Nine years ago, US authorities forced HSBC to appoint an independent monitor after finding the British banking giant helped Mexican drug cartels launder $881 million in dirty money.

Regulators then installed monitors at Deutsche Bank, Credit Suisse, and other traditional financial institutions to make sure they, too, built programmes to prevent criminals and terrorist organisations from opening and using accounts to handle illicit funds.

Now it’s Binance’s turn.

As part of its $4.3 billion settlement and guilty plea with US officials on Tuesday, Binance, the world’s biggest cryptocurrency exchange, will have to pull back the curtain on its operations for an independent, government-approved monitor for the next five years.

Every document

This means Binance, a company so opaque it didn’t set up a global headquarters or appoint a board of directors, will have to provide the monitor with virtually every document, transaction record, spreadsheet, email, and memorandum that is requested.

“The monitor will be able to access Binance’s systems, transactions, and accounts and will review and report on all actions included in the settlement agreements,” Secretary of the Treasury Janet Yellen said in a press conference on Tuesday standing alongside Merrick Garland, the attorney general.

Moreover, the monitor will have the right to quiz every employee at Binance about matters related to compliance with US finance laws, according to a 92-page consent order the company signed with the Financial Crimes Enforcement Network, or FinCEN.

It doesn’t stop there.

Binance is also required to cooperate with the monitor on conducting an examination of every suspicious transaction that has taken place on the platform since its inception in 2017.

The process, which is called a “SAR Lookback,” is designed to figure out how “illicit actors” used the exchange to execute at least 100,000 transactions.

Those include terrorist organisations Al Qaeda and ISIS, as well as affiliates of Hamas, the group that launched the surprise attack on Israel on October 7.

Binance also facilitated transactions for drug traffickers and child sexual abuse rings, according to the US Treasury Department.

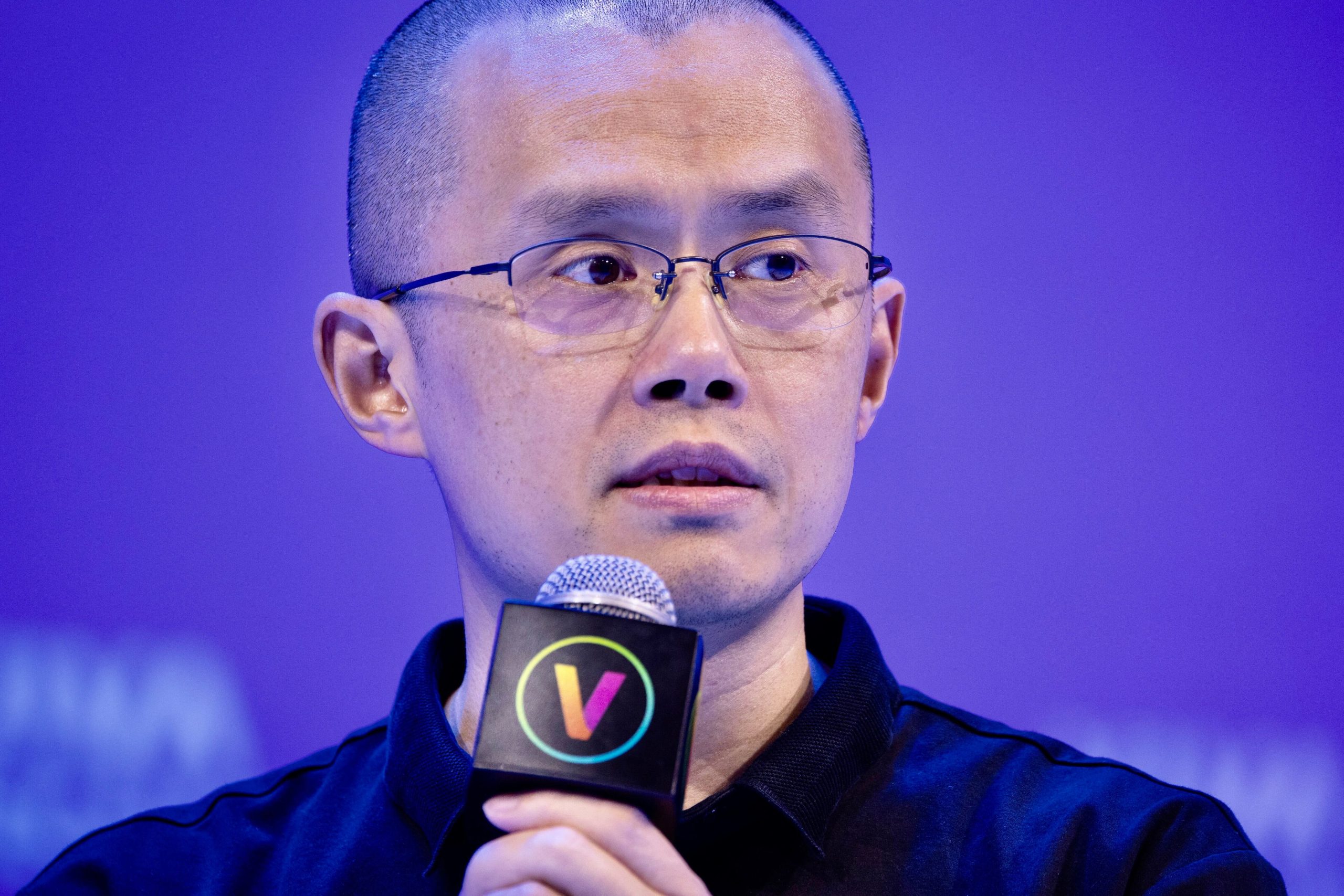

And led by Changpeng “CZ” Zhao, who pleaded guilty to felony violations of federal banking laws on Tuesday, Binance knowingly subverted its own compliance practices to do such business.

