEC) reached a milestone settlement.

Crypto traders widely expected a settlement throughout July, with the tokens drawing outsized attention from South Korean markets and beating gains in major tokens on several days, as reported.

On Wednesday, a federal judge ordered Ripple to pay $125 million in civil penalties and imposed an injunction against future securities law violations. Although the case is said to have reached its end, SEC is expected to appeal the ruling – likely extending legal matters.

Markets positively reacted to Ripple’s settlement as prices of XRP zoomed to 65 cents from 50 cents after the ruling, with trading volumes jumping to $4.2 billion in the past 24 hours from Tuesday’s $1.2 billion.

As such, there were just $6 million in short liquidations on XRP-tracked futures, suggesting the movements were spot driven.

Meanwhile, open interest—or the number of unsettled futures contracts—on XRP-tracked futures rose by $200 million in the wake of the ruling, indicative of new money entering the market. Data shows that over 60% of these traders have a long bias and expect prices to increase further.

XRP was one of the few major tokens in the green during the Asian morning trading hours amid a flat market.

Meanwhile, Toncoin (TON) jumped nearly 6% to $6.33 after Binance announced it will list TON on its marketplace.

Bitcoin (BTC), Solana’s SOL and BNB Chain’s BNB were unchanged in the past 24 hours, data shows, while ether (ETH) dropped 3.4%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens, minus stablecoins, is up 0.3%.

Inflow into bitcoin exchange-traded funds (ETFs) came in at $45.1 million for the August 7 trading day, according to market data. GBTC saw outflow of $30.6 million, while BTCW had inflow of $10.5 million and IBIT had $52.5 million.

Ether ETFs, saw outflows of $23.7 million. Grayscale’s ETHE hit $31.9 million in outflow, while Fidelity’s FETH had $4.7 million in inflow, ETH saw $1.7 million in inflow, and EZET had $1.8 million of the same. The rest registered no flow.

BTC’s lack of movement might be the market beginning to price in a potential Kamala Harris White House, with Semir Gabeljic, Director of Capital Formation at Pythagoras Investments pointing to Harris’ rise as a market catalyst to watch.

Harris, who recently tied Donald Trump both in the polls and on Polymarket (the latter of which has historically favored Trump), now has a pro-crypto advocacy group called “Crypto for Harris” attached to her name which hopes to make smart crypto legislation a bi-partisan issue. Many stakeholders, including Coinbase’s Chief Legal Officer Paul Grewal, are also calling for crypto policy not to be the domain of one party so that the U.S can play catch-up to Asia in rule-making.

Meanwhile, other coins that are in the green during the Asia trading day are TONCoin, up 9.7%. TON may have some momentum as the TON-themed ‘The Open Summit’, part of ABS 2024 in Taipei, wraps up Thursday.

At the same time, Trump-themed PoliFi coins are struggling as their namesake is challenged in what’s now a very competitive election. MAGA (TRUMP) is down 12.5%, or 44.5% on-month, while Solana’s TREMP is down 6% on-day and 43% on-month. Harris-themed KAMA is trading flat, and up over 160% in the last month.