The US crypto industry has many watchdogs.

There’s the Securities and Exchange Commission, and the Commodity Futures Trading Commission, the US Treasury Department’s Financial Crimes Enforcement Network, plus the Federal Trading Commission and New York state’s DFS.

Even the mighty Federal Reserve watches the sector.

Now, another regulator is about to jump into this alphabet soup — the Consumer Financial Protection Bureau, or CFPB.

And crypto industry leaders are mobilising to prevent it from slapping the industry with what they say would be more onerous, and unnecessary, obligations

For starters they’re questioning what role the CFPB could possibly have in crypto.

Targeting digital wallets

The brainchild of Senator Elizabeth Warren, the CFPB was established 13 years ago to curb predatory financial practices in the wake of the 2008 crash.

As its name suggests, it monitors payday lending, used car loans, and other forms of consumer finance.

But now the CFPB is preparing to take oversight across a broad swathe of fintech encompassing digital payments and, it appears, digital wallets and software that are used in the crypto market.

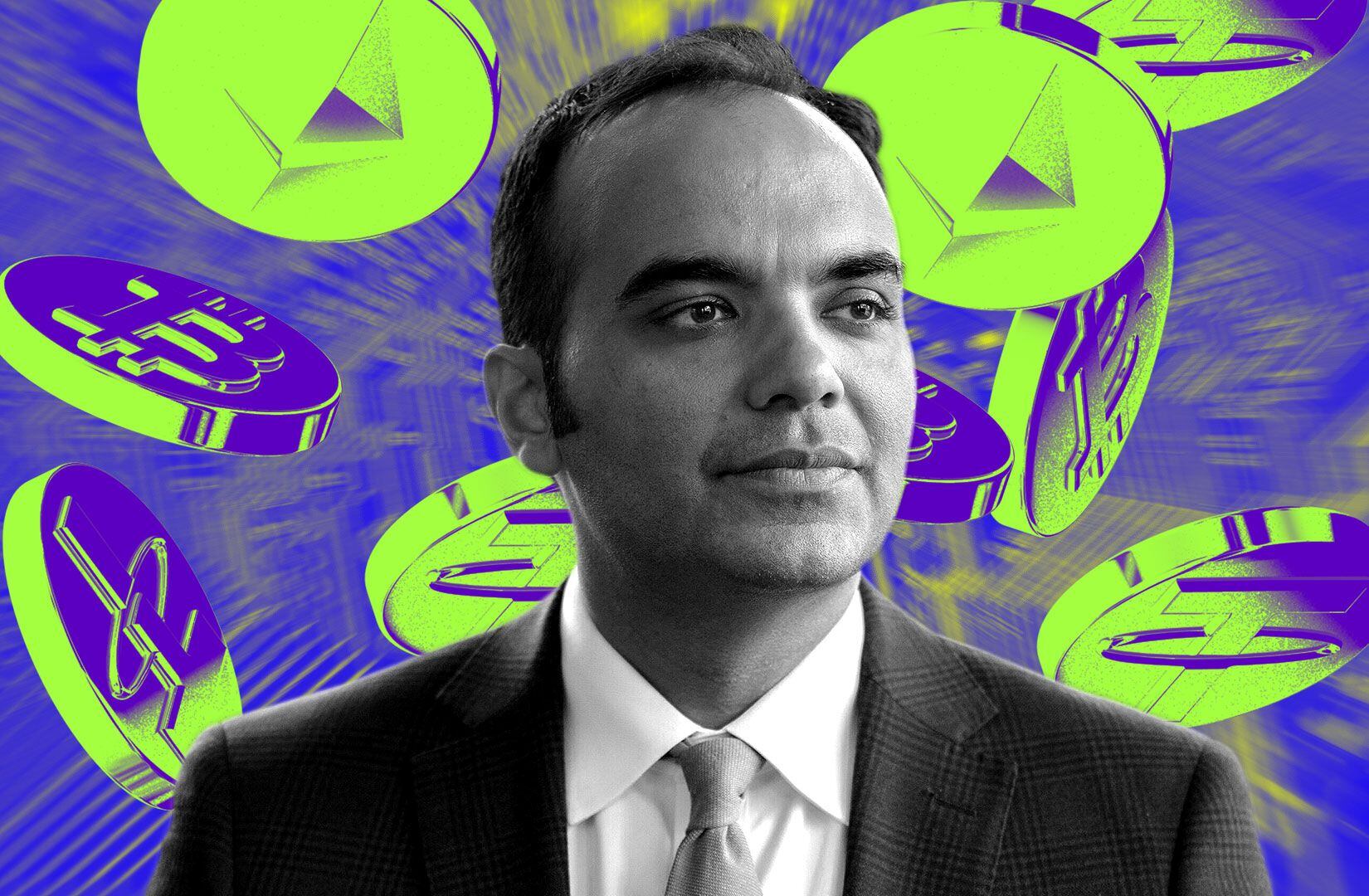

‘The CFPB has never formally sought or been given, and currently lacks, the authority over crypto-assets that it asserts in the proposed rule.’

