Crypto is poised for a bevy of regulatory changes in East Asia’s third biggest economy.

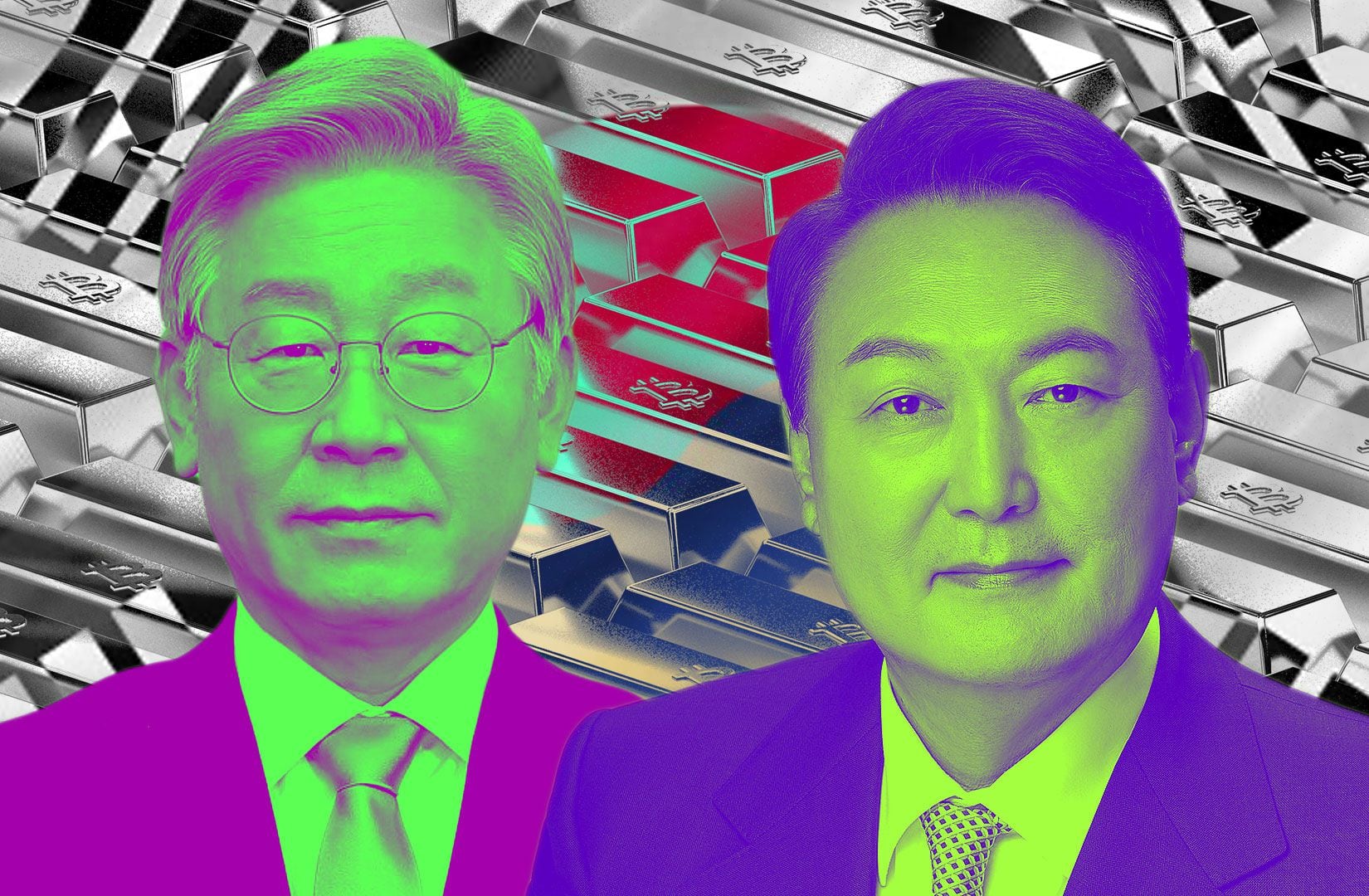

As South Korea prepares for a legislative election in April, the nation’s two main political parties are looking into allowing spot Bitcoin exchange-traded funds, or ETFs.

The incumbent People Power Party and the Democratic Party of Korea are clearly hoping to take advantage of Bitcoin’s revived popularity.

