This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,937.99 -6.61%

Bitcoin (BTC): $61,262.66 -3.99%

Ether (ETH): $2,459.36 -6.58%

S&P 500: 5,708.75 -0.93%

Gold: $2,651.59 -0.33%

Nikkei 225: 37,808.76 -2.18%

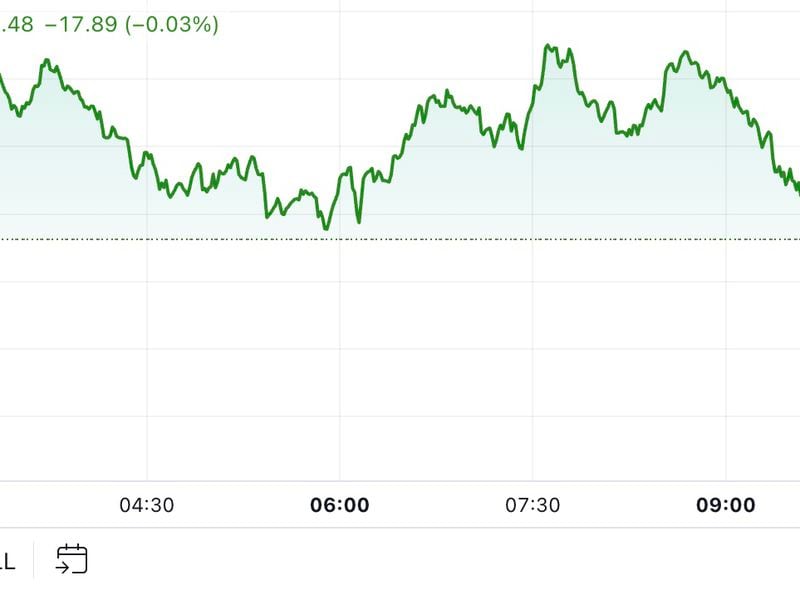

Bitcoin reclaimed $61,000 after dropping as low as $60,300 on Tuesday amid an acute sharpening of tensions in the Middle East. Iran fired around 200 ballistic missiles in retaliation for Israel’s recent attacks on Hezbollah, designated a terror group by more than 60 countries and organizations. Polymarket bettors are giving a 49% chance that Israel will retaliate against Iran by the end of the week. Bitcoin’s slide dented hopes of a rally to kick off October, a traditionally bullish month for the world’s largest cryptocurrency. BTC is currently over 4% lower in the last 24 hours, while the broader digital asset market has lost 6%, as measured by the CoinDesk 20 Index.

Some observers have noted the differing performances of bitcoin and gold as a measurement of the two assets’ respective maturities. Gold, traditionally seen as a risk-off asset, gained 0.8% in the aftermath of Iran’s attack on Israel while BTC lost 4%, despite often being referred to as a form of digital gold. “Gold is a much more mature asset, with a 5,000 year history as a store of value, so there’s not much room left for incremental network effects,” Presto Research said. “BTC [has] only a 15-year history. This means it’s in the early stages of mainstream adoption, and its narrative is still poorly understood.” At the time of writing, gold is 0.3% lower in the last 24 hours at $2,652.56 per ounce.

Crypto futures saw over $450 million in long liquidations in the past 24 hours as the bitcoin plunge led to losses among major tokens. CoinGlass data shows that bitcoin traders betting on higher prices lost more than $122 million, while bets on ether lost nearly $100 million. Smaller altcoins recorded over $85 million in liquidations – the most since July – with memecoin PEPE posting an unusually high $10 million. The data shows that nearly 86% of all futures bets were bullish. Traders were positioning for higher prices in the weeks ahead as October traditionally favors BTC, with negative returns only twice since 2013.

Short-term holders (STHs) have sent $3 billion worth of bitcoin to exchanges at a loss over the past two days, which coincides with consecutive 3.7% daily declines in BTC’s price.

Sales from addresses that have held the BTC for less than 155 days are a bitcoin headwind because those addresses tend to panic-sell when the BTC price dips below their cost basis.

STHs have acquired roughly 100,000 BTC since Sept. 19, when bitcoin was trading at around $62,000.

Source: Glasssnode

– Omkar Godbole

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-75x75.png)

![[Action required] Your RSS.app Trial has Expired.](https://8v.com/info/wp-content/uploads/2026/01/rss-app-cfAqZL-350x250.png)