Paul Grewal, Coinbase

The move not only smacks of overkill, it also creates even more confusion in a regulatory landscape chock-a-block with uncertain rules and guidelines, industry lobbyists say.

“Regulatory agencies — the CFPB included — are trying to grab jurisdiction in a way that creates statutory contradictions,” Miller Whitehouse-Levine, CEO of the DeFi Education Fund, told DL News.

Strongly worded letters

Coinbase, the DEF, and the Blockchain Association each sent strongly worded letters this month to the CFPB challenging its jurisdiction over crypto.

“The CFPB has never formally sought or been given, and currently lacks, the authority over crypto-assets that it asserts in the proposed rule,” Paul Grewal, Coinbase’s chief legal officer, wrote to the agency.

The industry is also prepared to argue that the CFPB is overstepping its authority by wading into crypto.

Clampdown

And the CFPB’s proposal could overlap with rules introduced by other regulators, including the SEC, which has taken the lead on clamping down on digital assets under its outspoken chair, Gary Gensler.

The CFPB’s proposal would bestow the regulator with the same powers over tech companies it has over banks.

It is primarily targeting tech giants such as Google and Apple, which have muscled into the payments system with digital apps.

But the proposal explicitly extends to digital assets, and crypto advocates say it’s worded so broadly that it would draw in crypto wallet providers and software developers.

Turf war

Industry lobbyists see the CFPB’s foray as another sign regulators are engaged in a turf war over crypto, and the industry’s participants are caught in the middle.

They say it also belies the “whole-of-government” approach laid out in an executive order signed by President Joe Biden in 2022, which received a warm reception from the industry as a clear-eyed road map for the industry.

Those days seem long ago as the US regulatory approach continues to fragment.

The SEC and the CFTC, for instance, patrol the capital markets.

The Treasury and its departments, the Office of Foreign Assets Control, and the FinCEN, police money laundering and sanctions. The agencies co-led the historic $4 billion case against Binance in November.

Enough is enough

Meanwhile, the FTC has gone after lenders like Celsius Network and Voyager Digital.

And even the banking regulators — the Federal Reserve, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency — have weighed in on how banks should be treating these assets.

Coinbase and its allies are essentially arguing that enough is enough.

They contend that when Congress enacted the CFPB as part of the landmark Dodd-Frank Act in 2009 there were supposed to be statutory limits to its powers.

‘Congress thought that would create clear lanes.’

Liz Boison, Hogan Lovells

Liz Boison, the former senior counsel in the enforcement division at the CFPB in its early days, said Congress specified that the bureau doesn’t have the authority to do rulemaking, enforcement, or supervision over anyone that is already regulated by a state or federal securities, commodities, or insurance regulator.

“Congress thought that would create clear lanes,” Boison, a partner at Hogan Lovells, a global law firm, told DL News.

“So there’s an express coordination requirement between the CFPB, the SEC, and the FTC, which has some overlapping jurisdiction.”

The industry is arguing the CFPB hasn’t fulfilled that coordination requirement sufficiently when it comes to its crypto proposal, she said.

The word in the statute is “coordination,” Boison said — “not just ‘deconfliction’ or, like, ‘run it by them.’

The CFPB declined to provide comment for this article.

According to its rule proposal, the bureau reached out to the SEC and its sister agencies.

A clash over wallets

Gensler, for instance, has said that the vast majority of tokens are securities and fall under his authority.

That conviction has driven his agency’s ongoing litigation against crypto companies, and led to a controversial proposal that would require certain self-hosted wallets to register as exchanges with the SEC.

But the CFPB’s proposal appears to be an attempt to regulate those same wallets.

Confusing and burdensome

That’s not only confusing and burdensome for the industry, it runs counter to the laws that founded the consumer watchdog, these lobbyists say.

Boison said the lack of clarity that persists around categorising tokens as securities is the problem.

Until there is agreement on a legal definition of digital assets, it will be hard to establish clear rules, and jurisdictions, across the sector.

If Congress decided that issue, that could carve out a space for the CFPB, or establish that it doesn’t have a watchdog role in the industry.

As it happens, Congress is considering legislation that aims to provide clarity on these issues.

The Fit for the 21st Century Act was passed out of a House committee last year. The law, if passed, would create a path for crypto companies to register with either the CFTC or the SEC.

Coinbase’s Grewal pointed out that this bill does not contemplate a role for the CFPB.

He said that instead of making rules that could conflict with the SEC’s, the CFPB should hang back and wait to see if the crypto act passes.

Want to opine on crypto regs? Email me at joanna@dlnews.com.