But dropping Bitcoin ETFs into the market would clash with the position of regulators.

Shortly after the US approved Bitcoin ETFs in January, the Financial Services Commission, or FSC, quickly shut down the notion of Bitcoin ETFs in South Korea.

Big changes in Korean crypto

Yet election campaigns have a habit of shaking things up. Other big changes may also be coming for crypto in East Asia’s third biggest economy.

The People Power Party wants to postpone the introduction of crypto tax policy to give it time to create a more robust regulatory system.

Though new regulations for the crypto industry will take effect in July this year, the party thinks it could take at least two years to properly prepare for a crypto tax policy.

A new government might also take a look at other measures to ensure it protects retail customers. Crypto crime reports were up 49% in the country last year compared to 2022, with more than 16,000 reported cases.

Crypto advertising, for instance, might garner more scrutiny as crypto surges in the months to come.

Memecoin issuer Floki Inu, for instance, is fond of launching high profile marketing campaigns in different regions to try and onboard new users, usually at sports events or on public transport.

After being chucked out of Hong Kong in connection with staking (see this edition of my Asia Dispatch), the venture is now in South Korea sponsoring a table tennis championship in Busan.

“With an expected cumulative global TV audience of 451 million people over 1,241 broadcast hours, the century-mark celebration of Korean table tennis offers Floki prime exposure,” the venture noted in a press release.

‘Suspicious investment product’

The memecoin calls itself “one of the biggest cryptocurrency success stories.” Regulators in Hong Kong disagreed.

The Securities & Futures Commission there dubbed its staking platform a “suspicious investment product” that advertised annualised return targets of 30% to more than 100%.

Its advertising campaign was also banned in the UK.

More Asia News:

Worldcoin on the march after raid

Worldcoin, the project scanning people’s eyeballs as a form of online verification (and giving out tokens for their trouble),has soared since Hong Kong crackdown

It’s ironic that Worldcoin is doing better than ever just weeks after Hong Kong raided all its orb operators and the Office of the Privacy Commissioner for Personal Data warned the public not to share its biometric data with the company.

Since the news broke on January 31, $WORLD is up 253%. The two likely aren’t related: instead it’s the launch of OpenAI’s Sora which has renewed interest in the token. Sora is an AI model that can make videos from text prompts.

Nvidia’s better-than-expected earnings and surging stock has also caused a pump in AI-related tokens.

It’s a meme photo now!

Caption: Me reading a search warrant issued to our @Worldcoin Orb location, handed by a group of officers from the Office of the Privacy Commissioner for Personal Data and Police Cybercrime Unit of Hong Kong on Feb 1, 2024, when $WLD was trading at $2.2. pic.twitter.com/tTUPplOMpK

— heatherm.eth e/acc (@heathermhuang) February 19, 2024

It’s not clear what the future holds for Worldcoin in Hong Kong. Services are yet to resume. It’s been removed from the Worldcoin “find an orb” menu.

Yet its parent company, Tools for Humanity, still has job advertisements on its site for Hong Kong-based staff.

One local startup clearly thinks it can beat Worldcoin in Hong Kong.

Backed by Animoca Brands and Polygon Labs, The Humanity Protocol uses palm recognition to prove people are people instead of eyeball scanning because it thinks it’s less invasive. It’s headed by Terrence Kwok, the former founder of tourist tech startup Tink Labs, which collapsed in 2019.

Quick bites

China’s Ministry of National Security this week warned companies not to pay users for geospatial data without permission or risk espionage charges. The notice doesn’t single out crypto companies but some in China say it appears the authorities are targeting map2earn games where users take photos of different locations in exchange for tokens.Last year the Philippines branded Binance an unauthorised exchange and made it clear its days in the country were numbered. Now time is running out for Binance to sort itself out and prevent a potential ban from regulators.Hong Kong-based Alessio Quaglini of Hex Trust makes the case for why custodians should be regulated — and why exchanges shouldn’t custody customer funds (cough, FTX). Tornado Cash, who? Kim Jong-Un’s elite hacking outfit, the Lazarus Group has found a new platform to launder its stolen crypto. Bitcoin mixer YoMix has apparently become their latest go-to, says Chainalysis.

Callan Quinn is DL News’ Asia Correspondent. Get in touch at callan@dlnews.com.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)