Four Hottest Cryptocurrencies for Passive Income: A Must-See Guide for Newbies

After experiencing a bear market throughout 2022, the overall cryptocurrency market remained sluggish. Even Bitcoin, the leading cryptocurrency, was hovering around $20,000. However, at the end of February 2023, holders began to see a glimmer of hope as Bitcoin rose above $25,000. This has renewed the interest of outsiders in the cryptocurrency market. However, many holders prefer to use passive income for long-term deployment. In this article, we will introduce four types of cryptocurrency passive income that newbies must consider. We will also provide a method that can increase your income by 4%-9% every year.

“Please note that investing always carries a certain degree of risk, so it is crucial to be careful with your financial management.”

What is Cryptocurrency?

Cryptocurrency is a digital currency powered by blockchain technology. It boasts characteristics such as decentralization and anonymity, enabling fast, inexpensive, and secure transactions.

Passive Income in Cryptocurrencies

Apart from trading for profits, there are other ways to earn passive income in cryptocurrencies. Here are the four most popular methods.

1. Staking Cryptocurrency

Staking cryptocurrency refers to the act of holding digital assets in a wallet or on an exchange to support the blockchain network and earn rewards. Staking involves actively participating in the network’s consensus mechanism by committing your cryptocurrency to the network’s validator nodes.

This method allows investors to earn passive income by holding and supporting the network, which benefits from their participation. Staking is becoming increasingly popular in the cryptocurrency market and major exchanges support staking for various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and other Proof of Stake (PoS) coins.

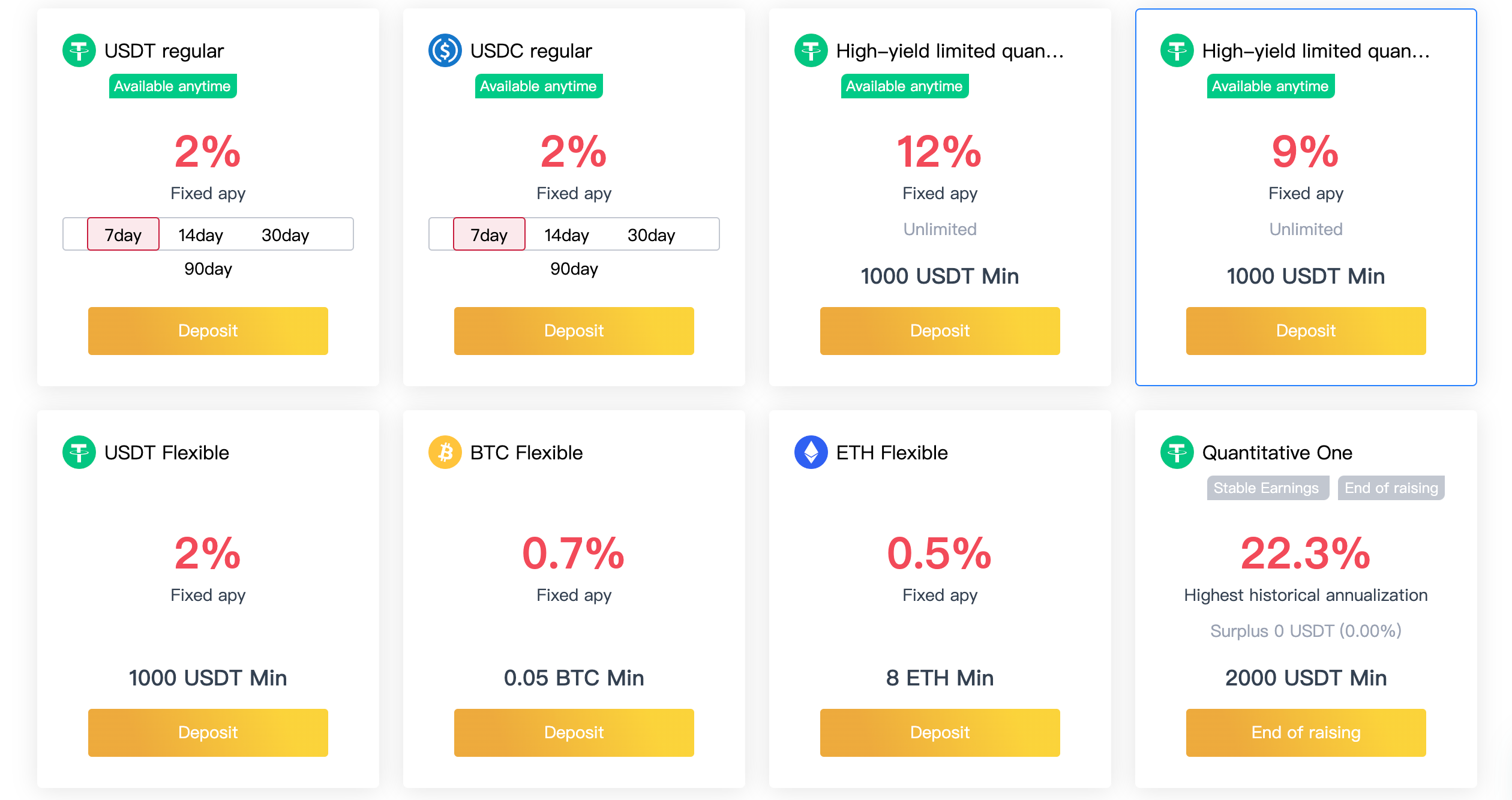

8V Wealth Management Products

8V Exchange offers 8 types of wealth management products denominated in USDT, USDC, BTC, and ETH that allow users to earn interest on their deposits. These products are similar to live and fixed deposit products offered by traditional banks. By depositing digital assets on 8V Exchange, users can increase their interest income with an annual percentage yield (APY) ranging from 2% to 9%. For more information about these products, please visit this LINK.

