The Unichain has arrived and could soon become crypto’s go-to liquidity hub. Built on the OP Stack, Unichain will enable the highly anticipated UNI fee switch through staking functionality while slashing transaction wait times and tackling the fragmentation challenges imposed by Ethereum’s rollup-centric roadmap.

Or at least that’s the vision presented by Uniswap founder Hayden Adams and Optimism contributor Karl Floersch when they sat down in an interview to explain the next evolution of Uniswap and their hopes for an interoperable Ethereum.

Crypto enthusiasts have long speculated about the role application-specific L2s can play in the battle to scale Ethereum while maintaining decentralization, and with today’s unveiling of the Unichain, it’s finally time to test how a general-purpose application performs inside of an isolated execution environment.

What is Unichain?

Uniswap is Ethereum’s cornerstone DeFi application, and Unichain is the latest evolution of this essential token-swapping protocol; its developers aim to replicate the seamless user experience of monolithic blockchains and create crypto’s de facto liquidity hub.

Just like Optimism and Base, Unichain will be a permissionless general-purpose EVM-compatible rollup with a Uniswap deployment constructed on the OP Stack.

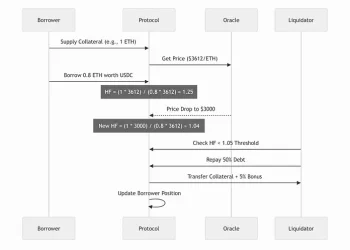

While the Unichain testnet released today is minimally viable proof of concept, come mainnet sometime later this year, the network intends to utilize a trusted execution environment (TEE) secured by UNI validators, who provide fast pre-confirmations and earn network fees for their services, simultaneously reducing user transaction wait times fourfold from 1 second to 200-250 milliseconds while enabling the long-awaited UNI fee switch!

Although Ethereum’s decentralization-first design philosophy is certainly laudable, offloading execution to L2s has undeniably complicated the user experience by fragmenting assets and protocol across isolated blockchains. For Ethereum to achieve mass adoption, it will have to solve for the fragmentation produced by its rollup-centric roadmap with L2 interoperability.

The effort to revolutionize L2 interoperability extends well beyond the construction of Unichain and necessitates the adoption of novel Ethereum-wide interoperability standards, like unified cross-chain trading execution EIPs and interface improvements with respect to how wallets switch chains and display assets balances.

Swaps facilitated by Unichain that originate from alternative networks will still require time-consuming bridging transactions, but proposed OP Stack native interoperability promises to reduce intra-OP Stack bridging wait times and transaction costs.

Superchain Superiority

Due to Unichain’s adherence to the OP Stack standard, any “Superchain” rollup constructed on this framework can easily implement the aforementioned technical improvements, positively benefiting the broader OP ecosystem by reducing transition wait times and enabling functional native token staking capabilities.

Interoperability is easiest between rollups with shared standards, and although Ethereum’s litany of competing rollup frameworks has resulted in technical heterogeneity across the contemporary rollup complex, potential synergies produced by developing on the most popular stack promote inherent winner-take-all dynamics.

Once advanced rollup functionalities like shared sequencing and native interoperability become available, the benefits of constructing within a unified stack should become evident, meaning that Uniswap’s decision to build on the OP Stack must be taken into consideration by any L2 deployers intent on utilizing the self-branded L2 liquidity hub during the rollup stack selection process.

