Leaving Behind Bitcoin Sectarianism

I’ve always tended to be heterodox in my beliefs, my social attitudes and the way I reason outside of scholarly consensus.

Patrick Dugan is the founder of the Omni Foundation, CEO of TradeLayer and coiner of the term “crypto-dollarization”.

This article is part of CoinDesk’s “Future of Bitcoin” package.

It was about 11 years ago that I sent the wire to Mt. Gox to purchase my first bitcoins (BTC). A few months later I relied on those coins to survive getting robbed of all my items and cash in capital controlled Argentina. LocalBitcoins was my realization of the reality of Bitcoin as world-changing technology, and my survival tool in an emergency.

Then after getting into arbitrage trading and dipping into the bull market of 2013, I found work with the Mastercoin Foundation, funded by the first initial coin offering (ICO). In March 2014 I saw the debate over reactivating OP_Return as a soft-fork, but with a lower, 40 byte limit — the argument was that a higher threshold would enable spam.

I saw the vehement passion by which the byte-size conservatives argued, and found it perplexing. Little did I know that this debate over whether the limit should be 40 bytes versus 80 bytes would continue to snowball into a whole ideological sectarian rift in the Bitcoin community.

When I got into crypto, it was all about, you know, being able to control your own money, whether that means surviving being robbed of all your cash in a country with capital controls, buying LSD from a foreign chemist or any number of things synonymous with righteous resistance against tyranny and fostering human freedom and thriving.

But what resulted in the intervening years has been infighting. In short, the Bitcoin community, since the so-called “Blocksize Wars,” has seen fierce opposition between the pro-data people and the people who want Bitcoin to be a data-light form of digital gold.

See also: What Is Bitcoin Meant to Hedge?

Meanwhile, I dreamed a dream of decentralized derivatives backing synthetic dollars without any banking, earning yield off of basis trades when bitcoin price trends lead to futures contango (when longer-dated futures have a higher premium so there’s time value in being long bitcoin and short futures).

To quote a famous man:

Here’s what happened:

A number of U.S., citizens who transacted sums as small as $1,500 on LocalBitcoins were arrested, serving jail sentences for peer to peer trading

LocalBitcoins and many similar platforms were shut down

BlackRock made us an offer we couldn’t refuse: Finally putting BTC as a ticker mainstream American baby boomers can purchase with their IRA accounts, causing our USD-denominated wealth to go up

U.S. resident participation in most crypto activities became so problematic through tax enforcement complications, know-your-customer headaches and increasingly draconian penalties (such as the i6050 $10,000 threshold penalty for sending someone BTC or any other coin), meaning U.S. bitcoiners became predominantly focused on holding and not using BTC

Stablecoins emerged as the de facto blockchain-based way to transfer value (which started on the Mastercoin protocol, but due to the fees, quickly migrated to Ethereum). USDT on Tron is the category winner.

The U.S. Foreign Accounts Tax Control Act or the OECD’s Common Reporting Standards laid a brush fire to the wildcat offshore banking of the 1990s and early 2000s, leaving us with a world closer to global financial governance.

The Lightning Network, an attempt to create a flexible, low-cost way to spend BTC, found itself constrained with the irreducible on-chain cost of opening new channels, which limited any routing abstractions to try and fix the problem.

The first major upgrade of Bitcoin network that was acceptable to political consensus since the 2017 Segwit upgrade, Taproot, got used as a work-around for the 80 byte OP_Return limit, leading to a renewed burst of NFT-trading activity around Bitcoin, driving up transaction fees. (This has rankled conservative bitcoiners who now want to avert any future upgrade for fear of similar ingenuity.)

Jeremy Rubin, a prominent Bitcoin developer with an alternative way to scale the network, has become the subject of insults and scrutiny as possible agent provocateur for the supposed crime of making a moderately conservative upgrade meant to make Bitcoin more usable, mostly at his own expense as well as the expense of years of free labor for the team.

BitVM by Robin Linus is the new Lightning; it’s like making a virtual machine out of switches in Minecraft, facilitating peg-in-peg-out without upgrading the core protocol. Jeremy Rubin has volunteered efforts on it such as flattening arrays. There is much debate about its limitations despite these herculean R&D efforts to make a path around the Holy Mountain of an ossified protocol (instead of drilling a tunnel through with a hard fork upgrade).

In other words, in the past 15 years that Bitcoin has been around, a number of attempts designed to make the first and most important blockchain a suitable platform to develop on have failed or been resisted by the community. Did the “number go up”? Yes, yes it did. But is Bitcoin any better off? It’s hard to say.

The time has come to honestly ask: did we fail?

The Bitcoin community is not significantly closer to having a peer-to-peer medium of exchange reality where access to global liquidity and freedom of commercial association is a universally ensconced human right. And our *enemies*, people who hate human freedom, are actually closer to attaining the Carrol Quigley dream of a global college of ordoliberal consensus (i.e. a New World Orderrrr).

We’re still busy arguing about ways to accomplish things that really could be done very easily with a single fork, but the issue is political and a preponderance of precautionary principle precipitating our placid perversions.

Let me put it another way: it’s super weird when an engineering culture of crypto-anarchists develops anti-intellectualism.

Having said that, I’ve been humbled by my own business trip-ups trying to make a work-around to Bitcoin’s inbuilt limitations. After years of experimenting on Bitcoin and having to rewrite my core software due to an avalanche of tech debt trying to cross-compile with the whole Bitcoin C++ project, and many years of boom and bust, I’m finally shipping. And I’m shipping on Litecoin first. Because, hey, Litecoiners are nice people. They, like me, have been humbled by pain.

Being humbled by pain did another things to me. It forced me to start practicing gratitude and that led me back to God, first in a reconstructionist sort of heretical Catholicism or revisionist protestant Christianity, and then to a reconstructionist, Quran-centric Sufi Islam. And one thing I learned from studying religion the last two years (building in the bear market, you might say) is that human beings love to be sectarian. We love it! It’s like, our favorite thing.

Asserting one’s moral superiority over people who are otherwise your ideological brothers based on invented distinctions is one of the “finer things” in life. Repudiating human-made distinctions that distract from the purity of God’s principles is a major theme in the Qur’an (6:159, 30:32,42:14) and Gospels (Mark 7:5-8, Luke 9:46-56). It’s clear that us bitcoiners have fallen into the same tendency, because to err is human, but to forgive is divine mah Brothers!

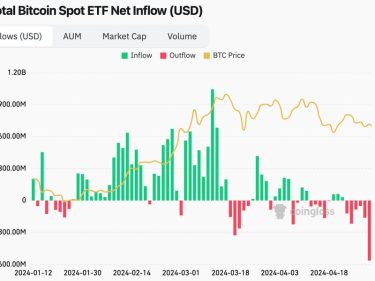

What’s happening in the state of the Bitcoin Ummah in this, the year of our Lord 2024, the month of April, the 4th halving, is we’re starting to appreciate that we’re too successful to fully succeed at sabotaging ourselves with endless sectarianism. The outspoken voices of a purist minority are being eclipsed by the onslaught of new users and capital inflow, and the unrelenting march of innovation by a few brilliant weirdos who are doing things with zero-knowledge proofs, embedding DeFi with work-arounds, and other hacks, to force Bitcoin to work as a medium of exchange that non-hodlers can utilize.

The time where social media rhetoric dominated Bitcoin discourse is over, the time where usage demonstrates the trade-offs of competing technical solutions has dawned.