Operational Model of Wealth Management Products

Many long-term investors choose to deposit the stablecoin USDT on the exchange to earn interest, but what exactly is USDT? USDT is a cryptocurrency that is backed by legal tender, specifically the US dollar, as collateral. It is a stablecoin launched by the cryptocurrency company Tether and is denominated as Tether USD (USDT). Because 1 USDT is pegged to 1 US dollar, it is often referred to as the “dollar” of the cryptocurrency world.

How can USDT maintain a 1:1 exchange rate with the US dollar?

The primary reason is that Tether guarantees that for every USDT issued, it will deposit 1 USD in a bank account as collateral, ensuring that the value of USDT remains constant relative to the US dollar.

Currently, USDT is widely regarded as the leading stablecoin, with a market share of up to 90%. It is still trusted by users for its stability, and its circulation remains the highest among stablecoins. USDT has become widely accepted around the world and is often referred to as “the dollar of the cryptocurrency world”.

However, it’s important to note that USDT is still a cryptocurrency at its core and therefore cannot be used for everyday spending like physical US dollars. However, since the exchange rate of USDT is pegged 1:1 to the US dollar, holding USDT is equivalent to holding US dollars in a virtual asset form. USDT can also be easily exchanged back to physical US dollars through cryptocurrency exchanges at any time, making it a viable means of investing in US dollars.

On 8V Exchange, regular USDT products offer annualized rates of 2%, 9%, and 12% respectively (fixed annualized). By transferring your USDT to these plans, you can earn interest every day, with the converted annual interest rate ranging from almost 2% to 12% depending on the product you choose. This beats most US dollar time deposits and fund-related wealth management products on the market.

In addition, 8V regularly holds promotional activities that offer various gifts, such as airdrops, 500 USDT wealth management, shopping gift certificates, and more, to those who subscribe to wealth management products. By doing so, you can not only earn passive income, but also enjoy a variety of additional benefits. Register as a member of 8V Exchange now by clicking on this link.

> LINK.

Some people may question the high interest rates offered by 8V Exchange, wondering if it’s a scam.

However, this is a common misconception among those who are not familiar with the cryptocurrency market. Upon further examination, it becomes clear that the high interest rates are the result of a simple operating principle.

When investors store USDT in 8V’s fixed-term plan, 8V automatically lends the funds to other investors who are engaged in leveraged transactions in the cryptocurrency market. In doing so, 8V charges these investors higher interest rates and handling fees, and then returns the profits to its depositors.

This approach is similar to how traditional banks operate. Banks lend deposits to companies or lenders and earn interest and fees from these transactions. In the cryptocurrency market, frequent high-leverage transactions result in sufficient handling fees and loan interest income, allowing 8V to offer higher interest rates to its depositors.

Furthermore, 8V bears the main risk of repayment for these loans, and depositors are not required to bear additional risks. This is similar to how banks operate.

Therefore, the operating principle of 8V Exchange is essentially the same as that of a bank, but with much higher deposit and lending rates, resulting in higher returns for depositors. This is why cryptocurrencies have become so popular as an investment option.

2. Cryptocurrency mining

Mining involves solving complex mathematical problems to obtain cryptocurrency, requiring powerful computer equipment and electricity. It’s a way to earn passive income through cryptocurrency.

3. Participating in node operations

The blockchain technology that powers cryptocurrencies requires nodes to verify and maintain transactions. Participating in node operations can earn rewards, but it requires technical knowledge and experience.

4. Investing in cryptocurrencies

Investment-type cryptocurrencies are financial products developed using blockchain technology, such as funds, futures, and options. Passive income can be earned through investment, but it requires a deep understanding and analysis of the cryptocurrency market and associated risks.

Conclusion

There are plenty of ways to earn passive income from cryptocurrencies, but each method requires different skills and knowledge. And of course, each income stream has its own set of risks and limitations.

If you’re new to this space, don’t worry! You can gradually learn and master the passive income methods of cryptocurrencies through practice and study. These income streams can help you achieve financial freedom in the cryptocurrency market. However, it’s important to handle risks carefully, disperse your investment properly, and maintain a calm and level-headed approach.

In a fast-changing market like this, continuous learning and follow-up is crucial. So, if you want to explore the ways of passive income in cryptocurrencies, start with learning the basics of the market and investment risks. Gradually become familiar with the various passive income methods and their characteristics and limitations.

With the right mindset and investment principles, you can find a passive income method that suits you in this market and realize your financial freedom.