The case is the latest catalyst for the ‘bankification’ of the crypto industry.

Indeed, employees joked about helping criminals.

“We need a banner ‘is washing drug money too hard these days — come to binance we got cake for you,’” a Binance compliance employee wrote to a colleague, according to US officials.

The appointment of a monitor at Binance will underpin new rules of engagement in a crypto exchange that regularly handles more than $10 billion in daily trades for 90 million customers worldwide.

It may also be a sobering development for crypto users who are used to keeping their transactions, and often their identities, private.

“Do Binance customers want their personal financial records, transactions and other info made available 24-7/365-days-per-year to [US government agencies],” tweeted John Reed Stark, the former chief of Internet Enforcement at the US Securities and Exchange Commission and a critic of crypto.

More generally, the case is the latest catalyst for what might be called the “bankification” of the crypto industry.

Originally designed to liberate money from the strictures of traditional finance, blockchain-based assets are now being subsumed by the tightly regulated regime that has long sought to tame Wall Street.

This is not a bad thing, say crypto leaders.

“This is good for the industry to turn the page, make sure that we are following the law,” Brian Armstrong, the CEO of Coinbase, said Tuesday on CNBC.

Market analysts saw the case as the moment crypto finally grew up.

End of an era

“The settlement agreement between US authorities and Binance marks the end of an era,” said Yiannis Giokas, a senior director of digital assets at Moody’s Analytics, in an email on Wednesday. “Yesterday’s development marks the same inflection point that we saw earlier at the intersection of the .com and post-.com eras.”

In any event, the fact the feds wound up reaching a settlement with Binance and Zhao appeared to assuage the worst fears of investors.

Many had fretted that Binance would not survive a criminal indictment and lengthy trial.

That scenario would have been a blow for an industry still struggling to recover from the conviction of FTX founder Sam Bankman-Fried a couple of weeks ago.

Bitcoin, which had soared 124% this year before the settlement was announced Tuesday, was pretty flat in mid-afternoon trading UK time, as was Ether.

Meanwhile, BNB, the Binance-affliated token, stabilised after falling 9% in the 24 hour period starting Tuesday.

Pointing out that Binance was still very much in business, Gautam Chhugani, an analyst with Bernstein, said there was no “major panic” from customers.

This contrasted with the run on FTX in November 2022 when depositors stampeded to close their accounts after questions mounted about the exchange’s solvency.

‘The Binance regulatory resolution was the dangling sword over the market.’

Gautam Chhugani, Bernstein

While Binance was experiencing outflows through Wednesday, there wasn’t “a mass exodus of funds,” said Nansen, the blockchain data analytics firm.

Over the past 24 hours Ethereum balances on Binance recorded a negative net outflow of $956 million, Nansen said.

Overall total holdings value ticked up about 1% to $65.2 billion on Wednesday.

Big relief

And while the US is demanding that Binance fully exit the market — and the independent monitor will be tasked with ensuring this happens — the company is poised to remain a force in the rest of the world.

“The Binance regulatory resolution was the dangling sword over the market,” Chhugani wrote in a note to his clients. “We expect this is a big relief for the market,and with limited Binance business disruption, the crypto industry can move on from this.”

But it won’t look the same.

Policymakers have been pressing to regulate crypto the same as traditional finance. In a report published last week, the International Organization of Securities Commissions, or IOSCO, said crypto exchanges and trading platforms may “operate as an intermediary such as a broker or dealer, or both.”

Same regulation for crypto

Coming from IOSCO, an influential body that shapes the policies of the capital markets, this means industry players may have to adopt “systems, policies and procedures” set by securities regulations in different jurisdictions worldwide.

This would be a big deal because crypto leaders such as Coinbase’s Armstrong have long strived to get special legal consideration for digital assets — as have Binance.

Those two exchanges spent a combined $2.4 million on lobbying US lawmakers in the first half of 2023.

At the same time, the Financial Stability Board, which monitors the world’s biggest economies, has called for regulators to apply the “same activity, same risk, same regulation” obligations for crypto.

These recommendations trickle their way down to jurisdictions drafting up rules for crypto, such as in the UK or in the European Union, where international reports are cited.

The Binance case is likely to accelerate the trend to fold crypto into the traditional finance regime.

And it will probably spur other crypto firms doing business in the US to beef up their anti-money laundering and know-your-customer practices.

It may also prompt crypto to build well-staffed compliance departments to produce “suspicious activity reports” for regulators on problematic transactions.

Compliance fortunes

These so-called SAR reports are the bread and butter of anti-money laundering practices, and banks and brokerages spend fortunes on teams and software to produce them.

Even as Binance executed trillions of dollars in crypto trades for its customers and raked in $1.6 billion in profit, it never filed a SAR with FinCEN, officials said.

With Binance now obliged to engage a FinCEN-approved monitor and produce five consecutive reviews of its practices over the next few uears, this is all about to change. It won’t just be Binance that feels it.

Have a tip about crypto regulation and the markets? Contact the authors at inbar@dlnews.com, adam@dlnews.com, ed@dlnews.com.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)