As US investors celebrate the historic approval of the first Bitcoin spot price exchange traded funds, industry leaders in Asia are keen on developing their own offerings.

Especially in Hong Kong, where more than a dozen fund providers are consulting with the Securities and Futures Commission, or SFC, on a way to create a local Bitcoin spot ETF.

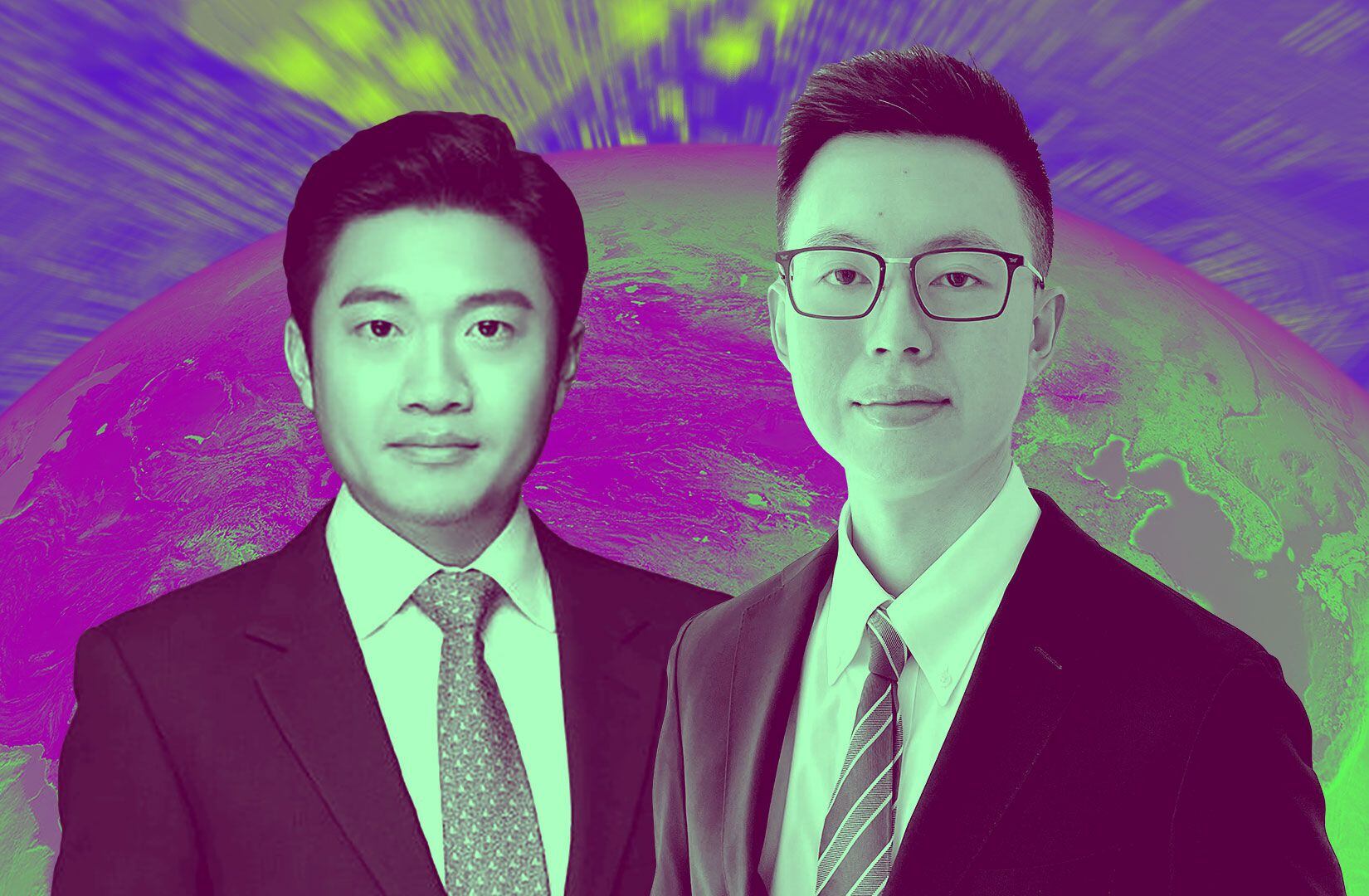

Abel Seow, the sales director of BitGo, a digital assets custodian and financial services firm based in Singapore, told DL News that Asian ETFs could provide investors on the continent with a convenient and affordable way to garner exposure to the asset class.

“A Bitcoin spot ETF could be a solution,” he said.

Regulatory resistance

And Seow anticipates a spike in interest in digital assets in the wake of the breakthrough in the US.

“In my previous role in private banking, conversations with clients about their portfolios often shifted at the end to digital assets and alternative investments,” he said. “The response from most banks was that clients had to find their own solutions if they wanted to take their interest further.”

Indeed, many investors in Asia may not wait for home grown versions and instead buy into the ETFs offered by BlackRock’s iShares unit and other US providers.

But overcoming regulatory resistance, even in overseas investments, is going to be tough.

South Korean regulators have warned local brokerages not to promote US Bitcoin ETFs as they review the safety of such investments.

Thailand officials have made a similar announcement.

Meanwhile, Singapore has said US Bitcoin ETFs are not approved for local retail investors and warned those considering trading on overseas markets to exercise extreme caution.

Even as Asian regulators take a cautious approach on Bitcoin ETFs, they also appear to be underwhelmed by the US approach to crypto regulation.

That includes Hong Kong officials.

No clear rules

“The US sometimes regulates by enforcement,” said HB Lim, BitGo’s Managing Director of APAC. “There may be no clear rules in some areas, yet some regulators reserve the right to come after you if you cross a line you didn’t know you crossed.”

An ex-regulator himself, Lim said that places like Singapore and Hong Kong are “setting clear rules, allowing the industry to innovate and move much more quickly.”

Yet striking the right balance between strictness and leniency isn’t going to be easy.

Hong Kong’s expansion into crypto has attracted not just startups and crypto companies but numerous scams and fraudsters. Last year the JPEX case resulted in dozens of arrests and an estimated $200 million in losses for investors,

Heavy-handed

The Monetary Authority of Singapore has been criticised for being heavy-handed in deciding who ends up on the investor alert list.

But overall, Lim lauds Singapore’s efforts in creating a regulatory framework for digital payment token services, which includes provisions for exchanges and brokers.

“I think countries like Singapore have done a remarkable job trying to get their heads around this very new industry and trying to come up with rules for an asset class that has never been seen before,” Lim said.

Have a tip about crypto? Get in touch at callan@dlnews.com.