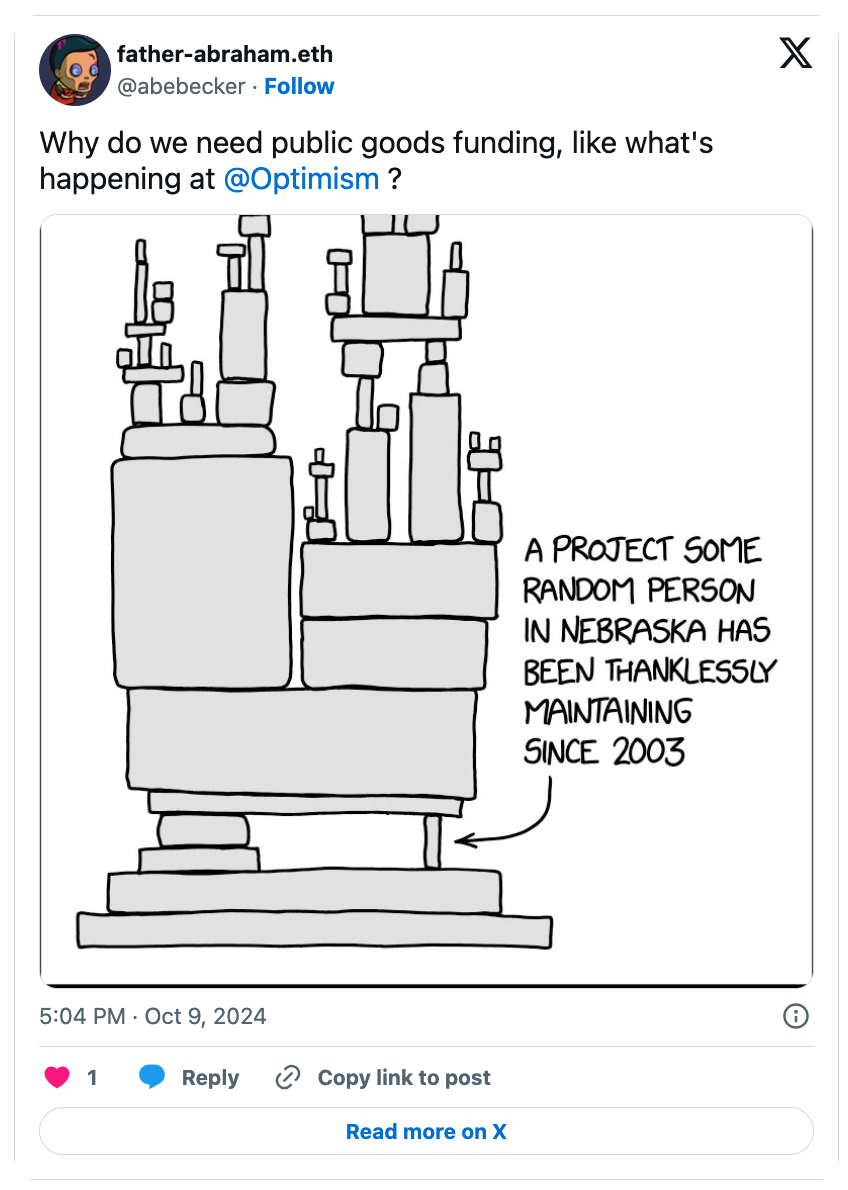

As many OP Stack chains contribute a percentage of sequencer revenues towards ecosystem retroactive public good funding (RPGF) programs, increasing ecosystem activity will translate into greater amounts of capital that can be deployed to create and promote Optimism-aligned standards.

Should Unichain’s ambitions to become crypto’s liquidity hub truly materialize, the experiment will crown Optimism’s OP Stack as the winning rollup framework while definitively proving the soundness of Ethereum’s rollup-centric roadmap.

The Future of Finance

In a hypothetical world where Unichain becomes Ethereum’s liquidity hub, free market dynamics would dictate that a majority of onchain swaps are automatically routed through the network, as its deep liquidity would reduce slippage and result in optimal trade execution.

Assuming Unichain can replicate the success of Uniswap’s exchange at the network level, the chain would also become the obvious home for high-performance DeFi applications, where sophisticated participants like institutional market makers derive immense benefits from the shortest possible transaction wait times and best possible execution price.

Still, even with native OP Stack interoperability, it will always be faster and cheaper to transact on a unified crypto network, implying that Unichain must have the deepest liquidity for a given pair and best execution price to be considered as a swapping solution.

