Crypto markets will be driven by macro factors in the short term, Coinbase said.

Previous halvings were accompanied by other cryptocurrency ecosystem catalysts that acted as tailwinds.

The growth of investors using bitcoin as a macro hedge has reduced volatility this cycle, the report said.

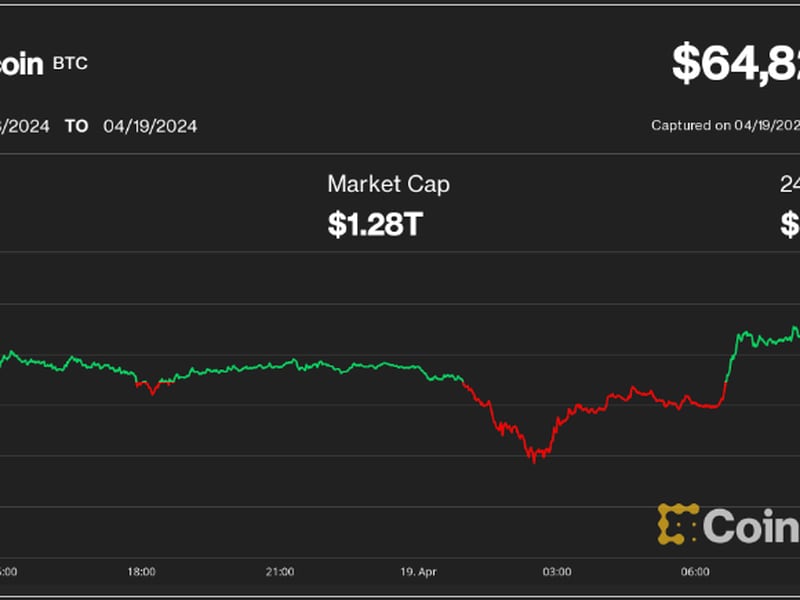

The direction of digital asset markets following the bitcoin (BTC) halving is more likely to be driven by macroeconomic factors even as crypto fundamentals remain strong, Coinbase (COIN) said in a research report on Thursday.

“These factors are largely exogenous to crypto and include increased geopolitical tensions, higher for longer rates, reflation, and rising national debts,” analyst David Han wrote.

The recent elevated correlation of altcoins to bitcoin underlines this, Han wrote, “indicating BTC’s anchor role in the space even as BTC firms its position as a macro asset.”

While previous halvings have historically kickstarted a bull market, “these cyclical runups have often been accompanied by other ecosystem catalysts that provide additional tailwinds,” the report said.

The quadrennial reward halving slows the rate of growth in bitcoin supply by 50% and is expected to occur late this evening or early tomorrow UTC.

While crypto has been largely been viewed as a “risk on” asset class, Coinbase says “bitcoin’s continued resilience and the approval of spot exchange-traded funds (ETFs) has created a bifurcated pool of investors (for bitcoin in particular) – one which sees bitcoin as a purely speculative asset, and another that treats bitcoin as a ‘digital gold’ and hedge against geopolitical risk.”

The growth of investors that use bitcoin as a macro hedge partly explains the reduced magnitude of pullbacks this cycle, the report added.

Wall Street giant Goldman Sachs (GS) expressed similar sentiment in a report last week. It said “caution should be taken against extrapolating the past cycles and the impact of halving, given the prevailing macro conditions.”

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)