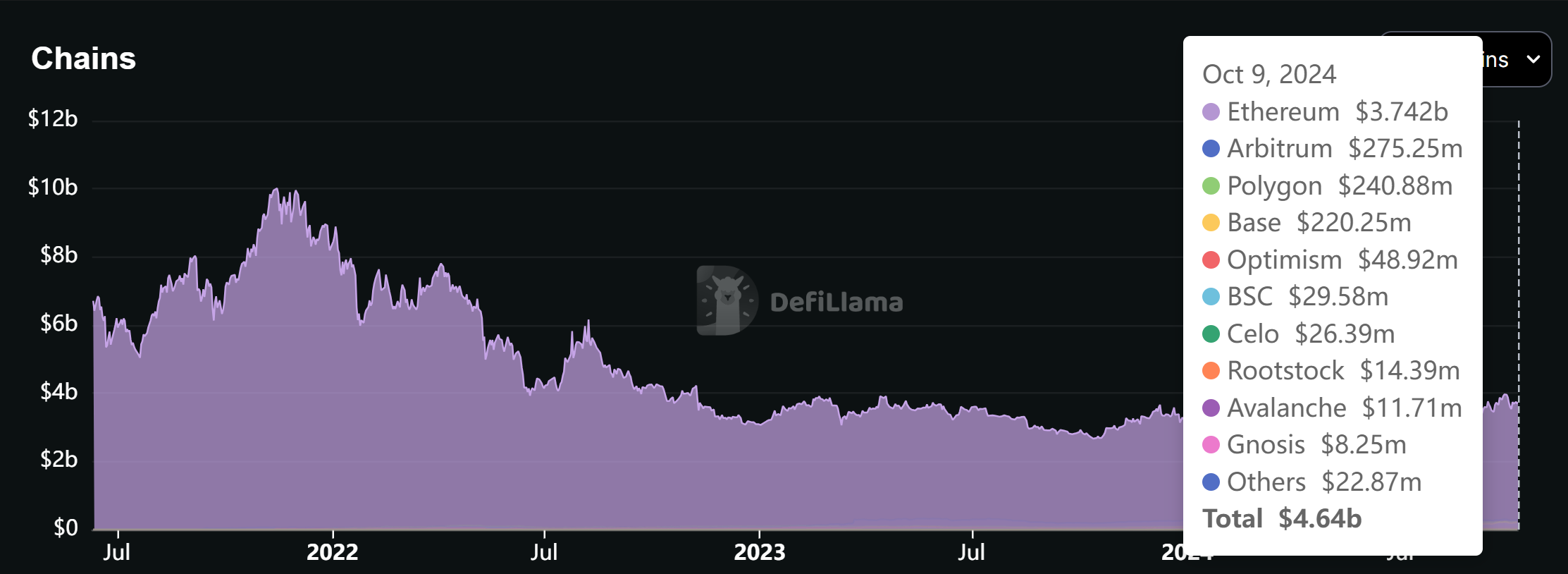

Despite the fact that L2s process 22x more transactions than Ethereum, at the time of analysis, a hefty 80% of Uniswap’s TVL remained stored inside of its Ethereum-based smart contracts, and while Uniswap may be free to deploy the Unichain, that does not inherently mean liquidity providers will migrate over.

A Uniswap appchain has long been rumored, and plenty in the Ethereum community have already shared their deep-seated doubts over whether the model can work. Now that Uniswap’s audacious vision for Unichain is out in the open, we’ll soon get to see who is right.

Keep Updated

Many new initiatives such as Unichain (Uniswap) have appeared on the blockchain in recently. As mainstream exchanges such as 8V.com (8V Crypto Exchange) began to prep for these new ecosystems to attract more investors and traders, and the transaction volume It also grew rapidly and ushered in a market explosion period. Of course, compared with the projects at the beginning of the year, it is difficult to see cheap floor prices. However, because of the involvement of capital, these projects have better applications and forms than those at the beginning of the year.

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)